DigitalOcean (DOCN)-the unlikely underdog in the cloud computing ring, it’s like David to the Goliaths of Microsoft Azure and Amazon Web Services, but this David is dressed in denim and delivering tech to the little guys-those beleaguered small and mid-size businesses (SMBs) that often get trampled in the digital stampede.

Not too long ago, they unveiled their second-quarter financial results for 2025, and BOOM! They dropped a bombshell revenue boom-record numbers that sent shockwaves through the streets. The stock tanked in a 75% rut since its euphoric 2021 highs but snatched everyone’s attention with a glorious leap of more than 30% post-revelation. But let’s not get carried away; it’s still burning in the shadow of its past euphoria, a relic of a tech boom gone berserk.

Wall Street, ever the goldfish swimming in its opulent bubble, seems convinced that DigitalOcean is in for a phoenix-like revival. Most analysts, huddled together like paranoid geeks in a basement, declare the stock a buy, with not a solitary soul willing to advocate selling. But is this optimism rooted in firm ground or delirium? Time to dive into the chaos.

Artificial Intelligence for the Perplexed

Let’s talk tech-juicy AI tech, folks. DigitalOcean is packaging up the complex stew of cloud services and dishing it out to SMBs with the finesse of a seasoned chef. They’ve mastered the craft of simplicity; think highly personalized service served on a porcelain dashboard, helping the little fish navigate the murky waters of artificial intelligence.

They’re letting these tiny enterprises dip a toe-or a whole foot-into the endless ocean of AI with their finely-tuned data centers. Fueled by the high-octane derivatives of Nvidia and Advanced Micro Devices, they’ve got the horsepower to make a fleet of chips take off like rockets. Perfect for those web chatbots that help keep customer queries from spiraling into oblivion.

Let’s not forget the new toy in DigitalOcean’s arsenal-GradientAI. It’s like a candy store for startups, crammed full of AI goodies. With this mid-2025 release, the little tech warriors can access the muscle of large language models from heavyweights like Anthropic, OpenAI, and Meta Platforms. Kids on the block are upping their game, creating armies of AI agents that can juggle everything from tackling customer queries to rifling through heaps of sales data to find the hidden treasures.

The stats are enough to make your heart race-over 14,000 agents spit out from the GradientAI factory in just a quarter. The demand is roaring like a hellish train storming down the tracks-there’s no stopping this freight train.

Revenue Rocketing to Unchartered Heights

Hold onto your hat! DigitalOcean blasted through the second quarter with a staggering $218.7 million in revenue-up 14% year-over-year, edging past the timid forecast of $216.5 million. But here comes the kicker: AI revenue skyrocketed by an OUTRAGEOUS 100%! That’s not just growth; it’s a full-blown growth spurt that makes puberty look like a minor hiccup.

They didn’t stop there! Buoyed by this thrill ride, they nudged their 2025 full-year revenue forecast from $880 million to an ambitious $890 million. Keep your eyes on this ride because the altitude is dizzying!

Digging into the numbers, it seems the bottom line is having a party too-net income shot up by a mind-boggling 93% to $37 million, all thanks to diligent cost management and some shrewd revenue strategizing, with operating expenses barely scratching a glum 3.8% year-over-year increase. Profitability isn’t just a buzzword; it’s the lifeline keeping their $1.5 billion long-term debt in check while fueling their ambitious AI dreams.

The Bullish Brigade of Wall Street

According to The Wall Street Journal, analysts have been sizing up DigitalOcean stock-13 analysts in total-and guess what? Seven are waving the buy flag furiously! One more is in the optimistic corner, and four are adopting a cautious hold. Only one lone wolf dares to venture into bearish territory, but they’re not even whispering “sell.”

With an average price target of $41.60, analysts allude to a 34% upside over the next 12 to 18 months. The brave souls aiming for the Street-high target of $55 are setting their sights on a savory 78% leap-now that’s a banquet I’d want a seat at.

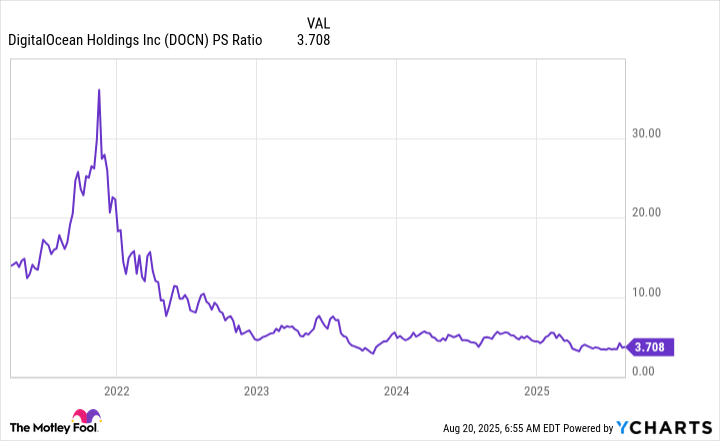

The predictions feel shockingly plausible not just because DigitalOcean is on a tear but also because of its valuation. The stock wades at a price-to-sales ratio (P/S) of 3.7-essentially a bargain compared to its dizzying IPO days.

And when you factor in trailing-12-month earnings hitting $1.30 per share, it comes down to a price-to-earnings ratio (P/E) of 23.7. That’s flirtin’ with the lower digits of the S&P 500 index bouncing around at a P/E of 25.2. Given that DigitalOcean’s earnings have more than doubled this year, an adjustment might well be overdue.

So, why not throw in your hat and follow Wall Street into the chaos? Investing in DigitalOcean could turn out to be that Cinderella story, especially if you’re willing to put on your long-term goggles and peer ahead five years or more. In this game of whirs and whirs, patience could just be your winning ticket! 🎟️

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

2025-08-22 11:26