Palantir (PLTR) has, without doubt, woven itself into the very fabric of 2025’s artificial intelligence narrative. A stock that, as of this moment, has ascended by a staggering 144%-a climb as steep as a lover’s first glance-suggests not only tenacity but a fervent march towards some utopian financial horizon. However, as always, the question lingers like an unwelcome shadow: can it sustain this meteoric flight, or is it a delicate balloon waiting to pop in the wind of reality? With financial results that, like an overly enthusiastic lover, often overpromise, Palantir’s story continues to unfold in intriguing, if unsettling, chapters.

Palantir, whose very name evokes a sense of omnipotence and mystery, was conceived for the lofty purposes of governmental oversight. It established a firm root within the secretive walls of bureaucracy before spreading its wings, venturing into the fertile yet fiercely competitive realms of commercial enterprise. The company’s AI platform is no less than an oracle: an intricate web capable of processing vast oceans of data, offering morsels of actionable wisdom that empower its clients to make decisions that would otherwise be relegated to mere guesswork. And for those seeking even more magic, the AIP (Artificial Intelligence Platform) offers automation, turning complex tasks into simple pleasures, as a master violinist makes his bow sing.

Impressive, isn’t it? Palantir’s revenue is soaring, with its commercial arm climbing 47% year-over-year, generating a staggering $451 million, while its governmental contracts boast a 49% increase, totaling $553 million. Altogether, this yields a remarkable 48% growth rate for the second quarter, a performance that would make even the most seasoned investors raise an eyebrow. But behind this flamboyant growth lies a cold, uncomfortable truth: for this stock to grow further, its valuation must be reasonably priced. And, alas, that is where the plot thickens.

But Palantir’s Price: A Riddle Wrapped in a Mystery Inside a Balloon

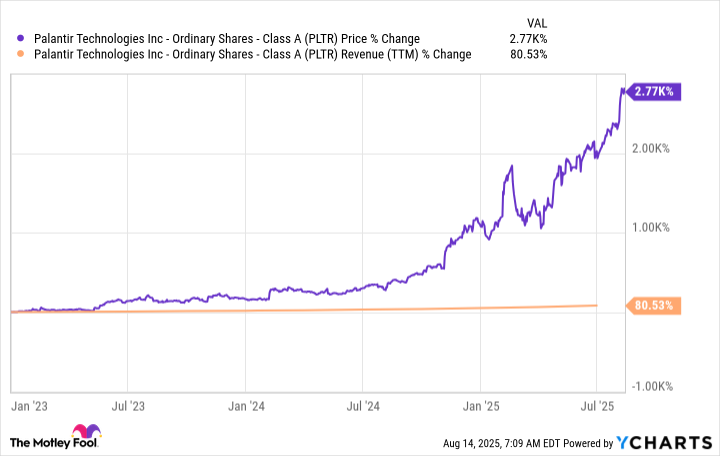

The mathematical paradox is apparent: revenue has risen by an enviable 80% since 2023, but the stock price has exploded by over 2,700%. One can only look on, both awestruck and wary, as the stock’s valuation surges to dizzying heights. At 135 times sales, Palantir’s stock is no mere overpriced trinket; it is a titan, towering among its competitors in a world where such valuations are often reserved for the stuff of dreams-and bubbles.

This oddity, this strange inflation of value, is an undeniable sign that a substantial portion of future growth has already been stuffed into the stock’s overripe belly. But what might the price of this prized commodity be three years from now? Will it be a golden chalice or a mirage in the desert of speculative excess?

Let’s entertain an optimistic hypothesis, one where Palantir’s growth accelerates, increasing by 50% annually. With such vigor, the company would likely reach $11.6 billion in revenue by the end of the third year, with profits nearing $4.1 billion. But no fairy tale ends in perpetual bliss. Even in this optimistic scenario, Palantir’s stock would still appear ludicrously expensive. Using a modest multiple of 50 times forward earnings-a lofty valuation, but one not unheard of in this surreal world-the company would boast a market cap of $205 billion. If we apply the current share count, Palantir’s stock would be worth a mere $86.30-far below its present, sky-high valuation.

This would represent a dramatic fall, the kind of decline that causes even seasoned investors to clutch their pearls. Palantir is no slouch. Far from it. Its growth is astonishing, its leadership in AI technology undeniable. But the market, like a school of fish, is often swept up in frenzies that may not reflect the underlying reality. Such is the burden of greatness-and of inflated expectations.

In conclusion, dear reader, one must tread carefully when navigating the frothy waters of Palantir’s stock. The company, while dazzling in its technological prowess, is an expensive proposition. Should you decide to partake in this tale of rapid ascent, do so with the awareness that much of its future success is already priced in. There are alternatives, less expensive, less inflated, and perhaps more grounded in reality. Perhaps, as Nabokov once mused, we should look at those companies-who remain, unlike Palantir, hidden in the shadows, ready to spring forth with an understated grace.

In the world of finance, after all, sometimes the brightest stars burn out first. 🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-18 04:02