Nvidia (NVDA), the belle of the artificial intelligence ball, has elegantly danced through 2023, generating returns that would make even the most seasoned investor gasp into their champagne flutes. Even as 2025 has presented a rather languid performance-merely a 35% rise-the anticipation that hangs in the air like a fine mist of gin suggests that change is nigh. The dramatic unveiling of Q2 results on August 27 could very well send Nvidia’s stock into the stratosphere, like a well-aimed firework over a particularly dull soirée.

Significant commentary is expected regarding exports to China-oh, the excitement!-especially in light of Nvidia’s decision to don a rather burdensome 15% export tax hat. One dare not underestimate the return of the Chinese market as a catalyst for Nvidia’s stock. Expect the festivities to commence post-results.

Domestic Demand: A Sizzling Affair

Nvidia’s prowess in crafting graphics processing units (GPUs) makes it the favored companion in the world of data centers, an exhilarating place indeed for all involved. From engineering simulations to chic cryptocurrency ventures and the enigmatic world of AI model training, Nvidia’s market share easily struts around like an aristocrat at a masquerade, boasting an astonishing 90% dominance.

With the data center sector positively thriving, propelled by entities like Meta Platforms (NASDAQ: META) and Alphabet (NASDAQ: GOOG) (also known as GOOGL for the more formal occasions), the invitation for capital expenditure merry-making for 2026 has been extended. ‘Expect robust growth, darlings,’ they chirped in their recent earnings calls, alluding to a bonanza focused on building data centers adorned with Nvidia’s accelerator jewels.

Such thrilling projections can only bode well for Nvidia’s stock, offering a piquant reminder to investors that domestic GPU demand remains exquisitely robust.

Yet, as audacious as ever, Nvidia casts its eyes overseas.

A Glimmering Gambit in China: Profound Potential

In a plot twist worthy of the West End, the Trump administration, in a fit of decision-making fervor, chose to revoke Nvidia’s export license for H20 chips-crafted, one might say, with meticulous intent to navigate the labyrinth of export restrictions to China. This little hiccup resulted in a rather shy £2.5 billion hole in Q1 revenues, prompting Nvidia to absent itself from H20 revenue guidance for Q2. Nevertheless, our gallant management brandished a projected 50% revenue growth, strutting toward $45 billion, though one can’t help but wonder how it would have grafittied the earnings stage with a projected $53 billion had H20 sales been included.

The china shop may soon be open for business again, with an export license likely to be approved, albeit with the 15% export tax looming like an uninvited guest at tea. Yet, any sale is better than none, and Nvidia, playing its cards with aplomb, is poised for a delightful profit surge from this Asian venture.

We shall await the pearls of wisdom from CEO Jensen Huang regarding these conquests-though alas! Nvidia’s Q3 is already underway, allowing it only a fleeting taste of H20 sales this quarter. Still, one suspects it might still work its magic behind the scenes.

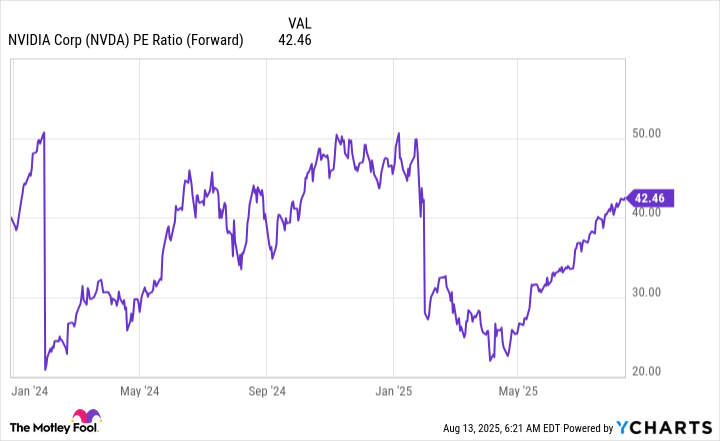

Two marvelous growth catalysts now swirl around Nvidia like well-aged vintage, with nary a boorish element to be found. Management guidance appears poised for a revenue resurgence, and such joyous tidings may well send shares gate-crashing the party. While the stock may not be considered a ticker tape bargain, it remains more graciously priced than last year’s gala.

As the earnings soirée approaches, now might just be the splendid moment to secure a spot at Nvidia’s table, ensuring one’s place amidst the anticipated festivities. However, should one prefer to take a more leisurely approach, rest assured that Nvidia shall undoubtedly retain its crown as one of the preeminent stocks of our time. 🥂

Read More

- 21 Movies Filmed in Real Abandoned Locations

- Gold Rate Forecast

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- The Timeless Allure of Dividend Stocks for Millennial Investors

- Trump Did Back Ben Affleck’s Batman, And Brett Ratner Financed The SnyderVerse

2025-08-17 12:45