Amidst the feverish carnival of modern markets, where algorithms dance like madmen and fortunes rise and fall with the flicker of a screen, there exists a quiet truth: even in the charnel house of growth stocks, value lingers like a ghost. The consumer goods sector, battered by tariffs and forgotten in the shadow of artificial intelligence’s glittering idol, now whispers secrets to those patient enough to listen. Here, amid the rubble of discounted valuations and fading hysteria, two companies stand as monuments to resilience and paradox.

1. Lululemon: The Agony and Ecstasy of Brand

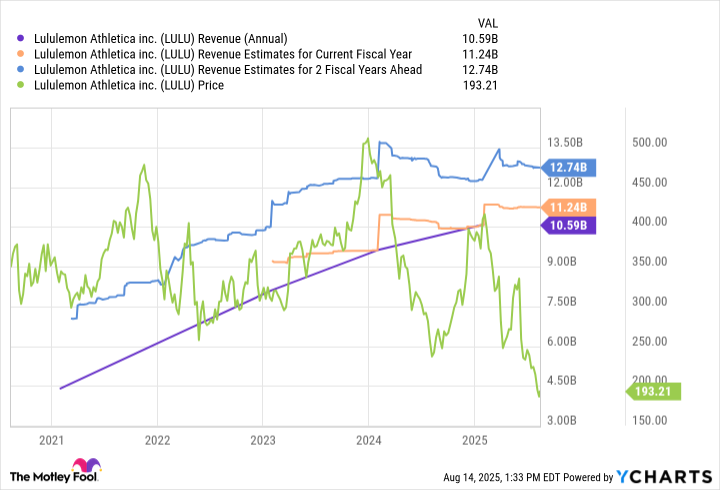

Consider Lululemon Athletica – a name that once summoned visions of endless ascent, now burdened by the mortal weight of maturation. Twenty years have forged its brand into a golden idol, worshipped by devotees who willingly surrender $100 for the privilege of wearing its sigil. Yet herein lies the torment: the god must feed on growth, and growth has grown shy. A 5% whisper of expansion in 2025, a shadow of its former roar, haunts the halls where once echoed the thunder of double-digit miracles.

The stock, once a phoenix soaring at $410, now crawls at $205 – a carcass picked clean by vultures who proclaim the end of an era. But what if this crucifixion has already priced in the worst heresies? A forward P/E of 13.4, a beggar’s pittance compared to its historical feast, suggests the market has condemned it to purgatory. Yet in this humility, a question festers: can pricing power born of cultish devotion withstand the decay of stagnation? Can menswear and foreign frontiers become the absolution this penitent seeks?

The mind reels at the contradictions. A company whose margins bleed from slowing momentum, yet whose soul remains unbroken by the lash of competition. Is this not the definition of value? To find divinity in the discounted, to perceive resurrection in the ruins?

2. MercadoLibre: The God of the Jungle

Turn now to MercadoLibre, that chimera of commerce and finance prowling the untamed wilds of Latin America. Here, in lands where cash still rules as king and digital phantoms haunt the unbanked masses, it spreads its tendrils like a strangler fig. E-commerce penetration crawls at infantile levels, yet within this backwardness lies diabolical potential: to leapfrog legacy systems and become the sacrament of transaction.

Observe its dominion: a marketplace where 15 competitors combined cannot match its might, yet two-thirds of online spending remain virgin soil. The mind reels at the implications. Will Mercado Pago become the baptismal font of financial inclusion, converting cash-wielding heathens into digital disciples? Or will the jungle reclaim its own, through currency storms and civil unrest?

The calculus of faith demands we weigh the spectral against the concrete. Take rates must hold, margins must not bleed, and active buyers must multiply like locusts. Should these stars align, the trillion-dollar pantheon awaits – a temple where Amazon and MercadoLibre might someday break bread as equals. But oh, the suffering between now and then! The market’s whip of quarterly expectations, the dagger of currency devaluation – can any mortal endure such torment?

In the end, we confront the eternal paradox: growth is both savior and temptress, a flame that warms today’s portfolio while threatening to immolate tomorrow’s hopes. To invest in these names is to embrace the existential gamble, to wager that beneath the decaying flesh of slowing growth still beats the immortal heart of human ambition. 📊

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- TON PREDICTION. TON cryptocurrency

- Top Actors Of Color Who Were Snubbed At The Oscars

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

2025-08-21 15:20