Apple, the titan of consumer technology, stands as the third-largest enterprise, its shadow stretching across the globe. Yet, in the shadow of its dominance, a quiet tremor stirs. Alphabet, the fourth-largest, lags behind by a trillion-dollar chasm, while Amazon, fifth in rank, dares to dream of surpassing even the colossus. The arithmetic of numbers, though, is a cruel master, demanding not mere ambition but a relentless tide of growth.

The gap between Apple and Amazon is vast, yet the winds of change carry whispers of possibility. Amazon’s engines of expansion-its digital bazaars, its cloud dominion, its advertising leviathan-throb with a vigor that belies the skepticism of critics. To invest in Amazon is to wager on the inevitability of progress, even as the specter of stagnation looms.

The Dual Engines of Profit

Apple’s business, a monolith of sleek devices and ecosystemic loyalty, is a tale of simplicity. Amazon, however, is a labyrinth of ventures, its true power lying not in the familiar storefronts but in the unseen arteries of its operations. The online stores, though robust, are but the surface; beneath lies the heart of its ascendancy.

Amazon Web Services (AWS), the cloud’s colossus, thrives on the migration of industries to the digital realm, its growth fueled by both the mundane and the revolutionary. Advertising services, meanwhile, harness the attention of millions, transforming the act of commerce into a calculated art. These two segments, though disparate, converge in their capacity to reshape the economic landscape.

AWS, with its 17% annual revenue surge, exemplifies the paradox of scale: a behemoth whose growth is both a triumph and a burden. Competitors like Microsoft and Google Cloud, though smaller, outpace it in velocity, a testament to the unyielding nature of innovation. Yet, even 17% is a force unto itself, a reminder that the titans of industry are not easily dethroned.

The advertising division, with its 23% year-over-year rise, is a beacon of Amazon’s adaptability. Its platform, a nexus of consumer intent, offers advertisers a unique vantage point-a chance to influence the very act of purchasing. This is not mere commerce; it is the alchemy of data and desire, a force that will shape the future of enterprise.

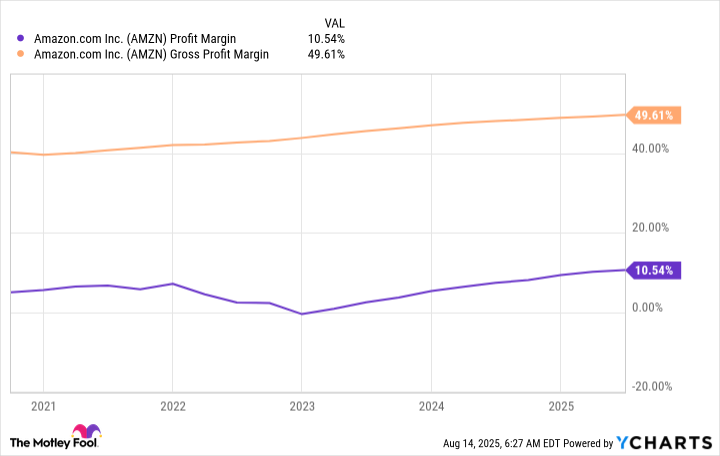

The Elevation of Margins

Amazon’s narrative is no longer one of mere revenue expansion, but of profit ascension, a trajectory that mirrors the relentless march of industrial titans. The rise of high-margin ventures like AWS and advertising has transformed its financial profile, elevating its profitability to heights once deemed unattainable.

In Q2, Amazon’s operating income surged 31%, a figure that eclipses Apple’s meager 11% growth. The disparity is not merely numerical; it is a chasm of vision, of strategy, of the will to evolve. Over five years, such divergences compound into cataclysms, reshaping the contours of corporate power.

To dismiss Amazon as a mere stock is to ignore the gravity of its ascent. It is a force that will not only rival Apple but redefine the very notion of market supremacy. In this reckoning, the question is not whether Amazon will surpass Apple, but whether the world is prepared for the consequences of such a shift.

Amazon, with its dual engines of innovation and profit, is not merely a company-it is a harbinger of a new era. To invest in it is to align oneself with the tide of history, even as the current of tradition resists.

📈

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Here Are All the TV Shows Coming to Disney+ This Week, Including ‘Limitless’

2025-08-18 05:03