In the vast library of surgical history, a curious tome has emerged-one that chronicles the ascendance of robotics in the operating theater. The market, once a mere footnote valued at $800 million in 2015, has burgeoned into a multi-billion-dollar narrative, exceeding $3 billion. The alchemy of this transformation lies in the dual attributes of these mechanical entities: their nimble instruments and diminutive cameras. With them, surgeons are no longer confined to the skin’s surface but can traverse the intricate maze of human anatomy, performing procedures of remarkable finesse that often daintily skirt the more brutal traditions of open surgery.

Yet, even as 78% of U.S. surgeons express a nascent curiosity toward this technology, many remain reluctant to embrace its potential, revealing regions of untapped opportunity akin to the unexplored shelves of an ancient library. The shift toward surgical robotics harbors the promise of significant winds at the backs of healthcare stalwarts such as Intuitive Surgical (ISRG) and Medtronic (MDT).

1. Intuitive Surgical

Intuitive Surgical occupies a commanding position in this arena, with its ensemble of products that includes the Ion system-an instrument that aids in the perilous yet revealing act of lung biopsies-and the most illustrious da Vinci system, which operates across a spectrum of general surgeries and beyond.

Regarded as the quintessential robotic surgical apparatus, the da Vinci system first received its ecclesiastical blessing in 2000. Over the years, this device has metamorphosed through successive generations; the fifth iteration graced the market recently, allowing for an infinite loop of innovation. In the grand theatre of surgery, Intuitive’s first-mover advantage echoes through three chambers of advantage as the market expands exponentially. The established brand name is a siren’s call for physicians, who lean toward familiarity-a comforting presence in their high-stakes dealings with life itself.

The reservoir of data amassed from clinical trials and real-world applications serves as a beacon in a field often shrouded in ambiguity; such is the potency of evidence in the healthcare arena. Moreover, Intuitive Surgical has cultivated a robust installed base, finishing the second quarter with a formidable count of 10,488 da Vinci systems-a 14% increase year-over-year. These artifacts, laden with cost, infuse a formidable barrier to exit for healthcare facilities, hence fortifying the company’s moat against the tempestuous waters of competition.

Notwithstanding, the path is fraught with challenges, such as stilting costs borne from tariffs. Yet, with the undercurrent of the robotic surgery market swelling, Intuitive’s stock, akin to an ancient tome awaiting discovery, calls to discerning investors. A precarious year has dulled its shine, yet the promise of its narrative persists, a stock worthy of contemplation.

2. Medtronic

Meanwhile, Medtronic lingers at the threshold of a momentous entrée into the U.S. surgical robotics domain. Earlier this year, whispers of triumph wafted forth-clinical trials for its Hugo system rendered successes in the delicate realm of urologic procedures. Awaiting the аpproval of the U.S. Food and Drug Administration is but a minor labyrinthine step in a grander narrative.

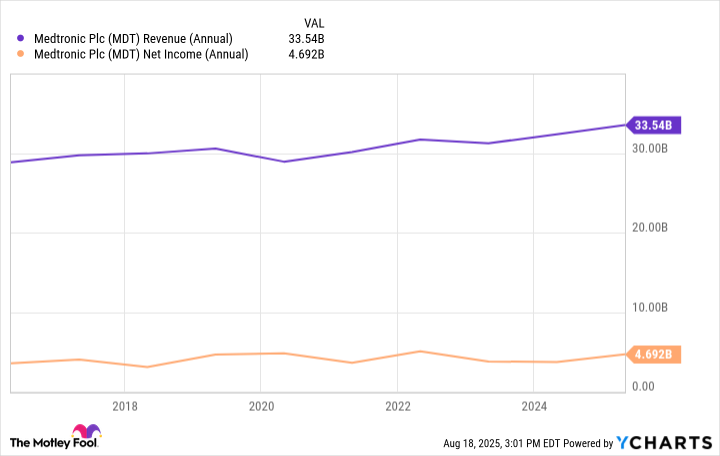

The company’s advance into this innovative arena is predicated upon the recognition of the gaping chasm in receptive adoption; mere years past, fewer than 5% of suitable procedures utilized robotic assistance. The Hugo system, equipped with promise, beckons further approvals, and while its impact may linger in the shadows for some time, its entry heralds a significant shift for a company that has wrestled with languid revenue growth.

Even as Medtronic grapples with tariff-induced tribulations, the recent strategic decision to part ways with its underperforming diabetes care segment represents a calculated evolution. Its commitment to diverse therapeutic territories, spanning 150 countries, speaks to its resilience; the company is a veritable tapestry of myriad revenues, promising dividends enriched by longevity. In a remarkable display, it has elevated its payouts for 48 consecutive years-an approaching duurzaamheid, sanctified in the realm of Dividends. The stock, possessing one foot on this threshold of perpetual continuity, glimmers for income seekers, especially amid the fertile grounds of its forthcoming Hugo debut.

In the end, the labyrinthine paths of surgical robotics lead inexorably toward a future rich with investment potential, echoing the infinite possibilities contained within a library of Babel. 📈

Read More

- 21 Movies Filmed in Real Abandoned Locations

- Gold Rate Forecast

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 39th Developer Notes: 2.5th Anniversary Update

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- The Timeless Allure of Dividend Stocks for Millennial Investors

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

2025-08-21 15:35