In the vast ocean of commerce, where fortunes rise and fall like tides, there exists a peculiar vessel-the cruise industry. Once battered by the tempest of a global pandemic, these ships now glide upon calmer waters, buoyed by the winds of recovery. Yet beneath their gleaming decks lie scars etched deep into their balance sheets, remnants of debts accrued during the long winter of uncertainty.

As spring returns to this maritime realm, two captains vie for attention: Carnival Corporation, an old mariner weathered by decades on the open market, and Viking Holdings, newly emerged from the harbor of privatization. Each carries its own cargo of dreams and risks, beckoning investors to embark upon their journeys. Which is the wiser port of call?

A Symphony of Success

Both Carnival and Viking sing songs of triumph, their voices resonating across the waves. In the first light of 2025, Carnival reported a crescendo of growth, with revenues swelling by 9.5% in the last quarter. More remarkable still was the tripling of its adjusted earnings per share-a feat akin to a shipwright transforming splintered wood into gilded hulls.

Josh Weinstein, Carnival’s helmsman, spoke of horizons reached ahead of schedule. The company had already achieved its 2026 SEA Change objectives-targets set amidst the chaos of the pandemic. Like a gardener nurturing saplings through frost, Carnival cultivated sustainability, profitability, and efficiency. Its EBITDA per available lower berth day soared by 52%, while return on invested capital blossomed to 12.5% over two years.

Yet Viking, too, charts a course of brilliance. In its maiden voyage as a public entity, it dazzled observers with revenue growth of 24.9%. Net yields climbed, reflecting the quiet satisfaction of passengers who find value in every wave they traverse. Management peers into the distance, declaring that 2025’s cabins are nearly filled, and whispers of bookings stretching into 2026 echo through the corridors of optimism.

The Weight of Anchors

Though both vessels sail toward prosperity, the weight of their anchors differs greatly. Viking’s debt-to-EBITDA ratio stands at a modest 2.0, a testament to prudent stewardship. Meanwhile, Carnival drags behind with a heavier burden of 3.7 times its trailing EBITDA. Why this disparity? Perhaps it lies in the differing paths they tread before the storm.

Carnival, seasoned by years of public trading, indulged in the leverage of stock buybacks-a strategy that left it vulnerable when the seas turned hostile. Viking, cloaked in private ownership until recently, may have avoided such excesses. Or perhaps it is the nature of their routes: Carnival roams the globe’s oceans, catering to diverse travelers, while Viking meanders along Europe‘s rivers, appealing to those whose hearts yearn for quieter shores.

The Mirage of Valuation

Investors, ever eager to chase mirages, have propelled Viking’s stock to dizzying heights since its debut. From an IPO price of $24, it has ascended to $60-a journey marked by exuberance rather than caution. Carnival, though less meteoric, has also found favor, rising nearly 23% this year.

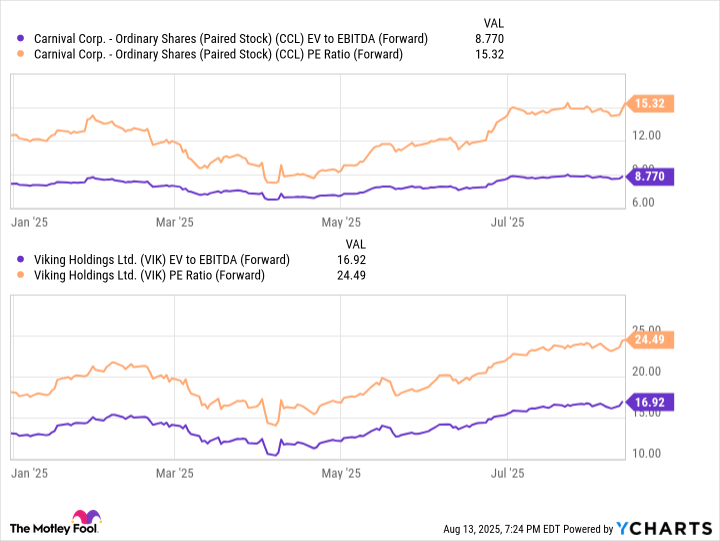

And yet, valuation tells a tale of contrasts. Viking commands a forward price-to-earnings ratio of 24.5, its sails billowing with confidence. Carnival, by comparison, drifts at a more modest 15.3, its silhouette shadowed by lingering debt. Even accounting for this encumbrance, Carnival’s enterprise value-to-EBITDA ratio remains markedly lower, suggesting untapped potential.

A Balance of Risk and Reward

Thus, we arrive at a crossroads where choice becomes art. Viking, with its sleek design and lighter load, appeals to those who seek swift currents and uncharted waters. It promises growth, tempered by relative safety. Carnival, meanwhile, offers a different allure-a chance to uncover hidden treasures buried beneath layers of obligation.

For the value investor, Carnival holds particular charm. Its discounted valuation whispers of opportunities awaiting discovery. As it sheds its debts like autumn leaves falling from a tree, its story may yet transform, shedding risk and revealing resilience. To invest in Carnival is to believe in redemption, to see beauty in the process of renewal.

And so, dear reader, whether you choose the steady rhythm of Viking or the patient rebuilding of Carnival, remember this: the sea of investment is vast and unpredictable. But within its depths lie stories waiting to be told, fortunes waiting to be made 🌊.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Banks & Shadows: A 2026 Outlook

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-17 18:14