TL;DR

- Over $2B in ETH longs teeter on the edge, ready to plunge if the price dips below $4,200. 🌊

- Institutional shorts reach record highs, while ETFs quietly hoard ETH like squirrels with acorns. 🐿️

- The market holds its breath for Powell’s speech, FOMC minutes, and jobless data-the trifecta of fate. 🎭

The $4,200 Precipice: A Tightrope for Bulls and Bears Alike

Ah, Ethereum, the capricious maiden of the crypto world, was trading at $4,280 at the stroke of the pen, following a 24-hour tumble of 6% and a modest weekly decline. Analysts, those modern-day soothsayers, gaze intently at the $4,200 mark, where a staggering $2 billion in long positions dangle precariously, according to the ever-watchful Cipher X. 🧙♂️

LIQUIDATION WARNING

• Over $2 Billion in longs could be liquidated if $ETH dips to $4,200

• A liquidation cluster of epic proportions awaits its trigger.

• Breaking this level could unleash a torrent of forced selling across exchanges. 💥

– Cipher X (@Cipher2X) August 18, 2025

Exchange data reveals the largest concentration of leverage lurking just beneath the current price. On Binance, the liquidation exposure near this level stands at $52.18 million, with additional positions on OKX ($21.56M) and Bybit ($23.59M). “Breaking this level could spark a cascade of forced selling across exchanges,” Cipher X ominously wrote, like a raven perched on a crypt’s gate. 🦅

Ethereum, that fickle siren, recently closed a weekly candle above $4,000, a level some analysts deem crucial for its trend structure. Lennaert Snyder, with the air of a sage, proclaimed that any price action above $3,490 still supports an uptrend. 🧘♂️

“Flipping $4,000 into support would be a very bullish retest,” he noted, his voice dripping with the gravitas of a Gogol protagonist.

Support levels are etched around $4,240 to $4,190, while resistance looms higher, with the $4,550-$4,571 zone seen as a potential breakout arena. Snyder, ever the optimist, identified $4,780 as a range high and declared that a clean move above it could set the stage for a test of $5,000. 🚀

Short Positions Reach Gogol-esque Heights

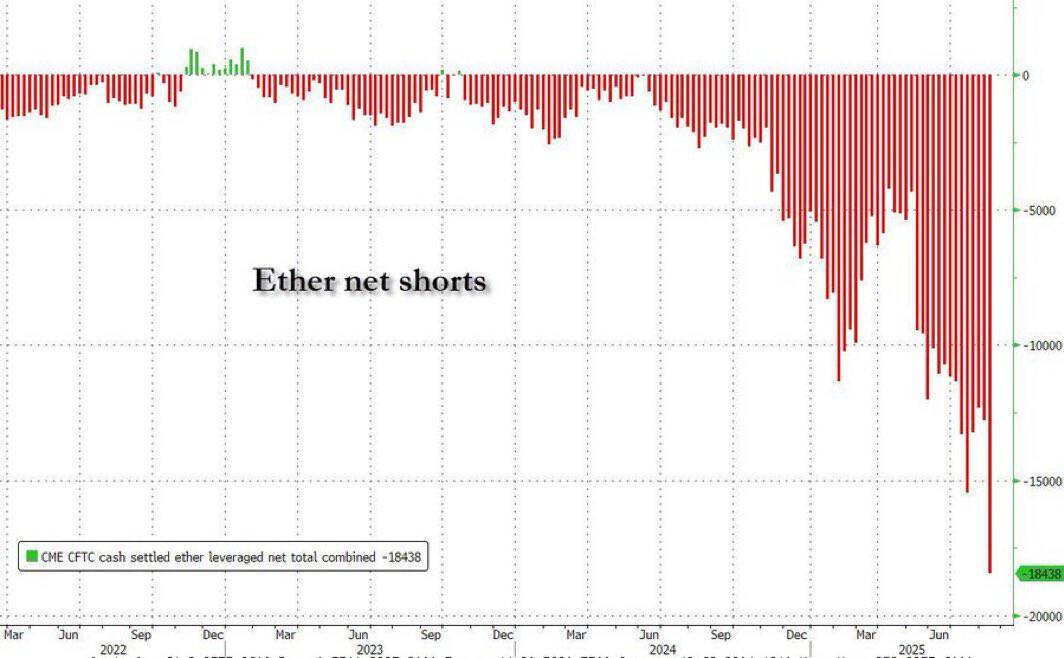

Meanwhile, short interest on Ethereum has swelled to proportions that would make even Chichikov blush. According to Quinten, institutional short exposure through CME futures has hit an all-time high. 📉

“ETH shorts hit record high,” they posted, their words echoing through the digital void like a ghostly lament. 👻

Spot accumulation by ETFs continues unabated, adding a layer of tension between spot demand and futures positioning. It’s a financial ballet, with bulls and bears pirouetting on the edge of chaos. 💃🐻

If Ethereum holds its ground and turns upward, traders are eagerly watching for a possible short squeeze. That could force some positions to close rapidly, adding to price swings in both directions-a true Gogol-esque farce of financial folly. 🎭

Key Events: The Market’s Grand Guignol

Several events this week may shape the market’s direction, each more dramatic than the last. These include the FOMC minutes on Wednesday, U.S. jobless claims on Thursday, and remarks from Fed Chair Jerome Powell on Friday. A separate meeting between Donald Trump and President Zelensky is also scheduled for today, adding a touch of political absurdity to the mix. 🗳️🤡

With ETH teetering near a heavy liquidation zone and broader markets on edge, traders are bracing for volatility that would make even Gogol’s nose twitch. 🌪️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

- 📅 BrownDust2 | August Birthday Calendar

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- Is T-Mobile’s Dividend Dream Too Good to Be True?

2025-08-18 14:01