Celebrity tax cases often grab attention due to their substantial values and publicly disclosed details. Over the years and across borders, these cases share common themes, such as undeclared income, falsified returns, and unpaid debts that may lead to criminal accusations. Courts commonly impose restitution alongside prison sentences or probation, resulting in varying outcomes despite similar-sounding charges.

This text discusses notable individuals who have been involved in tax-related criminal cases. It breaks down each case by describing the accusations made against them, the specific charges that were upheld, and how the court resolved those charges. Additionally, it details the penalties these individuals faced, which could include prison time, probation, fines, or restitution payments, and provides information on any subsequent events following their sentencing.

By rephrasing your text in a more accessible and natural way, readers will find it easier to understand and follow along with the information being presented.

Wesley Snipes

In 2008, a federal jury in Florida found him guilty of three misdemeanors related to not filing tax returns for the years 1999 to 2001, but he was found not guilty on charges of fraud and conspiracy. The trial centered around his significant income during those years and the lack of submitted federal tax returns.

In December 2010, he began serving a three-year prison sentence. He was released from custody in 2013, serving the rest of his time under home confinement. Afterward, he completed supervision while the IRS pursued civil collection for unpaid taxes and penalties.

Lauryn Hill

In 2012, she admitted her guilt in a New Jersey federal court for not filing tax returns for the years 2005 to 2007, despite earning over a million dollars from music and endorsements during that time. This confession came after she had been making payments to lower her substantial tax debt.

In 2013, the court imposed a sentence on her that included spending three months in a federal prison, followed by house arrest and being under supervision until released. Additionally, the court mandated compensation for any damages caused and fines, and she served her time at a correctional facility located in Connecticut.

Richard Hatch

In 2006, he faced trial in a federal court for tax fraud and submitting a falsified return, as he had failed to disclose a million-dollar prize from the first season of ‘Survivor’, along with other undeclared income. The jury was presented with evidence concerning undisclosed payments and incorrect filings.

Originally, he served a 51-month prison term along with three years under supervision. Later, he was back in custody due to a breach concerning taxes, and he was obligated to pay reparations to the Internal Revenue Service (IRS).

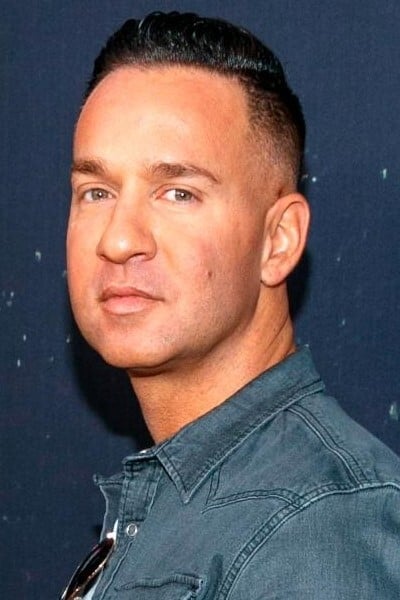

Mike Sorrentino

In the year 2018, a well-known figure from reality television admitted guilt for tax fraud in a federal trial. The case detailed a continuous scheme of underreporting cash earnings from appearances and businesses linked to ‘Jersey Shore’, as well as structured deposits. Prosecutors claimed that income was left out on tax returns, while deductions were deliberately altered.

He received an eight-month prison sentence, followed by two years under supervised release, was ordered to perform community service, and had to pay a fine. In 2019, he turned himself in, served the sentence, and has since been making payments as mandated by the verdict.

Joe Giudice

In the year 2014, he admitted his guilt in relation to several federal charges which encompassed bankruptcy fraud and the omission of filing tax returns. According to authorities, he hid business income and neglected to submit the necessary federal tax returns.

Originally, he was given a 41-month prison term, which he served. Upon completion of his jail term, he was handed over to immigration detention. Eventually, following an expulsion order, he moved to Italy. There, he has been working on resolving restitution and tax issues.

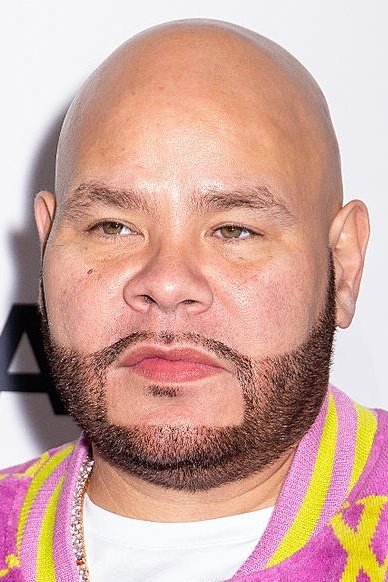

Fat Joe

In 2012, it was admitted by him that he hadn’t submitted federal income tax declarations for multiple years during which he made substantial earnings from his music and tours. The court records detailed a tax debt surpassing one million dollars.

In 2013, he received a sentence that included four months in prison, probation supervision, and a fine. Additionally, he made payments to settle overdue federal taxes and related penalties.

Ja Rule

In 2011, he confessed that during the mid-2000s, he neglected to submit tax returns, which resulted in an unpaid tax amounting to millions due to income from royalties and performances. This admission came after a series of discussions about the extent of his tax liability.

He was given a 28-month prison term by the federal government, which also required him to pay restitution and fines. For a period of time, he served this sentence simultaneously with a state sentence. He was discharged from prison in 2013 under supervised release conditions that stipulated ongoing tax compliance.

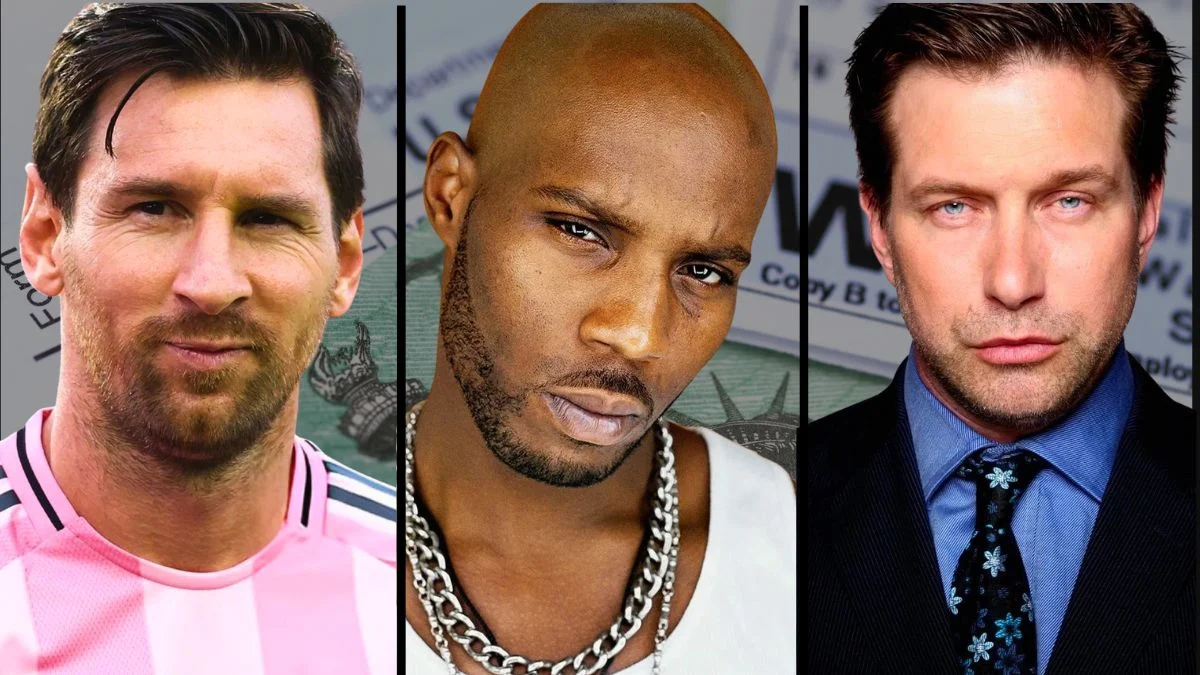

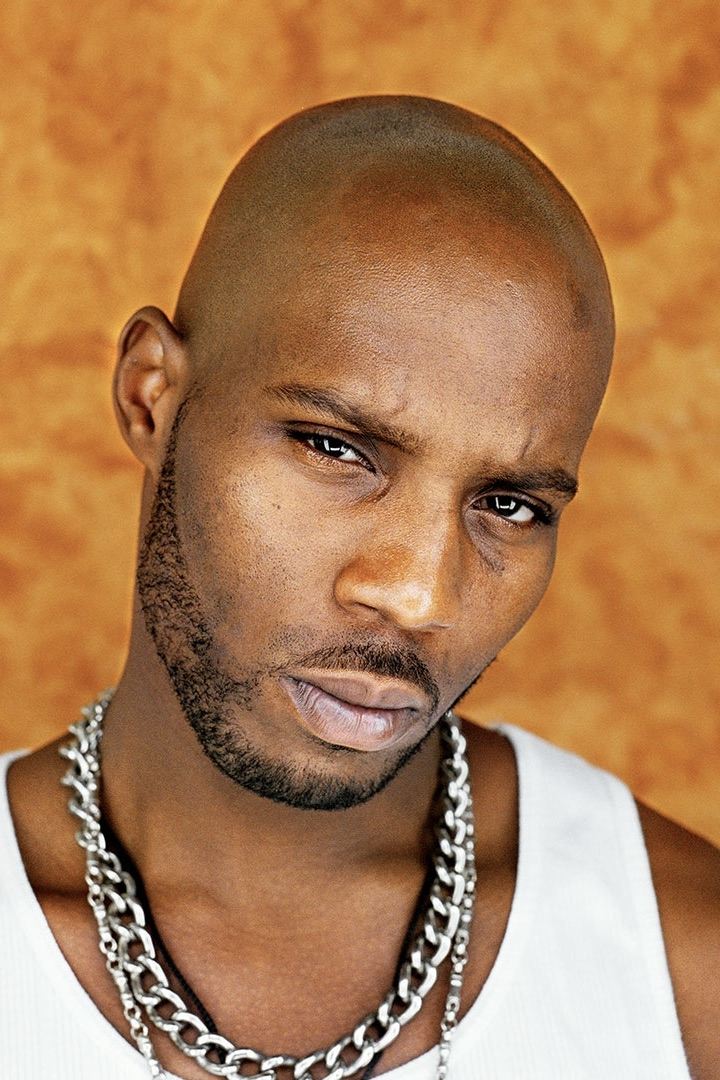

DMX

In the year 2017, he admitted his guilt for a charge related to tax evasion at the federal level. This was following claims by prosecutors that he had hidden income through cash transactions and accounts owned by others. The case in question amounted to approximately $1.7 million worth of unpaid taxes accrued over an extended period.

In 2018, a court ordered him to spend a year behind bars, followed by three years under supervision. His sentence required him to repay what he owed to the IRS and adhere to certain conditions while under supervision.

Beanie Sigel

In the year 2012, he admitted his guilt for not filing tax returns for multiple years during the 2000s, despite earning over a million dollars. The court examined undeclared income stemming from his music and business ventures that should have been reported on time in the proper tax filings.

After being given a two-year sentence in a federal penitentiary, he was also instructed to repay any remaining amount as restitution. Later in the year, he surrendered himself and served his time before transitioning to supervised release.

Chuck Berry

In 1979, he admitted his guilt in a federal case concerning income tax evasion. This was due to unreported cash earnings from his tours, which were not declared in the submitted tax returns. The authorities followed up on the concert receipts that were missing from the filed documents.

He spent roughly four months behind bars, performed a great deal of community work, and was obligated to pay past-due taxes and fines as determined by the authorities, according to the verdict.

Leona Helmsley

In the year 1989, she faced conviction on federal charges which encompassed tax evasion. These charges arose from her habit of charging personal expenditures to her respective businesses. The court trial in New York delineated instances of property renovation and luxury purchases that were classified as business expenses.

She was given a four-year jail term along with a substantial financial penalty. She spent approximately 18 months behind bars, followed by house arrest and monitored parole, and also had to pay extra fines as instructed by the court.

Boris Becker

In 2002, a German court determined that he was guilty of avoiding taxes by claiming to reside abroad, despite living in Munich for some parts of the 1990s. The investigation focused on undeclared income and residency assessments conducted by tax officials.

Instead of serving jail time, he was given a two-year probation period during which he must abide by certain conditions. Additionally, he is obligated to pay back taxes and penalties, and ensure his future actions adhere to the regulations.

Lionel Messi

Back in 2016, I found myself embroiled in a tax scandal here in Spain. My dad and I were accused of misusing our image rights earnings by channeling them through offshore companies. The court’s ruling, which spanned over several years, primarily focused on the questionable licensing agreements we had in place. It was quite a turbulent time for me!

Under Spanish legislation, he was granted a suspended 21-month prison term instead of imprisonment, on the condition of paying a fine. Additionally, he settled considerable financial obligations to clear up outstanding tax debts and penalties owed to the Spanish government.

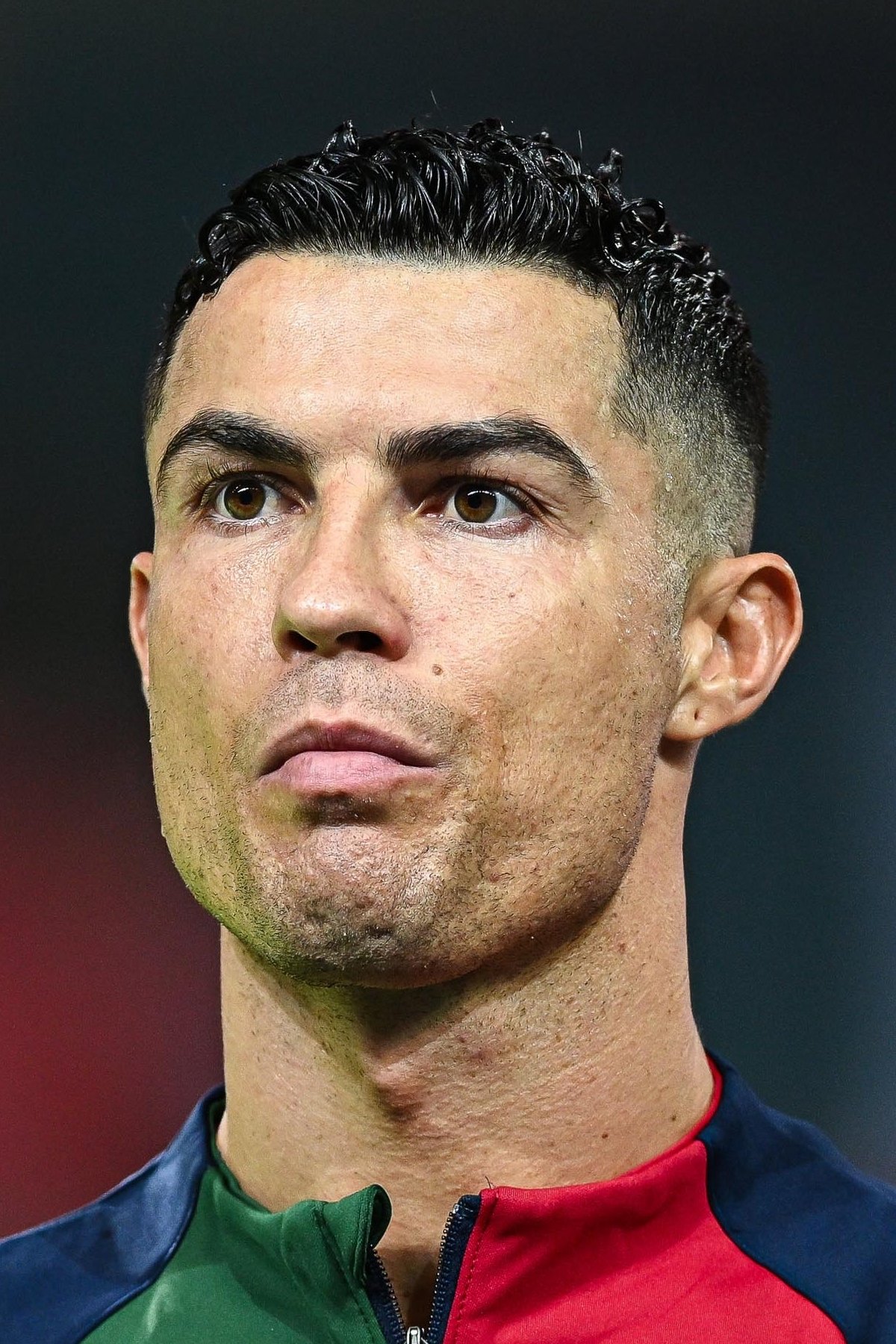

Cristiano Ronaldo

In 2019, he came to terms with Spanish authorities regarding allegations of tax evasion linked to his image rights earnings during his time as a player in Spain. This settlement wrapped up years where his endorsement income was kept via offshore entities.

He received a prison sentence suspension for 23 months, along with a significant financial penalty. Additionally, he made payments to cover charges and accrued interest as determined by the authorities.

Shakira

In 2023, she successfully resolved a tax-related criminal case in Spain which centered around her residential status and tax liabilities from the years 2012 to 2014. The authorities claimed that her extended stays in Spain during those years made her a resident with corresponding tax obligations there.

As a film enthusiast putting pen to paper, I’d rephrase that into: “In the courtroom, I reached an agreement where I received a suspended sentence and paid fines – it was part of my plea deal. The resolution also took note of earlier tax payments made during the administrative process, including any interest accrued.

Stephen Baldwin

In 2013, he admitted his guilt in New York for not submitting state income tax returns for several years. This legal matter focused on unpaid taxes related to earnings from his work in films and television within the state.

The court agreed to a payment arrangement that kept him out of prison, as he gradually paid off his overdue taxes and fines according to the judge’s plan, while staying under supervision until all amounts were fully repaid.

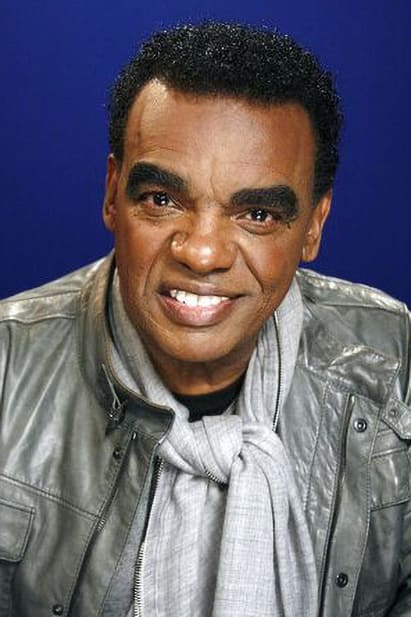

Ronald Isley

In 2006, a federal court convicted him for tax fraud and associated offenses. Prosecutors claimed that he concealed his personal earnings using various business entities, which also encompassed unreported royalties and earnings from performances.

He received a prison sentence of three years and one month, along with an order to repay large sums as restitution. He served this sentence at a federal institution before being released on probation, with the terms requiring him to adhere strictly to tax regulations.

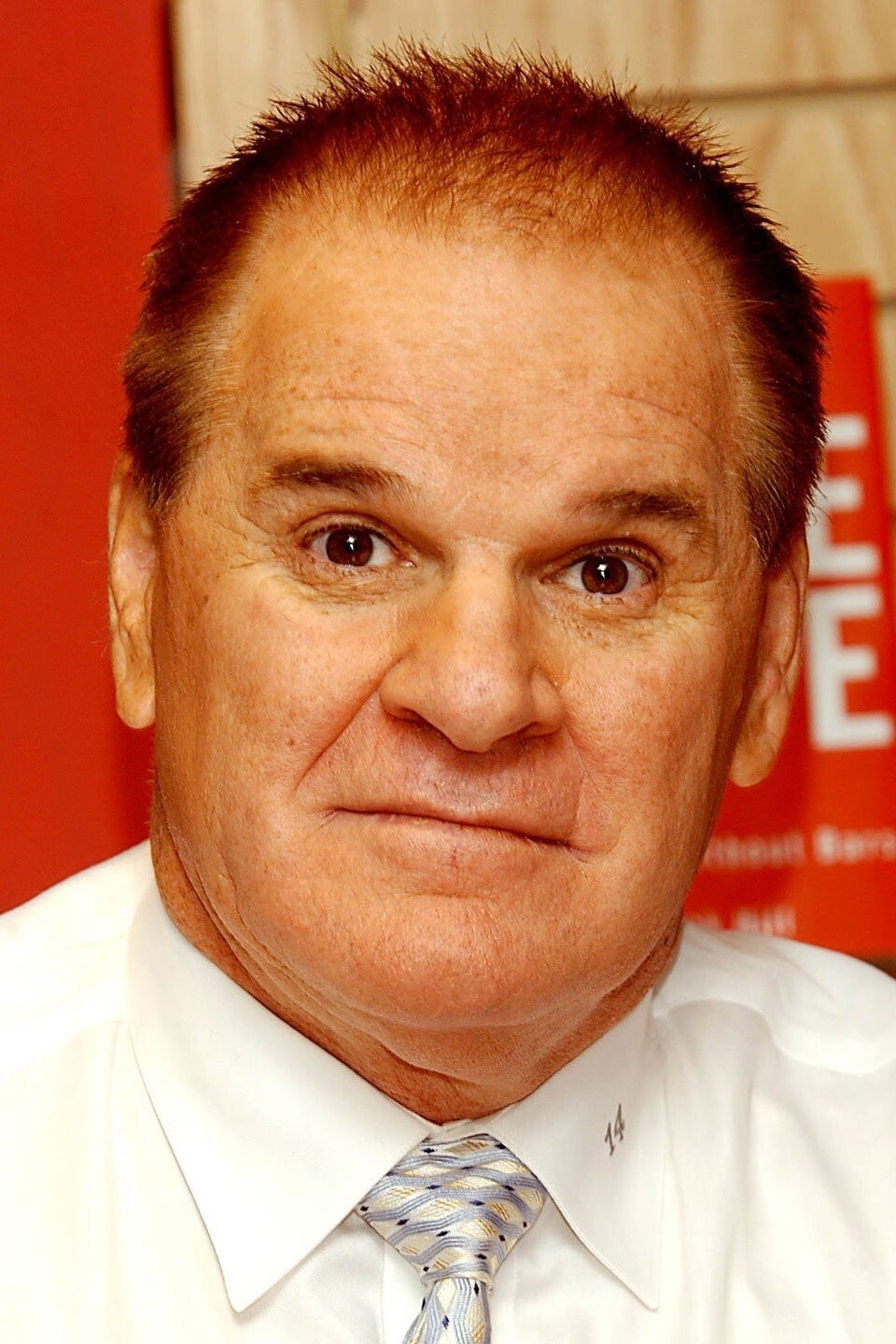

Pete Rose

In the year 1990, he admitted his guilt in a federal court for submitting fraudulent income tax documents for numerous years during the late 1980s. These undeclared earnings originated from the sale of memorabilia and personal engagements.

He was given a prison term of five months, a significant monetary penalty, and required to perform community service. Additionally, he settled his overdue taxes with interest and fulfilled the terms set during his supervised release.

Heidi Fleiss

During the mid-nineties, she faced trial in a federal court and was found guilty of tax evasion in 1996. This conviction was related to undeclared earnings from an escort service located in Los Angeles. The federal case came after previous state charges, which were handled independently.

In 1997, she was given a 21-month sentence in a federal prison and was also fined. After serving her time, she underwent supervised release as she worked to resolve the remaining tax-related financial obligations.

If you’d like to contribute your ideas about these subjects or if you’re aware of similar cases that could be added to this list, please feel free to express them in the comment section below.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- The Best Actors Who Have Played Hamlet, Ranked

- USD PHP PREDICTION

- 9 Video Games That Reshaped Our Moral Lens

2025-08-17 21:17