On a day that could easily have been mistaken for any other, Voyager Technologies (VOYG) managed to perform a peculiar dance that many would interpret as a miraculous ascent, as if its shares were ignited with a force unknown to human comprehension. A gain of 13%, so unexplainably vast, was achieved after an announcement which, in its essence, could only be described as entirely ordinary: an investment into a nebulous entity named Latent AI. It was an action, perhaps, taken by a company forever lost in its own labyrinthine machinations, seeking a handhold in the volatile terrain of the AI market.

The Alleged Investment in Latent AI

At the break of the day, Voyager unveiled, with an almost casual indifference, a decision to funnel unspecified sums into Latent AI, a private company whose business model is described, with a peculiar sense of bravado, as the creation of AI solutions suited to “contested and constrained environments.” The notion of what this actually means is as abstract as it is unsettling, resembling the language of bureaucracy that one might hear when attempting to procure something from a faceless governmental institution-a promise with no substance, delivered with practiced ease.

Interestingly, Voyager, while no stranger to self-congratulation, refused to offer specifics regarding the scale of its investment. How much money has been allotted to Latent AI? What fraction of this alien enterprise will Voyager now control? These are questions which, it seems, might never be answered. After all, why bother revealing the details of a deal that is itself so inexplicably convoluted? What matters, perhaps, is that Latent AI will now have the ability to “accelerate development” and “broaden hardware reach,” which, in the absence of clear context, is as enigmatic as any corporate jargon one might encounter.

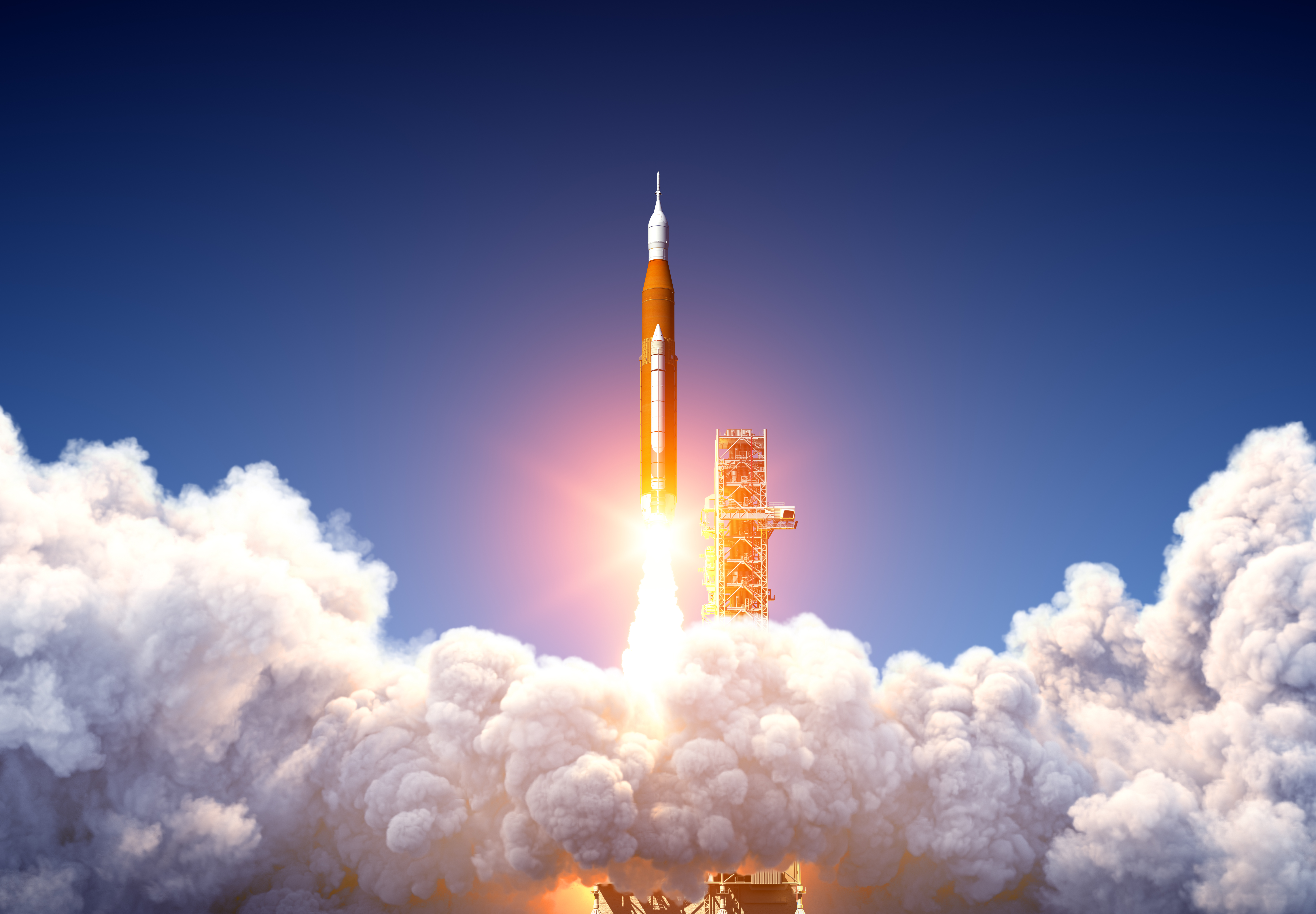

The intended purpose of this arrangement, if one may be permitted to make such an assumption, is to embed AI processors into Voyager’s spacefaring vessels, ensuring that their craft, which may or may not exist in any tangible form, will be equipped with the latest in AI-enhanced decision-making technology. One can only wonder: in the cold, empty vastness of space, what decisions will these processors truly need to make? And in this vast scheme of things, is it possible that AI itself is no more than a tool to give the semblance of progress, masking the reality that the true mission of Voyager is lost somewhere in the murky depths of its own plans?

The Elusive Voyage into the Unknown

Without the faintest hint of transparency, Voyager, that strange and distant entity, leaves its investors stranded in an abyss of uncertainty. It is difficult to assess the true nature of the deal’s ramifications, for in its obfuscation, it mirrors the very essence of market speculation-a world where even the simplest question can lead one down an interminable hallway of dead ends and false assumptions. What exactly does this investment entail for Voyager’s fundamental state, a company that, over the years, has managed to consistently post losses? It would seem that the answer is, ultimately, no more than a speculative fog, surrounding us in all its impenetrable mystery.

And yet, a singular thought persists, nagging at the back of the mind, quietly suggesting that this partnership, although seemingly meaningless in its details, could serve to grant Voyager some manner of edge in the highly competitive technological arms race. Perhaps, just perhaps, this obscure investment could allow the company to unlock some hidden potential. But can one truly rely on such vague promises, on such brittle constructs of hypothetical outcomes? One cannot help but wonder.

In the end, it appears that the stock market, much like the company it attempts to evaluate, operates in its own peculiar, absurd way. A curious thing, really-an illogical system, where transactions occur on whims, driven by news that feels as empty and unfocused as the promises of a company lost in its own ambition. Does it matter that Voyager’s stock rose, or will it, like everything else, fall back into the oblivion from whence it came? This, too, remains an unanswered question. And so, we wait, in this strange bureaucratic dance of profits and losses, as the world turns its gaze, ever more uncertain, towards the next step in this endless cycle.

🌑

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Zack Snyder Shares New Ben Affleck Batman Image: ‘No Question — This Man Is Batman’

- Games That Faced Bans in Countries Over Political Themes

2025-08-19 02:27