In what can only be described as a spectacle of patience, Bitcoin (BTC) decided to start the week with all the subtlety of a sleeping cat-completely still, unbothered by the usual market hustle, even as the bigwigs in Washington and Jackson Hole are sharpening their speeches like a cat about to pounce.

Now, despite weekends being the financial equivalent of a tea party-quiet, genteel, and full of harmless chatter-the crypto pioneer has maintained a level of calmness that would make even the most jittery investor wonder if the market’s just having a lie-down. The latest figures show Bitcoin chilling at $117,600, as if it’s convinced that volatility is just a passing fancy, not worth the bother.

Bitcoin Holds Steady as Fed Minutes and Jackson Hole Loom

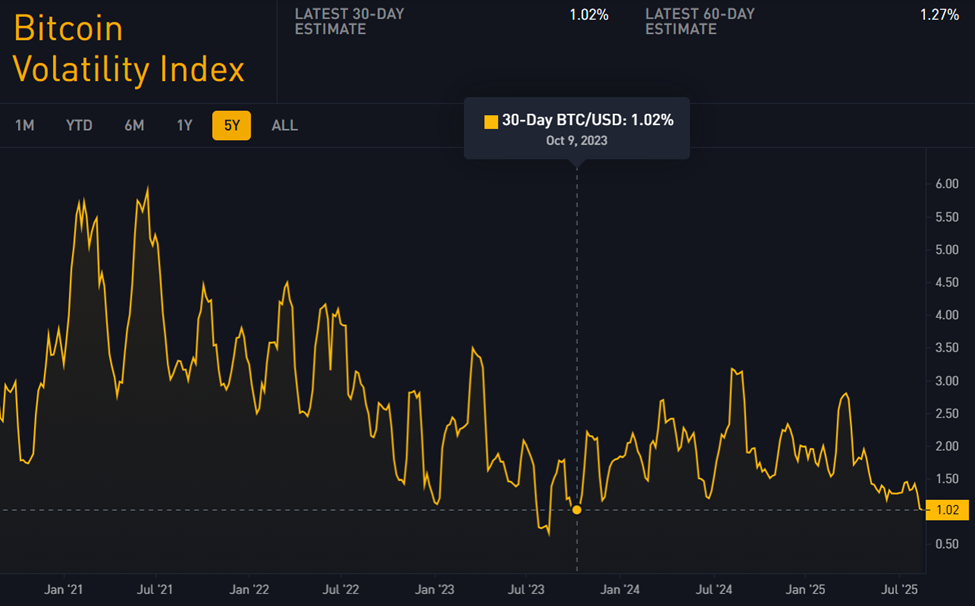

At this very moment, Bitcoin’s trading like a Zen master-completely serene-thanks to volatility metrics that have plummeted to 1.02%, a level suspiciously reminiscent of the good old October days of 2023, when markets still had a faint taste of unpredictability.

Mike Alfred, a Bitcoin investor with a face that suggests he’s seen it all, remarked on the market restraint: “Great to see zero exuberance in Bitcoin this weekend. No futures gaps to close,” he enthused on X, sounding like someone who’s just finished a calming meditation session.

“It’s as if the market took a sedative and decided to practice the art of doing absolutely nothing,” he added, looking remarkably pleased with himself.

This newfound tranquility hints at a maturing market, where retail froth has been replaced with a sort of cautious, institutional hush, as if everyone’s waiting for the next act. Bitcoin Archive, always eager to keep us on our toes, chimes in, noting that Bitcoin’s volatility is now flirting with all-time lows-precision tools akin to doubling gold’s volatility, which, if you ask me, sounds like a profitable hobby if you’re into that sort of thing.

“Bitcoin’s volatility is near all-time lows. Institutional buyers are compressing Bitcoin’s volatility to just double gold’s. Double the volatility for 10x returns? I’ll take it!”

But hold onto your hats, chaps, because this peaceful façade might not last. The US economic machinery is already whirring into action, with indicators that could turn the market on its ear faster than you can say “spare change.”

On hump day, the Federal Reserve will release the minutes of their latest powwow-it’s the transcript of their thoughts on inflation, rates, and the rest of the monetary soap opera. Recent CPI data showed inflation creeping up to 2.7%, giving the Fed’s meeting a bit of the old “what did they say about rates?” mystery. The Fed, in their infinite wisdom, left rates unchanged at 4.25-4.50%, with a vote that included two brave dissenters advocating for cuts-something that hasn’t happened since 1993. Powell’s subsequent words, however, were as clear as mud, leaving markets to guess whether they’re coming or going.

If the minutes reveal a divided committee, expect fireworks-probably more in the form of a hawkish, “hold onto your wallets” tone-pushing yields higher, the dollar surging, and Bitcoin possibly taking a backseat. But a dovish hint could turn the tables, sending stocks soaring and Bitcoin embracing its newfound calm like a puppy after a bath.

And then there’s Jackson Hole-where Jerome Powell will take the stage on Friday, possibly donning a metaphorical clown nose, to deliver a speech that could tilt the market’s mood like a bartender with a penchant for surprise shots. Past speeches have set the market’s pulse racing faster than a hare on a sugar rush, impacting everything from stocks to crypto.

If Powell hints at slowing growth-like a cautious chess player- Bitcoin might just enough to bask in the glow of lowered yields and increased risk appetite. But if he insists on sticking to the inflation script, well, expect the yields to climb and Bitcoin to take a breather, perhaps contemplating its life choices.

So, in this theatrical week of economic revelations, markets will dance to the tune of Fed minutes, Jackson Hole sagas, and other US economic puzzles. Will the week bring fireworks or just another long, meditative pause? Stay tuned, and maybe keep a snack handy-you never know when this financial circus will turn on a dime.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

2025-08-18 00:32