When one speaks of artificial intelligence (AI) stocks, one naturally thinks of semiconductors and glistening data centers, much like one might think of caviar when pondering a sumptuous dinner. While our minds flirt with images of giants like Nvidia, Advanced Micro Devices, and the likes of Alphabet, it would be rather remiss to overlook the sprightly newcomers that frolic just beyond the usual suspects.

Indeed, the rise of enterprise-grade software is becoming increasingly crucial-like the delicate embroidery on a tuxedo jacket-nestled perfectly atop the hardware stack. The allure? To tantalize large corporations with complex demands, from data analytics to cybersecurity, crafting an elegant tapestry of AI-powered solutions.

Now, dear reader, allow me a moment to pivot to our splendid government sector, where AI is swiftly redefining operations under the meticulous gaze of our dear statesmen. News has it that Defense Secretary Pete Hegseth has unveiled a rather grand plan to devote additional resources to the Software Acquisition Pathway (SWP), a bit of strategical foresight first introduced in 2020, aimed at ensuring a seamless acquisition, development, and delivery process for secure software.

Let’s dive into the delightful details of how Palantir Technologies (PLTR) and BigBear.ai (BBAI) are elegantly pirouetting with AI’s enchanting transition from hardware solidity to software fluidity, each embracing the SWP opportunity with all the grace of a well-rehearsed ballet.

1. Palantir Technologies: The Government’s AI Darling

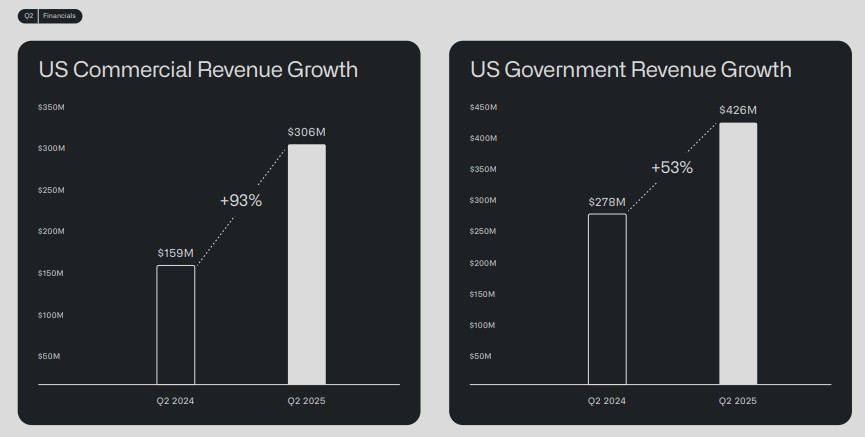

Ah, Palantir-it finds itself at the epicenter of several most impressive deals with the federal government throughout this splendid year of 2025. In a rather pizzazz-laden move, it expanded its alliance with the Department of Defense (DOD) to the tune of a $795 million deal, not too shabby, I daresay. This gives their Maven Smart System (MSS) a resounding total of $1.28 billion-an exquisite long-term revenue fountain. Recently, they also snagged a rather tantalizing contract with the Army, reportedly worth up to $10 billion over the next decade.

Yet, let us not confine our gaze solely to the military; Palantir is also cooking up the Immigration Lifecycle Operating System, or ImmigrationOS if you will, for the Immigration and Customs Enforcement (ICE). Merely a trifle, one might say.

By signing contracts that resemble the rough dimensions of a royal decree, Palantir affords itself remarkable revenue visibility, ensuring customer loyalty that is stickier than the finest honey, while also opening up avenues for future upselling of its many delightful services.

The ability to leverage its defense acumen into broader government endeavors only serves to amplify Palantir’s public sector persona, establishing it as an omnipresent AI backbone for our esteemed U.S. government.

2. BigBear.ai: A Niche Player Aiding the Public Sector

Meanwhile, continuing on this splendid jaunt through AI, we have BigBear.ai, another software developer that has struck deals with our illustrious government this year. In a swift and clever maneuver, it landed a DOD contract aimed at refining national security decision-making through trends and patterns analyzed in foreign media. Oh, how delightfully espionage-themed!

Not content to rest on its laurels, BigBear.ai subsequently clinched a $13.2 million arrangement spread over three and a half years to bolster the Joint Chiefs of Staff’s force management and data analytics prowess. Quite the accomplished little trooper!

Furthering its ambitions, this industrious company has joined hands with Hardy Dynamics to enhance the Army’s exploits in machine learning and AI with autonomous drones. And as if that weren’t enough, they secured a deal with U.S. Customs and Border Protection to deploy their biometric AI infrastructure, affectionately dubbed Pangiam, across several bustling airports in North America, streamlining arrivals better than a Picasso hanging in a gallery plug.

Palantir vs. BigBear.ai: A Question of Class

In the grand sweep of stock market choreography, Palantir stands as the more prudent choice. While BigBear.ai has made commendable strides in securing lesser, albeit noteworthy, contracts, its endeavors are more akin to charming vignettes when held against the grand tapestry of Palantir’s multibillion-dollar escapades.

My dear connoisseurs of dividends, I posit that BigBear.ai is rather like a young debutante nervously hoping to become the next Palantir. However, as we savvy investors know, hoping is not a strategy worth pinning our portfolios upon. Diligent valuation analysis, rather than mere speculation, ought to guide our discerning minds in determining which stock truly deserves a place in the pantheon of investments.

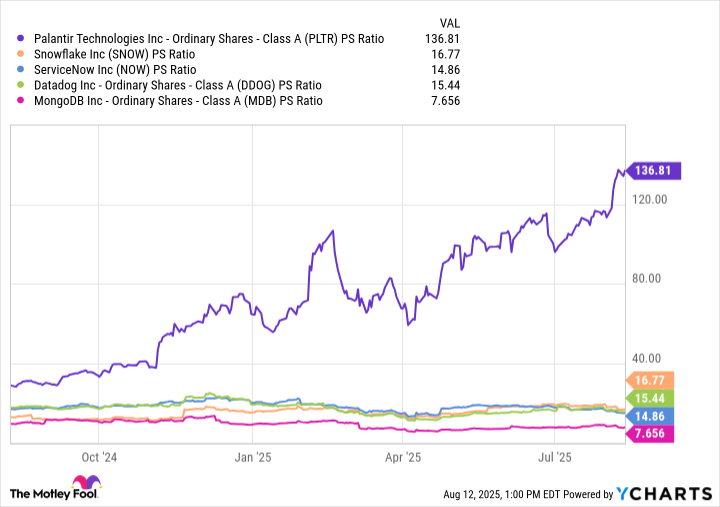

While some of Wall Street’s le tout Paris might argue that Palantir’s stock is quite affordable, based on software-specific metrics, I’m not entirely convinced. Traditional valuation approaches, such as the price-to-sales (P/S) ratio, suggest that Palantir may be the priciest software-as-a-service darling amongst its peers depicted in the accompanying chart-what a delightful irony!

Palantir is undeniably a thrilling company with the gall to deliver critical applications; yet, historically, its stock has resembled a royal sedan chair in terms of price. I daresay investors may be better served by biding their time, awaiting a more palatable entry point-a wise move as entrées can be rather rich, don’t you think?

🥂

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 39th Developer Notes: 2.5th Anniversary Update

- 22 Movies Where Colorism in Casting Became the Actual Plot Point

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- XRP’s $2 Woes: Bulls in Despair, Bears in Charge! 💸🐻

- 15 Western TV Series That Flip the Genre on Its Head

2025-08-17 01:12