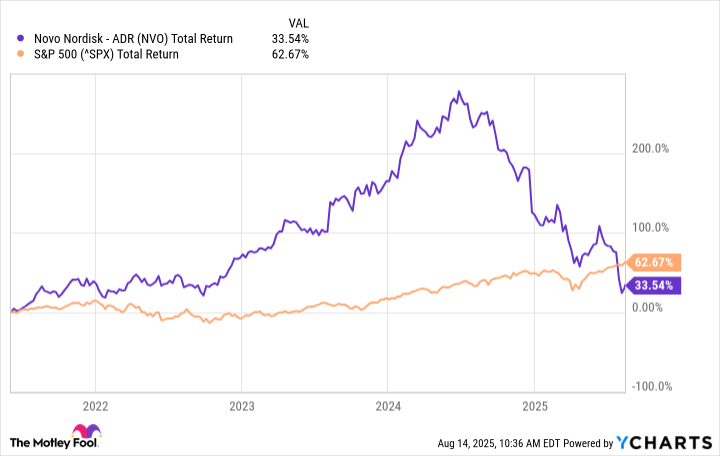

Novo Nordisk (NVO) first earned U.S. approval for its now-legendary weight management medicine Wegovy in June 2021. A triumph, one might say, though the subsequent performance of its shares has been less of a waltz and more of a stumble. Since January alone, the stock has pirouetted into a 40% decline-a rather dramatic dip for a company once buoyed by the promise of its flagship product.

Yet here we are, faced with a curious paradox: a stock in freefall may yet offer a rare opportunity for the discerning investor. Let us dissect this conundrum with the precision of a well-tied cravat.

The Weight Management Opportunity

Novo Nordisk, for all its recent woes, remains a titan in diabetes and weight management. Its stumble has been twofold: financial results that left the market underwhelmed and clinical setbacks that have rattled its confidence. Meanwhile, Eli Lilly has stolen the spotlight with its own successes. But let us not conflate setbacks with obsolescence.

The market for anti-obesity medications? A veritable goldmine. Analysts predict it will balloon from $15 billion last year to $150 billion by 2035. Novo, with its deep pipeline and recent licensing deals, is not merely a spectator in this feast-it is a master of ceremonies.

Consider this: Eli Lilly’s oral GLP-1 candidate, orforglipron, has stumbled in phase 3 trials. Novo’s oral Wegovy, by contrast, achieved a 13.6% average weight reduction-superior to its rival’s 12.4%. While cross-trial comparisons are as reliable as a politician’s promise, the data suggests Novo is not merely keeping pace-it is setting it.

And there is more. Amycretin, another phase 3 contender, is being tested in both subcutaneous and oral forms. Novo, it seems, has mastered the art of the encore.

Why, you ask, does an oral option matter so? Because pills are easier to manufacture, store, and swallow-unlike needles, which many patients regard with the enthusiasm of a child facing a vaccination. An oral solution is not just a convenience; it is a revolution in market access. And Novo, poised to be first to market, may yet reap the lion’s share.

The Price Is Right

Let us return to Novo’s financials. Revenue rose 16% year-over-year to 154.9 billion Danish kroner ($24.2 billion) in the first half of the year, with net profit at 55.5 billion DKK ($8.7 billion). One might even call it commendable-though perhaps not quite the fireworks the market anticipated.

Yet the stock trades at a mere 13 times forward earnings, a discount to the healthcare industry’s 16.2. A bargain, one might say, if you have the patience to wait for the market’s next act.

So where does this leave us? Novo Nordisk, for all its misfortunes, remains a company of formidable innovation and profitability. Its pipeline, though battered, is far from broken. And in a world where weight management is both a medical and financial imperative, Novo’s resilience may yet be its greatest asset. For the patient investor, the question is not whether to buy-but whether to have the wit to recognize the opportunity.

And if you’ll excuse me, I believe I’ll take a moment to sip my gin and consider the finer points of capital allocation. 🧠

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-08-17 17:12