In the quietude of market movement, where echoes of past transactions linger like the scent of rain on parched earth, dividend-paying stocks emerge as the unsung heroes of the financial landscape. For five decades, their steady rise has outstripped the chorus of non-payers, a veritable duet of resilience and reward. Research from the insightful pens at Ned Davis and Hartford Funds reveals that, under the soothing caress of time, dividend payers have returned an annual performance of 9.2%. In stark contrast, the non-payers plodded along, mustering but 4.3% – a reminder of the enduring nature of yield over whimsy.

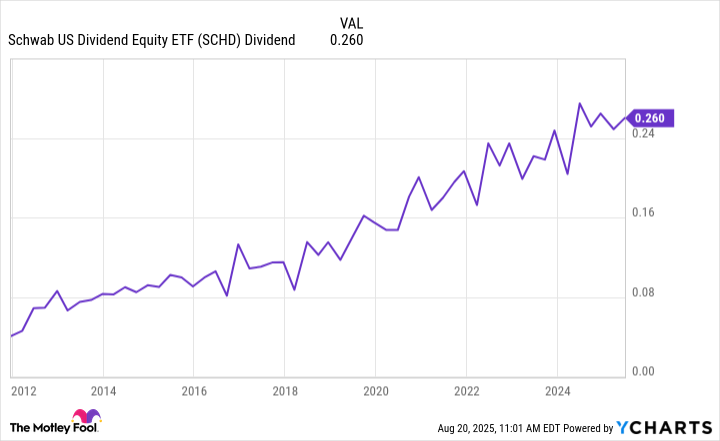

Enter the hallowed realm of the Schwab U.S. Dividend Equity ETF (SCHD), a vessel for those untethered souls seeking to anchor their investments in reliable, dividend-yielding stocks. With the grace of a seasoned angler, one might ponder the reasons this fund is worth a contemplative spot within one’s financial portfolio.

The top 100 dividend stocks in one fund

The Schwab U.S. Dividend Equity ETF is a smoothly flowing stream, meandering through the majestic landscape of the Dow Jones U.S. Dividend 100 Index. Its custodians meticulously select U.S. companies that have bestowed dividends upon their shareholders for no less than a decade. Such a temporal passage delineates the hopeful from the transitory, with four key metrics serving as guiding stars:

- Cash flow to total debt.

- Return on equity.

- Indicated dividend yield.

- Five-year dividend growth rate.

In employing these discerning criteria, this fund casts aside the dross, allowing only those stocks imbued with robust financial fortitude and the promise of rising tides, enriched by growing payouts, to flourish within its embrace.

Each passing March heralds the updating of its hundred holdings, where the horizon shimmers with an average dividend yield of 3.8% – a bounteous offering in stark contrast to the S&P 500’s modest 1.2%. Over the past half-decade, these chosen companies have committed to a ritual of generosity, enhancing their dividends at an impressive 8.4% annually, overshadowing the S&P 500’s more languid pace of 5%. The fund, therefore, stands as both a sanctuary for income and a fertile ground for growth.

Among its esteemed holdings is the iconic PepsiCo (PEP), a titan of refreshment and sustenance, which has woven its dividend fabric for an astounding 53 consecutive years. This venerable company, a member of the elite Dividend Kings, has proudly nurtured its dividend growth at a compound rate of 7.5% since 2010, yielding 3.7% in return. The promise of further increases seems as assured as the perennial flow of the rivers – a testament to its long-term aspirations for high-single-digit annual earnings growth.

Growing income and total returns

Schwab’s ETF, like a diligent gardener, tends to companies that prioritize dividend growth, allowing for a blooming of distributions that flow freely into investors’ gardens:

Presently, it offers a generous annualized yield of 3.9%. As these steadfast companies continue to elevate their dividends, this flow will flourish, ensuring a steady inflow of returns even amid the tumult of fickle market tides.

In the tapestry of dividend stocks, the focus on growth weaves a narrative apart. While dividend payers have historically trifled not with the deep valleys of non-payers, it is the companies that actively grow their dividends that have emerged as the true luminaries:

| Dividend policy | Returns |

|---|---|

| Dividend growers and initiators | 10.2% |

| No change in dividend policy | 6.8% |

| Dividend cutters and eliminators | (0.9%) |

The Schwab U.S. Dividend Equity ETF invests primarily in the flowered fields of high-quality companies, nurturing those that persist in growth and stability. This prudent allocation has yielded an impressive average annual return of 11.5% since its inception, a hearty return on investments that tend to be less prone to the sharp, cold winds of volatility – rendering it an appealing long-term companion.

An ideal foundational holding for any portfolio

For those who yearn for a straightforward path towards wealth accumulation, the Schwab U.S. Dividend Equity ETF emerges as a wise companion on the journey of time, offering both the promise of growing income and an inheritance of stability. Its venerable track record and unwavering focus on reliable, ascending dividends make it the quintessential choice for tempests of doubt, fostering a refuge where growth is more than an aspiration – it is a quiet promise waiting to unfold. 🌱

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Top Actors Of Color Who Were Snubbed At The Oscars

- ‘The Conjuring: Last Rites’ Tops HBO Max’s Top 10 Most-Watched Movies List of the Week

- New Sci-Fi Movies & TV Shows Set to Release in December 2025

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

2025-08-22 10:32