Behold, the tempest of capital surges toward August 27th, when Nvidia (NVDA) will unveil the latest chapter in its fiscal 2026 saga-a quarterly reckoning that could either crown it as the messiah of silicon or expose it as a hollow prophet. The data center business, that modern-day Promethean forge where GPUs are wrought into the very sinews of artificial intelligence, will reveal whether the company’s dominion is divinely ordained or a house of cards built on caffeine and code.

Consider the irony: as the titans of tech-Alphabet, Meta, Amazon, Microsoft-plunge into their own Sisyphean quests for AI supremacy, they pour billions into capex, their hands trembling with the fever of creation. Yet in this frenzy, do they not merely court the god they themselves have birthed? The capital expenditures swell like the hubris of Icarus, and Nvidia, the unwitting Midas, finds itself both architect and spectator to this madness. What solace can it take in quarterly reports when the very world it fuels may one day render its chips as obsolete as the quill?

Since 2023, Nvidia’s stock has ascended with the zeal of a zealot’s psalm-1,150% in valuation, a crescendo of greed and hope. Yet herein lies the rub: is it too late to board this chariot? The earnings report on August 27 may yet be the spark that ignites the pyre of further ascent-or the final, delusional gasp of a man who believes he can outpace the tide.

Tech Giants and the Alchemy of AI

The Blackwell and Blackwell Ultra GPUs, those infernal engines of computation, have rewritten the sacred scrolls of performance. The GB300, with its 50-fold acceleration over the H100, is the philosopher’s stone for AI’s reasoning models-GPT-5, Claude 4, Gemini 2.5-each a Golem of silicon and syntax. But what is this progress if not the serpent biting its own tail? For every token processed, every “thought” simulated, the demand for power grows, and with it, the existential dread of obsolescence.

Jensen Huang, the oracle of Nvidia, whispers that reasoning models consume tokens in quantities that mock the scales of Babel. They “think” in the background, those digital minds, churning with a laboriousness that borders on the tragic. And yet, investors cheer, for in this madness lies profit. The GB300, set to ship in 2025, may yet be the last gasp of human ingenuity before the machine takes the reins.

The capex forecasts of Nvidia‘s patrons are a litany of hubris:

- Alphabet now dares to spend $85 billion in 2025, a sum that could buy a small nation.

- Meta, once content with $64 billion, now eyes $72 billion-a Siren’s call to the abyss.

- Amazon‘s $118 billion pledge is less an investment than a confession of mortal fear.

- Microsoft, having spent $88 billion in 2025, now stares into the void and sees only more.

The Fiscal Crucible of August 27

Nvidia‘s guidance whispers of $45 billion in Q2 revenue-a 50% year-over-year leap. Yet what is this figure but a fleeting shadow on the wall of Plato’s cave? The data center business, that 90% of the total, is both the company’s savior and its executioner. For every dollar earned, a thousand questions linger: Is this the peak? The trough? The illusion?

Wall Street, that modern-day Iliad of numbers, fixates on the third-quarter forecast. Analysts dare to predict $52.5 billion, a sum that could either sanctify Nvidia as a prophet or expose it as a charlatan. The earnings per share-$1 in Q2-is but a drop in the ocean of speculation. Yet in this drop, the stock price drowns or dances, depending on the whims of the market’s fickle heart.

The Investor’s Paradox

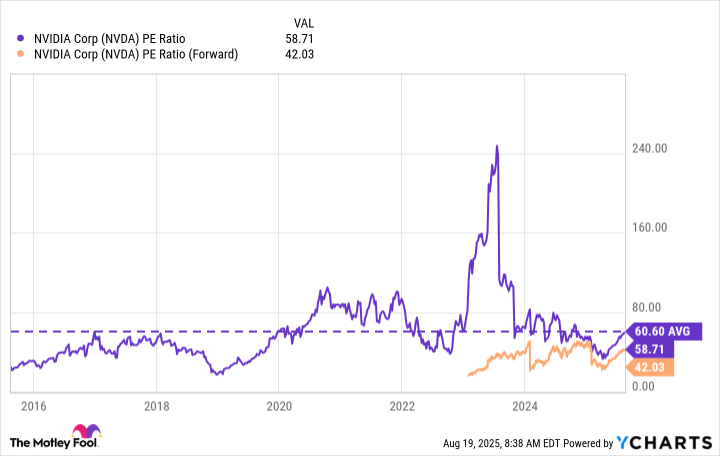

Since May 28, Nvidia‘s stock has risen 35%, a figure that glimmers with the false gold of optimism. Its P/E ratio of 58.7 is a tenuous bridge between past and future, a fragile thread that binds the present to the hypothetical $4.33 per share in fiscal 2026. To reach its 10-year average of 60.1, the stock must ascend 43% in six months-a feat that demands not just faith, but a leap into the void.

And yet, the capex crescendo from its patrons suggests that the abyss may yet yield. The risk of missing estimates is as remote as a snowfall in Hell. Thus, the question lingers: is this stock a vessel of salvation or a siren’s song? The answer, like the market itself, is a riddle wrapped in a paradox, cloaked in the fog of human folly. ♟️

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

2025-08-21 11:32