The alchemy of artificial intelligence has transmuted the fortunes of Nvidia (NVDA) and Palantir Technologies (PLTR) into gilded relics of recent years, their trajectories etched in the annals of silicon and code. Yet, amid this pantheon of progress, a shadowed colossus stirs-CoreWeave (CRWV), a progeny of cloud-born ambition, whose stock has pirouetted with the grace of a dervish, outpacing its elder siblings in a ballet of capital.

Nvidia’s crystalline chips, those luminous labyrinths, have lit the path for cloud-cloaked colossi and state apparatuses alike, while Palantir’s algorithms, like sly magicians, have woven AI into the very sinews of enterprise. Their shares, once vibrant as springtime, now flutter with the languor of well-fed sparrows. Yet CoreWeave, a fledgling phoenix, ascends with the fervor of a moth drawn to a flame, its wingspan unfurling across the market’s vast expanse.

Palantir’s ledger swells with 116% triumph in 2025, a feat as resplendent as a peacock’s display, while Nvidia’s 33% ascent, though commendable, seems a mere whisper beside CoreWeave’s crescendo. This latter entity, having donned the mantle of public scrutiny less than half a year past, has already etched its name in the ledger of audacity, its stock vaulting 125% since March’s inaugural curtain call.

The genesis of CoreWeave’s ascent lies in the siren song of cloud-based AI, a chorus that has swollen to a cacophony of demand. Its business, a tapestry of Nvidia’s GPU serfdom, rents out these digital gladiators to clients thirsting for machine-generated revelations. A symphony of storage and networking complements this orchestra, each note a testament to its acumen.

Its Q2 2025 results, released on the 12th of August, unveil a veritable carnival of capital, revenue tripling to $1.21 billion, a number that eclipses even the loftiest of its forecasts. More tantalizing still, its revenue backlog, that elusive ghost of future profits, swelled 86% year-over-year, a gilded hoard surpassing the 63% of the prior quarter. A $30 billion trove, this, a treasure map for the fiscally adventurous.

This bounty, a product of both a burgeoning clientele and the alchemy of contract expansion, finds its apex in a $4 billion pact with OpenAI, an addendum to a prior $12 billion accord. The company’s management, ever the sly fox, boasts of a new hyperscale patron whose contract, like a vine, coiled ever tighter around CoreWeave’s offerings. Its data centers, those cathedrals of computation, now hum with 470MW of power, a 50MW increase from the previous quarter’s 420MW.

The contracted power capacity, a metric as elusive as a mirage, surged 37% to 2.2GW, a figure that whispers of future scalability. Such metrics, when parsed through the lens of a dividend hunter, suggest not mere growth, but a veritable engine of perpetuity, its pistons fueled by the inexorable march of AI.

CoreWeave’s management, with the hubris of a prophet, envisions a $400 billion total addressable market by 2028, a figure as grand as a cathedral’s spire. To achieve this, it has poured $4.8 billion into capital expenditures in H1 2025, a sum that dwarfs its predecessor’s $3.7 billion. This fiscal fervor has birthed a revised revenue forecast of $5.25 billion, a leap from the earlier $5 billion, a testament to its unrelenting ambition.

The Stock’s Quiet Allure

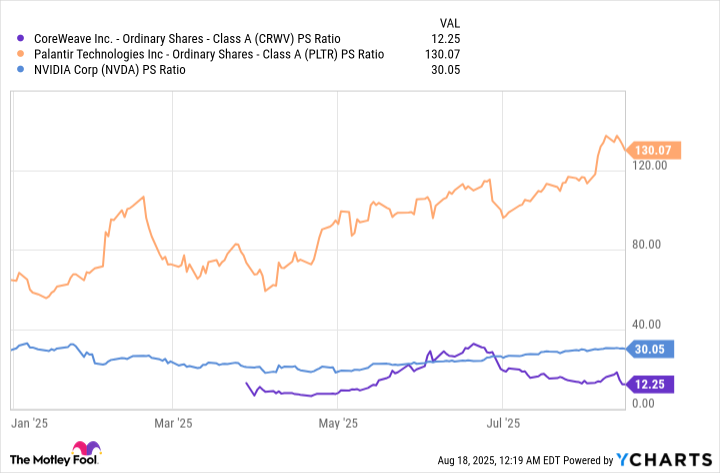

Trading at 12 times sales, CoreWeave’s valuation, though steep, is a bargain when juxtaposed with its peers. Nvidia and Palantir, those titans of yore, command higher multiples, their prices a testament to past glories rather than future promise. The chart, that silent oracle, reveals a tale of relative undervaluation, a narrative ripe for the discerning investor.

Its growth, a locomotive of relentless momentum, outpaces even the most ardent of its rivals. While Nvidia’s 69% revenue surge and Palantir’s 48% leap are commendable, CoreWeave’s backlog-a trove of tokens-suggests a trajectory that may yet eclipse these benchmarks. A company with such a gilded hoard is not merely a stock; it is a promise, a siren’s song to the dividend hunter who dares to listen.

In this grand theater of capital, CoreWeave’s performance is not merely a spectacle, but a revelation. Its story, woven with the threads of innovation and audacity, beckons the investor who seeks not just returns, but the thrill of the chase. To purchase its shares is to wager on a future where the algorithms of tomorrow are already being forged in the crucible of today.

🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-20 13:55