Shares of BigBear.ai (BBAI) have surged 375% in a year, a feverish reaction to the promise of artificial intelligence and defense technology. But the second-quarter report has turned the tide against the stock, leaving investors to wonder whether the company’s future is as bright as its CEO claims-or merely a mirage.

The numbers tell a grim story: revenue fell 18% year-over-year, earnings missed estimates by an order of magnitude, and contracts with the U.S. Army were quietly abandoned. CEO Kevin McAleenan, however, insists the company is poised to benefit from President Trump’s “big, beautiful bill,” a legislative windfall he describes as tailor-made for BigBear.ai. Such optimism, while welcome, raises a question: Is this a vision of opportunity or a sales pitch for desperation?

If McAleenan is correct, the current dip might be worth buying. But if the fundamentals-declining revenue, ballooning losses, and shaky guidance-are any indication, this could be a trap for the unwary.

A Bleak Quarter for a Sector in Peril

BigBear.ai sells AI-powered analytics to the defense, security, and logistics sectors. Yet in 2024, its revenue grew by a paltry 2%. The most recent quarter saw a 18% drop in revenue to $32.5 million, and the first half of 2025 brought an 8% decline compared to the prior year. The company blamed these results on government cost-cutting, including the loss of a $165 million Army contract. McAleenan promised to “compete to win this work again,” but the damage is already done: The company withdrew its EBITDA guidance, and its net loss per share of $0.71-1,000% below expectations-left investors reeling.

Management attributed the $228.6 million net loss to accounting charges tied to debt financing, a convenient explanation for a company that has long struggled to turn a profit. The revised annual revenue guidance of $125-$140 million-a sharp cut from $160-$180 million-only deepens the unease. BigBear.ai’s results suggest a business more concerned with survival than growth.

Liquidity as a Sword and Shield

Amid the gloom, BigBear.ai raised $293.4 million through at-the-market stock sales, ending the quarter with $390.8 million in cash. Management called it the strongest balance sheet in company history, a claim difficult to dispute. But liquidity alone cannot fix a flawed strategy. McAleenan’s plan to use the cash for “strategic transformational acquisitions,” marketing, and talent recruitment sounds bold but lacks specificity. The CEO’s declaration that the company will “go on offense in a big way” rings hollow without a clear roadmap.

The “big, beautiful bill” signed by Trump on July 4 offers billions for defense tech and border security-areas where BigBear.ai claims expertise. Yet the company has failed to capitalize on market tailwinds despite operating in one of the fastest-growing sectors. This disconnect between potential and performance is troubling.

A Discounted Bargain or a Time Bomb?

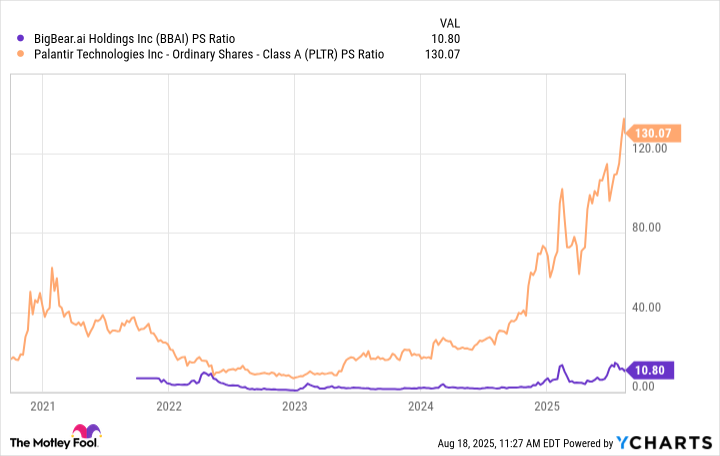

BigBear.ai’s stock fell 18% after the Q2 report, briefly rebounding on news of a biometric application in Panama. Investors may take comfort in the company’s price-to-sales ratio, which appears cheaper than Palantir Technologies’. But this metric is a poor substitute for substance. Palantir’s revenue grew 48% in Q2 and its guidance was raised; BigBear.ai’s sales are trending downward. The numbers speak plainly: BigBear.ai is not a peer to Palantir, but a shadow of it.

McAleenan’s capital raise suggests a recognition of the need to compete, but cash does not guarantee success. Mergers or acquisitions could stabilize the business-or sink it further. The coming months will test whether BigBear.ai can transform its balance sheet into real value or if it will join the ranks of overhyped companies that fail to deliver.

For now, only the most risk-tolerant investors should consider BigBear.ai. The market has spoken, but not in the language of confidence. 🎯

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-20 17:11