Oh, quantum computing. The tech world’s shiny, futuristic bauble that promises to revolutionize everything from curing cancer to making your Wi-Fi faster than the speed of light-or so they say. It’s like being handed a lottery ticket where the numbers are written in invisible ink. Exciting? Sure. Reliable? Not exactly.

Now, I’m no wide-eyed optimist clutching my wallet at the altar of innovation. Let me be clear: I’ve got one eyebrow permanently arched when it comes to investing in anything labeled “nascent.” But here we are, staring down two contenders in this high-stakes game of quantum roulette-D-Wave Quantum (QBTS) and Quantum Computing Inc. (QUBT). Both sound impressive, don’t they? Like something James Bond would mutter into his martini glass before saving humanity. But let’s not kid ourselves; beneath all the jargon lies a swamp of uncertainty.

Untangling D-Wave Quantum’s Business Performance (or Lack Thereof)

So, D-Wave makes money by renting out its quantum machines via the cloud and offering professional services to help clients use them. Sounds straightforward enough, right? Well, buckle up, because their financials are more chaotic than a toddler on a sugar rush.

In Q1 2025, D-Wave pulled in $15 million after selling one of its quantum computers-a solid start, if you ignore the fact that revenue plummeted to $3.1 million in Q2. Yes, there was a 42% increase compared to last year’s $2.2 million, but only because someone decided to upgrade their shiny new toy. Meanwhile, bookings grew 92% year-over-year to $1.3 million. Bookings! Orders yet to become actual cash. It’s like celebrating Christmas gifts before realizing you still have to pay for them.

And then there’s the elephant in the room: profitability. Spoiler alert-it doesn’t exist. D-Wave’s Q2 operating loss ballooned to $26.5 million, up 42% from last year. For context, that’s eight times their quarterly revenue. Eight. Times. If this were a rom-com, we’d call it tragicomic.

But wait, there’s hope! Or at least a big pile of cash. D-Wave is sitting on $819.3 million, which means they can keep the lights on while they figure out how to turn those photons into profits. Whether they’ll succeed remains as mysterious as quantum mechanics itself.

Quantum Computing Inc.’s Budding Business (Emphasis on ‘Budding’)

Now onto QCi, the company using photons to do… well, something vaguely scientific. They sell chips, hardware, and services, but honestly, their revenue stream feels less like a river and more like a leaky faucet. In 2024, they eked out $373,000-a mere 4% bump from the previous year. And guess what happened in the first half of 2025? Sales dropped 52% to $100,000. Ouch.

On paper, QCi’s technology has potential. Photons could unlock endless possibilities in imaging, sensing, and other optical applications. But until they find customers willing to pony up real money, it’s all just theoretical glitter. Oh, and did I mention they’re hemorrhaging cash too? Their Q2 operating loss hit $10.2 million against $61,000 in revenue. That’s like burning a Picasso to light a cigarette.

Like D-Wave, QCi has a hefty stash of cash ($348.8 million) to tide them over. But let’s face it: without significant traction soon, this ship might sink faster than the Titanic-and trust me, nobody wants to go down with Rose and Jack.

The Verdict: Choosing Between D-Wave and QCi

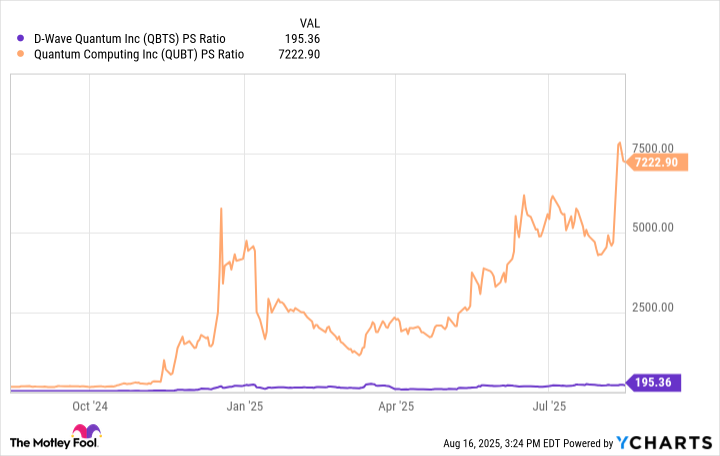

If you’re thinking about throwing your hard-earned money at either of these companies, congratulations-you’ve officially entered the realm of speculative insanity. Now, since neither firm is profitable, we’re forced to rely on the price-to-sales (P/S) ratio to gauge value. Spoiler: QCi’s P/S multiple makes D-Wave look downright bargain-bin cheap.

Combine that with D-Wave’s slightly less catastrophic sales trajectory, and voilà-they win by default. But let’s not get carried away. Investing in D-Wave isn’t exactly akin to finding buried treasure. It’s more like buying a map to buried treasure that may or may not lead to quicksand.

Here’s the kicker: quantum computing is still in its infancy. These machines are delicate little divas prone to errors at the slightest provocation-a temperature fluctuation, a stray cosmic ray, who knows? Some experts predict scalable devices won’t arrive until 2040. So unless you’re prepared to wait decades for returns, tread carefully.

Look, I’m not saying avoid these stocks entirely. Just know what you’re signing up for: a wild ride fueled by hype, hope, and heaps of uncertainty. If you’re the type who thrives on chaos, go ahead-place your bets. As for me, I’ll stick to index funds and existential dread. Cheers to capitalism, I suppose. 🍸

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-20 13:33