Berkshire Hathaway (BRK.A) (BRK.B) stands as a veritable colossus in the sprawling landscape of finance, a hallowed bastion of investment wisdom presided over by the indomitable Warren Buffett-a name synonymous with sage guidance and gold-plated success. Yet, as whispers of his impending resignation waft through the ether, a palpable anxiety has cast a shadow upon its esteemed stock, leading many to ponder whether an era of inevitability is bowing out to the uncertainties inherent in a new dawn.

Since May, Berkshire Hathaway’s stock has succumbed to the forces of gravity, yielding a 10% decline while the seemingly effervescent S&P 500 has frolicked to a 15% crescendo. This disjuncture between reality and expectation sparks the perennially poignant question: could this disarray present an opportune moment for sagacious investors to arm themselves with the company’s shares? Allow me to elucidate.

Behold the Diversified Doyenne of Profitability

At its very nucleus, Berkshire is a bustling metropolis of cash-generating enterprises, an illustrious constellation featuring its insurance behemoths such as GEICO, the Berkshire Hathaway Primary Group, and a global reinsurance division-a veritable trifecta of financial fortitude. Last year, the insurance underwriting segment cavorted into profitability, conjuring $9 billion in operating earnings, while its investment income chimed harmoniously with a robust $13.7 billion. These two formidable forces coalesced to comprise nearly half of its earnings last year, a trend that continues into the present year.

Notably, Berkshire’s investment strategy diverges from the pedestrian norm, favoring a delectable assemblage of equity securities more concentrated than one might expect in the insurance industry-akin to a costly wine poured from a vintage bottle. Moreover, as interest rates have ascended to altitudes previously reserved for airplanes, the company has luxuriated in a veritable windfall of interest income.

Furthermore, the investment Spire encompasses a cornucopia of industries, from transportation (the venerable Burlington Northern Santa Fe-BNSF, a titan in North American railroads) to an array of manufacturing delights and retail establishments (Dairy Queen and Pilot Travel Centers spring to mind). Each subsidiary spins a thread in the intricate tapestry that forms the core of this economic juggernaut.

Embarking Upon a Period of Transition

Yet, as the year marches forth, Berkshire faces a tortuous transition-the chrysalis of leadership is undergoing metamorphosis, with the venerable Buffett set to retire, leaving a void that even the most polished diamonds would find hard to fill. This is not merely a change of the guard; it is the turning of a page in an epic penned over six decades-an era defined by Buffett’s quasi-mythical investment acumen.

Enter Greg Abel, Todd Combs, and Ted Weschler-the triumvirate poised to guide Berkshire into a new zenith-as the sun sets on Buffett’s tenure. Abel, the chosen successor and currently the Vice Chairman of Non-Insurance Operations, will bear the weighty mantle of leadership. Combs, whose hedge fund past and reformation of GEICO have distinguished him in the pantheon of investment strategy, and Weschler, whose astonishing trajectory of growing a mere $70,385 to a staggering $131 million-yes, you read that correctly-over 28 years, will join him as custodians of legacy.

This trio, handpicked and imbued with Buffett’s pedagogical spirit, embodies a meticulously orchestrated succession plan, designed to preserve the sacred culture of Berkshire Hathaway steeped in long-lasting value creation.

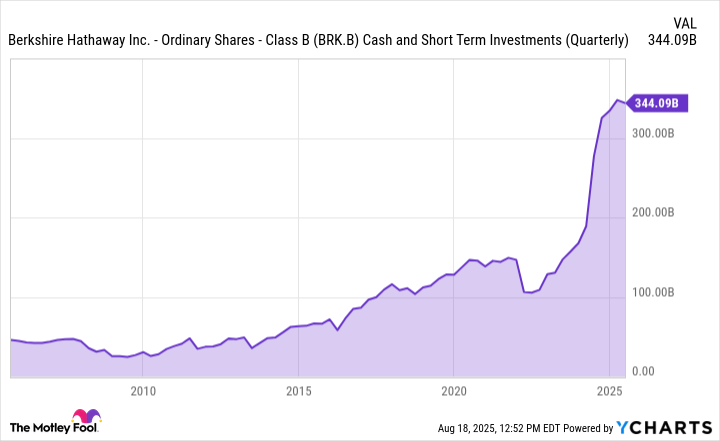

A Tidal Wave of Cash Awaits, Priced Fairly

Speaking of preservation, Berkshire Hathaway’s financial situation mirrors that of an opulent mansion-its cash and short-term investments are not only ample but provide a veritable fountain of opportunities for prospective undertakings. The insurance operations project an endless fountain of investment capital, yielding a magnificent float that enriches Berkshire’s coffers.

For now, our illustrious conglomerate has taken refuge in the safe embrace of treasuries and other transient holdings, all while they prudently capitalize on elevated short-term rates, eschewing the dizzying heights of historical equity valuations.

By the end of June, Berkshire’s treasury bill hoard burgeoned to a staggering $340 billion, thus generating investment income on a majestic scale, reported at $5 billion within the first half of 2025-a delightful uptick of 11.3% from the preceding year.

Despite the recent market blues, Berkshire’s stock is obtaining an air of reasonable attire adorned with a 16.3 price-to-earnings ratio and a 1.5 price-to-book value, illuminating its potential as a splendid investment nurtured within a fertile landscape.

Though the specter of leadership transition looms large, the company’s storied diversity unmarred, coupled with its cash-laden balance sheet, positions it splendidly to exploit the ripe opportunities awaiting beyond the veil-perhaps rendering it an advantageous procurement for the discerning investor today. 🦋

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-20 03:54