Ah, mes amis, gather ’round for a tale of intrigue, ambition, and the eternal dance of bitcoin and folly! Strategy-formerly Microstrategy, now rechristened like a debutante at a ball-finds itself embroiled in a grand debate over its mNAV policy. Investors cry foul, claiming the company hath abandoned safeguards against share dilution, all while its bitcoin-heavy treasury remains both a beacon of hope and a target of skepticism. 😅

A Reversal Most Curious: MSTR’s mNAV Gambit 🔄

Strategy, once a humble purveyor of business intelligence software, hath transformed into a corporate bitcoin behemoth under the ever-watchful eye of Executive Chairman Michael Saylor. With 629,376 BTC in its coffers, it stands as the world’s largest corporate holder of the digital gold. But pray tell, what is this “mNAV” that stirs such passions? 🤔

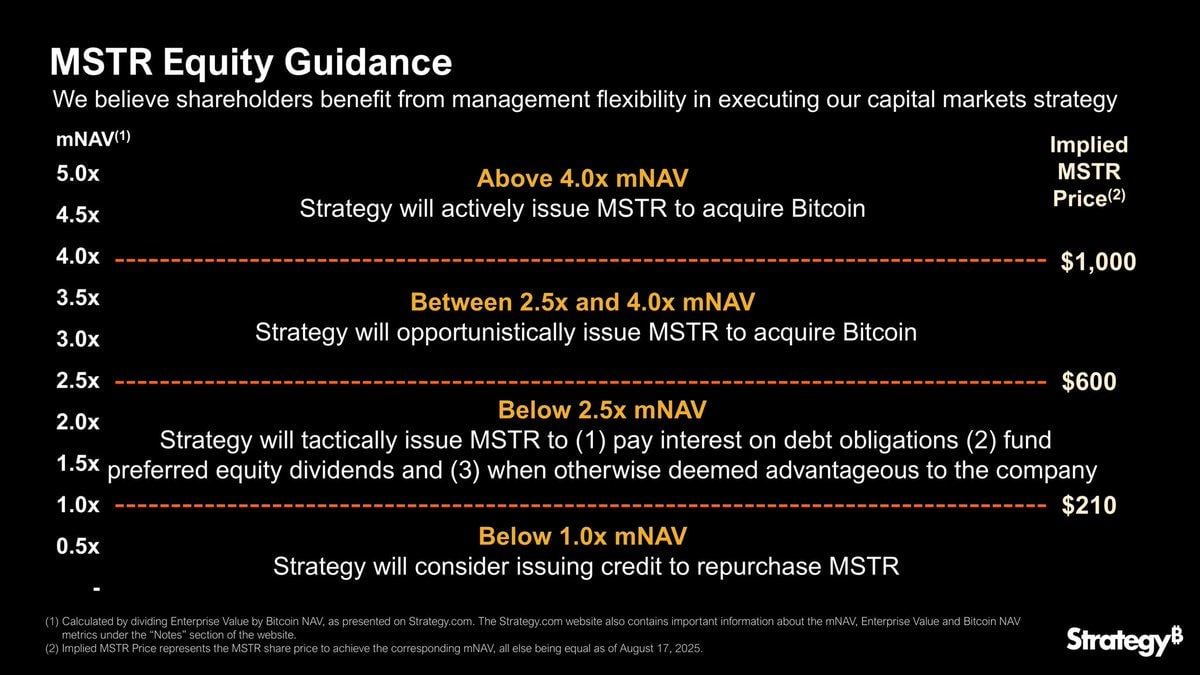

Behold, dear reader, the metric known as mNAV-or multiple of Net Asset Value-a measure of how much the market is willing to pay for Strategy’s stock relative to its bitcoin holdings. An mNAV of 1 means parity; above 1, a premium; below 1, alas, a discount. Historically, MSTR hath traded at a princely premium, often between 2x and 3.4x its bitcoin value. But lo! Critics decry this as folly, arguing investors could acquire bitcoin far cheaper via ETFs or direct ownership. “What madness is this?” they cry. 🙄

Yet, supporters of Strategy proclaim it not merely a holder of bitcoin but a veritable “bitcoin refinery,” employing financial alchemy to increase its hoard. They claim this warrants a higher valuation. Ah, the audacity of man to turn debt into treasure! ✨

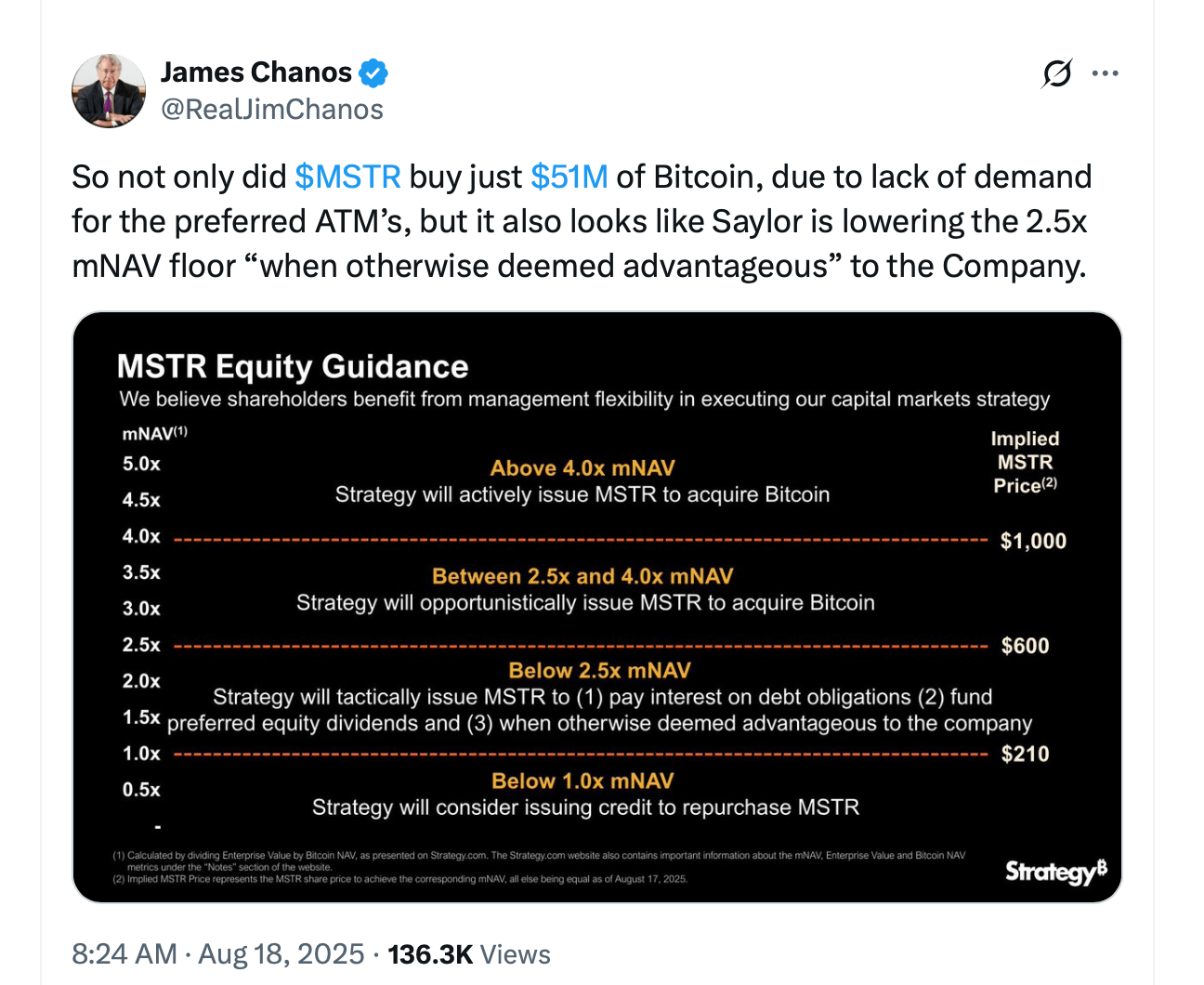

But hark! A tempest brews. During its Q2 2025 earnings call, Strategy vowed not to issue new stock below an mNAV of 2.5x-only to abandon this pledge on Aug. 18, 2025. Now, it claims it may issue shares below this threshold if “management deems it advantageous.” Cue the gnashing of teeth and rending of garments among investors! 😡

Nor does this drama unfold in isolation. A class-action lawsuit accuses the company of misleading statements, while critics liken its tactics to preying upon the gullible with bullish rhetoric. And yet, in bull markets, Strategy raises billions to buy more bitcoin, only to risk collapse when the bears return. Such is the capricious nature of fortune! 🐻❄️

The company’s capital structure, rife with preferred shares and dividend obligations, adds another layer of complexity. Truly, it is a house of cards built upon the shifting sands of bitcoin’s price. 🃏

In the end, the mNAV controversy reveals a clash of philosophies: the simple allure of direct bitcoin ownership versus the perilous thrill of a leveraged corporate bet. For those who dare tread these waters, understanding mNAV is as vital as knowing one’s lines in a play. Break a leg, investors! 🎭

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ETH PREDICTION. ETH cryptocurrency

- Why Nio Stock Skyrocketed Today

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Games That Faced Bans in Countries Over Political Themes

2025-08-19 18:58