In the grand theater of capitalism, where angels fear to tread and demons take front-row seats, General Motors (GM) stands as a curious player. Once a symbol of near-collapse during the financial crisis-its resurrection funded by taxpayer largesse-it has since transformed into something far more intriguing. It is no longer merely an automaker but rather a creature of paradox: part phoenix rising from ashes, part gambler betting its chips on electrification and buybacks. Let us peer through the smoke and mirrors to uncover why this stock may well be screaming for attention.

A Faustian Pact with Shareholders

There are two ways to return value to shareholders, those insatiable creditors of corporate ambition: dividends, which drip like honey onto their tongues, or share buybacks, which vanish shares into thin air like so many whispers swallowed by night. General Motors has chosen the latter path with almost religious fervor. Its price-to-earnings ratio hovers around eight-a number that would make even the most jaded devil smirk at the inefficiency of modern markets.

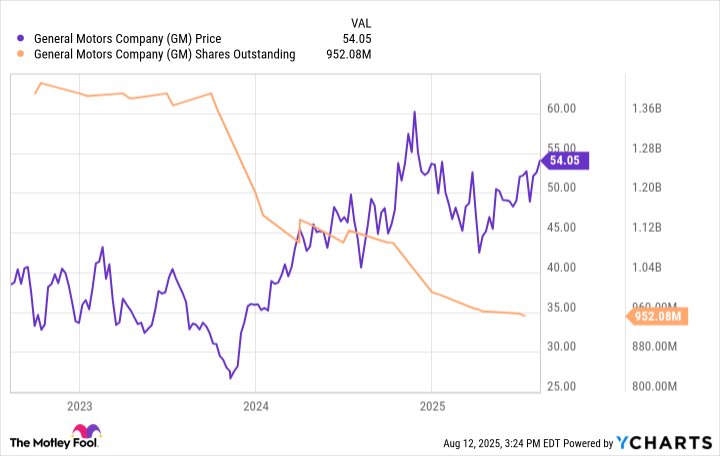

Over the past decade, GM has spent nearly $25 billion repurchasing its own shares, reducing the count from 1.5 billion to 950 million. Imagine a sculptor chipping away marble until only the essence remains; such is GM’s approach to its equity. The result? A market capitalization hovering around $50 billion while management insists the stock is woefully undervalued. One might wonder if they have struck a deal with some infernal financier, trading future profits for present gain.

And yet, who can blame them? In a world where perception often outweighs reality, buying back stock cheaply becomes both strategy and survival. As long as Wall Street refuses to see what Detroit knows-that GM is not the same beast it once was-the company will continue this ritual sacrifice of its shares.

The Artistry of Steel and Silicon

If automobiles were poetry, then Chevrolet and GMC would be sonnets penned in steel and silicon. These brands, the beating heart of General Motors, have begun to sing again after years of reinvestment and reimagining. In 2025, GMC enjoyed its best first half ever, while Chevrolet returned to glory reminiscent of 2019. But these achievements are mere preludes to greater symphonies.

Behold the wave of innovation cresting over GM’s portfolio: updated crossovers, SUVs, and electric vehicles (EVs). And looming on the horizon, like titans preparing for battle, are its highly profitable trucks. Yet it is the Equinox EV that steals the spotlight, becoming the second-best-selling EV brand in America behind Tesla. July saw record sales for the Equinox, proving that GM’s gamble on electrification is paying off-not just in dollars but in relevance.

This transformation did not happen by accident. Billions flowed into research, design, and manufacturing, fueling a machine built not just to survive but to thrive. Perhaps there is artistic integrity here after all, hidden beneath the cold calculations of balance sheets.

China: A Second Act in the Middle Kingdom

China, that vast and enigmatic land, has long been the El Dorado of automakers-a place where dreams of untapped wealth danced in boardrooms across the globe. Alas, recent years turned those dreams into nightmares. Domestic brands rose like dragons, breathing fire upon foreign competitors and igniting brutal price wars. Even mighty GM staggered under the assault, retreating to redraw its battle plans.

Enter Steve Hill, GM’s senior vice president and president of GM China, armed with a $4 billion restructuring strategy. Like a sorcerer weaving spells, he conjured growth from chaos. For two consecutive quarters, GM reported sales increases, including a 20% surge in Q2. “Sustainable growth,” he declared, as though invoking a sacred mantra. Local innovations, business agility, and customer choices became his holy trinity.

But let us not forget: China is a land of contradictions, where fortunes rise and fall faster than the tides. Whether GM’s resurgence proves lasting or fleeting remains to be seen. Still, one cannot help but admire the audacity of their efforts-a David standing tall against Goliath, albeit with billions in cash reserves.

An Ode to Contradictions

So here we find ourselves, contemplating General Motors-a company that buys back its soul on the cheap while investing lavishly in its future. It thrives in America’s heartland yet struggles in China’s labyrinthine markets. It builds cars powered by electrons yet clings to the ghosts of combustion engines past. Is it a hero or a fool? Both, perhaps, depending on the lens through which you gaze.

Wall Street, ever blind to nuance, has yet to awaken to GM’s metamorphosis. But time, that great revealer of truths, may soon force even the skeptics to reconsider. Should you follow suit? That decision rests with you, dear reader. Just remember: in the dance between man and market, fortune favors the bold 🪄.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- TON PREDICTION. TON cryptocurrency

- 39th Developer Notes: 2.5th Anniversary Update

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- The Timeless Allure of Dividend Stocks for Millennial Investors

- 15 Western TV Series That Flip the Genre on Its Head

- Is T-Mobile’s Dividend Dream Too Good to Be True?

2025-08-16 16:23