There’s a peculiar thrill in watching one’s investment swell like a well-fed goose, isn’t there? Yet chasing individual stocks feels akin to playing roulette with a blindfold-exciting until your pockets empty. Enter ETFs, the charming tricksters of modern finance who promise to do the heavy lifting while you sip champagne. They’ve grown so popular that global assets under management ballooned to $14.6 trillion by 2024-a number so large it could make even a tsar blush.

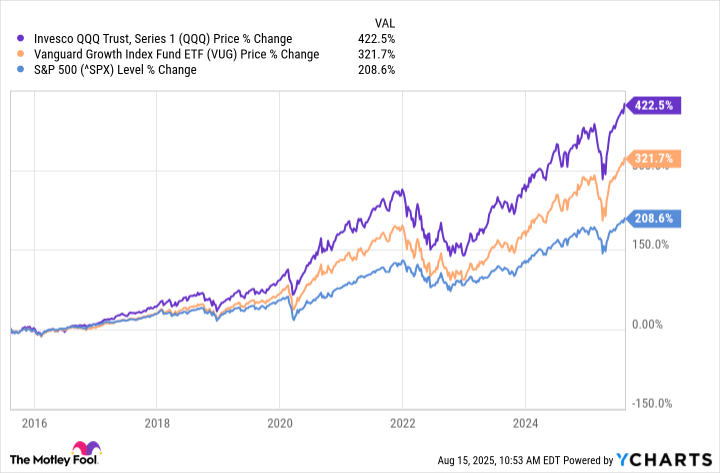

Now, measuring performance against the S&P 500 is like comparing a street urchin’s wits to a bishop’s solemnity. The S&P 500, that ever-so-serious index of 500 corporate titans, remains the yardstick for measuring market virtue. But what if we told you two ETFs-Vanguard Growth ETF (VUG) and Invesco QQQ Trust ETF (QQQ)-have played the part of Ostap Bender himself, repeatedly outwitting this gilded standard?

The Art of Outperforming, Ilf & Petrov Style

VUG, our first swindler, targets large-cap companies with the audacity to grow earnings faster than the market’s plodding pace. These firms must boast revenue growth sharper than a Cossack’s saber, return on equity so gleaming it could blind an auditor, and capital investments grander than a provincial governor’s banquet table.

QQQ, meanwhile, shadows the Nasdaq-100-a congregation of 100 tech titans (excluding financiers, those eternal opportunists). Picture a glittering ballroom where silicon chips waltz with algorithms, and every guest owns a patent or two.

History whispers sweet nothings to those who listen: both ETFs have outdanced the S&P 500 for a decade. But as any connoisseur of Russian literature knows, past glories are but ghosts at the feast. Still, they offer a tantalizing glimpse of what might be possible when one dances with the devil-and wears better boots.

The League of Extraordinary Gentlemen (and Ladies)

Let us now meet the rogues’ gallery steering these funds. Behold the table of honor:

| Company | Percentage of VUG | Percentage of QQQ |

|---|---|---|

| NVIDIA | 12.64% | 10.00% |

| Microsoft | 12.18% | 8.74% |

| Apple | 9.48% | 7.83% |

| Amazon | 6.72% | 5.52% |

| Broadcom | 4.39% | 5.45% |

| Meta Platforms | 4.62% | 3.82% |

| Tesla | 2.69% | 2.75% |

| Alphabet | 6.01% | 5.16% |

These corporate maestros control over 66% (VUG) and 54% (QQQ) of their respective ETFs’ fortunes. They’re the modern-day equivalents of 1920s American bootleggers-except their contraband is cloud computing, AI infrastructure, and digital ecosystems so vast they’d make Marx weep into his beard.

Amazon, Microsoft, and Alphabet dominate cloud computing like three cardinals in a corrupt papacy, controlling 63% of the market between them. Their servers hum like church organs powering AI’s cathedral. NVIDIA’s GPUs? The holy relics every alchemist seeks. Broadcom supplies the gears; Apple remains the pied piper of consumer tech; Meta’s advertising machine could sell ice to a polar bear.

In this grand opera of capitalism, these ETFs aren’t merely investing-they’re staging coups in the palace of progress. If you must bet on market-beaters, bet on those who’ve already stolen the crown jewels. After all, as Ostap Bender might say, the road to riches is paved with other people’s algorithms. 🧠

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- The Weight of First Steps

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Opendoor’s Stock Takes a Nose Dive (Again)

2025-08-19 18:16