The numbers on Roku’s stock look like a neon sign flickering in the rain-bright, loud, and just a little too desperate to convince you. At first glance, it’s trading at 100 times forward earnings estimates. That’s the kind of valuation that makes accountants reach for their whiskey bottles and investors clutch their pearls. And let’s not forget, the company isn’t even profitable yet. On paper, it’s a mess. A $12.9 billion market cap hanging by a thread, swaying in the wind like a loose shutter.

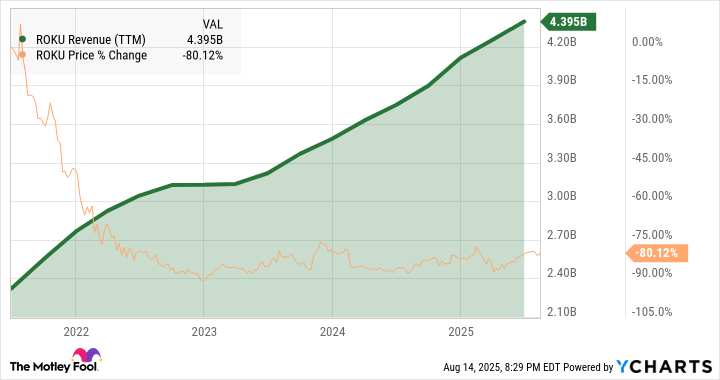

But there’s more to this story than meets the eye. Behind the cold arithmetic of ratios and multiples lies a pulse-a heartbeat. Roku’s growth is the kind of thing that doesn’t show up neatly in spreadsheets. It slinks around the edges, lurking in shadows where analysts fear to tread. Take a look at this chart, and tell me I’m wrong:

The Price Fell, But the Engine Kept Running

Roku’s stock took a nosedive over the past four years, plummeting 81%. If stocks could bleed, this one would have painted the floor red. But here’s the twist: while the price was busy free-falling, the company’s top-line sales were climbing higher than a cat burglar on a moonless night. Revenue surged 89% during the same period. That’s an average annual increase of 17.3%, while the stock dropped 34% per year. Chew on that for a moment.

Sure, Roku started this wild ride from an unsustainable peak, riding the streaming boom born out of pandemic lockdowns. Back then, it was the belle of the ball, dressed to kill and dancing like nobody was watching. By summer 2021, the music stopped, and reality came knocking with brass knuckles. The stock was overdue for a correction, no doubt about it.

But the fall went too far. Too damn far. Strip away the noise-the panic of 2020, the inflation hangover of 2022-and what you’re left with is a company that’s alive and kicking. Roku’s growth isn’t some flash-in-the-pan mirage; it’s real, tangible, and as steady as a heartbeat under a doctor’s stethoscope.

You’ve seen the revenue surge. Now compare it to the big names everyone loves to talk about. Netflix trades at 12.6 times sales. Meta Platforms? 11 times. Roku? It’s limping along at a measly 2.9 multiple. That’s like putting a Ferrari engine in a jalopy and charging Yugo prices. Something doesn’t add up.

Growth Is Still the Name of the Game

I’m not saying Roku should be worth more than Netflix or Meta. That’s not the argument here. What I am saying is that Roku deserves a seat at the table. Its sales multiple should reflect its potential, not its current growing pains. Profitability will come-it always does for companies with legs-but until then, don’t sleep on the fundamentals.

I’ve dug deep into Roku’s strategy before, peeling back layers like an onion in a smoke-filled room. This isn’t the place for another autopsy. The short version? Roku’s profit-based valuation is a decoy, a red herring hiding the real treasure: its explosive business growth. When you factor that in, the stock looks less like a gamble and more like a steal. Like finding a Picasso in a pawn shop.

So next time someone tells you Roku’s stock is overpriced, show them the numbers. And if they still don’t get it, pour yourself a drink and enjoy the view. After all, opportunity rarely knocks twice. 🍸

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-16 15:33