Behold, dear reader, the grand stage upon which our modern-day farce unfolds-a tale not of heroes or gods but of green leaves and greener ambitions. Enter Tilray Brands (TLRY), a player in the cannabis industry, whose rise was heralded with the fanfare of trumpets yet whose fall whispers like autumn leaves swept by winter winds. Let us examine this theatrical spectacle through five acts, each more absurd than the last.

Act I: The Illusion of Triumph

Ah, the sweet scent of opportunity wafting through Canada’s air as recreational cannabis legalization graced the land in 2018. Investors, those ever-eager gamblers, rushed forth to purchase shares of companies such as Tilray, believing themselves destined for fortune. And lo, Tilray ascended swiftly, claiming its crown as an industry leader. But alas, appearances can deceive, much like a painted visage masking hollow cheeks.

Act II: The Market’s Cruel Jest

What follies befell these pioneers of pot! In their haste to dominate, they spawned competitors aplenty, each vying for scraps of market share amidst labyrinthine regulations. Ah, the irony! While marijuana became legal, its sale remained shackled by provincial peculiarities-none more maddening than Ontario’s lottery system, which mocked hopeful retailers. As Mark Zekulin, erstwhile CEO of Canopy Growth, lamented: “The market opportunity today is simply not living up to expectations.” Indeed, dreams of riches crumbled faster than poorly rolled joints.

Act III: Shadows of Illegality

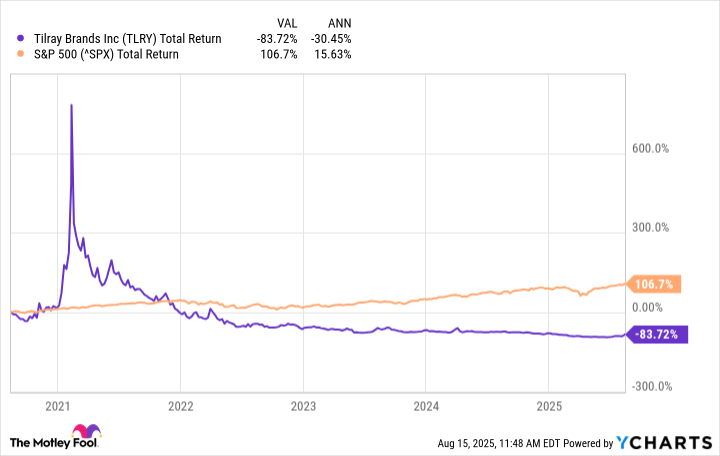

But wait, there is more folly to unfold! Despite legalization, illicit markets thrived, accounting for nearly one-third of Canadian cannabis sales by 2022. Poor Tilray, forced to contend with both oversupply and shadowy rivals peddling wares without regard for licenses or laws. Prices plummeted; profits vanished. Thus did the company stagger under the weight of its own hubris, leaving investors bereft. Consider this: had you entrusted $1,000 to Tilray five years past, you would now possess a paltry $163. Meanwhile, the S&P 500 transformed your modest sum into $2,067-a cruel jest indeed.

Act IV: Diversification’s Empty Promise

Yet some cling to hope, pointing to Tilray’s diversification into wellness products, pharmaceuticals, and even craft brewing. “Surely,” they cry, “the U.S. will legalize cannabis soon!” Yet consider Germany, where recent legalization allows citizens only to grow their own plants or join exclusive clubs. Will America mimic such restrictions? Who can say? What we do know is that larger corporations, armed with deeper coffers and greater expertise, may swoop in to claim dominion over any emerging market. Thus does Tilray’s future resemble less a triumph and more a tragicomedy.

Act V: The Verdict

And so, we arrive at the denouement of this farcical drama. Shall we invest further in Tilray? Nay, for its history speaks louder than promises of redemption. Its financial results remain inconsistent; its leadership unprofitable. To hold onto such stocks is akin to grasping smoke-it slips through fingers, leaving naught but regret behind.

In conclusion, let us bid adieu to this tale of greed and delusion, wherein dreams of wealth dissolve into thin air. Forsooth, it serves as a cautionary chronicle for all who chase mirages in the desert of capitalism 🎭.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-20 14:12