In the grand theatre of modern commerce, where fortunes rise and fall with the swiftness of a summer storm, few names have captured the public imagination as thoroughly as Palantir Technologies (PLTR). This darling of artificial intelligence (AI) has danced its way into the hearts of investors, boasting an ascent of over 140% in 2025 alone. Yet, such remarkable success naturally invites scrutiny. Is it too late to join this ball, or might one still secure a favorable position amidst the revelry?

There exists, among certain circles, a whisper-a tantalizing notion that $10,000 invested today could yield a princely sum of $1 million within a decade. Such dreams, though beguiling, warrant careful examination, for even the most dazzling prospects may conceal pitfalls beneath their polished veneer.

The Unlikelihood of a Hundredfold Return

For those who had the foresight-or perhaps the good fortune-to invest at the dawn of the AI race in early 2023, their original $10,000 would now be worth nearly $285,000. A handsome reward indeed, yet the question lingers: what of those who arrive later to the feast? At its current valuation of $430 billion, Palantir would need to swell to a staggering $43 trillion to fulfill such lofty ambitions. To put this into perspective, consider that Nvidia (NASDAQ: NVDA), the titan of our age, commands but $4.4 trillion. The prospect of such exponential growth borders on the fantastical, akin to expecting a modest cottage to transform into a palace overnight.

Thus, while the dream of turning $10,000 into $1 million remains alluring, prudence dictates we temper our expectations. But fear not, dear reader, for there is yet much to admire in Palantir’s accomplishments.

A Quarter Worthy of Note

Palantir began its journey as a purveyor of wisdom to governments, transforming torrents of data into actionable insights. Its transition into the commercial sphere proved equally fruitful, and recent results speak volumes. In the second quarter, commercial revenue surged by 47% year-over-year to $451 million, while government revenue leapt by 49% to $553 million. These figures culminated in the company’s first-ever billion-dollar quarter, a milestone celebrated with quiet pride by those attuned to such matters.

And yet, one cannot help but observe that the stock price reflects a degree of optimism bordering on presumption. It is as though society has already granted Palantir the accolades reserved for future triumphs, leaving little room for error should reality fail to align with these lofty projections.

An Expensive Proposition

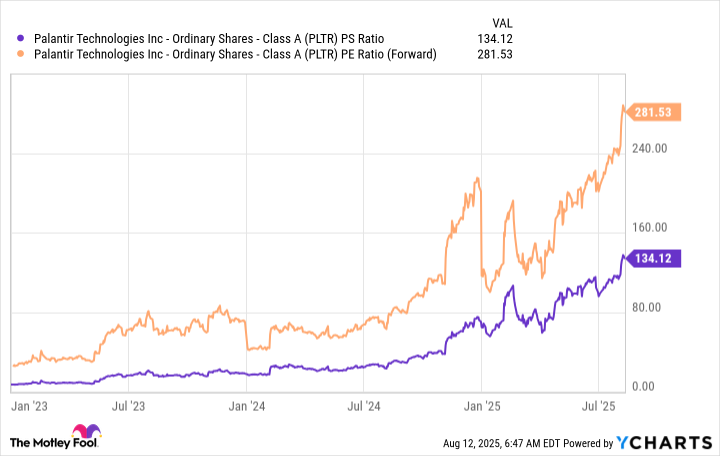

To describe Palantir’s valuation as “rich” would be an understatement of considerable proportions. At 281 times forward earnings and 134 times sales, it stands as one of the priciest securities available. Indeed, one might say its price carries within it the weight of years yet unfulfilled.

Let us entertain a hypothetical scenario, framed within the span of five years. Suppose revenue growth accelerates to 50% annually, sustaining this pace throughout the period. Further imagine a profit margin of 30%, achieved and maintained despite the considerable burden of stock-based compensation-an expense often overlooked but never forgotten. Under such conditions, Palantir’s revenue and profits would soar to $26.1 billion and $7.83 billion, respectively.

Yet, what of its valuation? Were Palantir to command a multiple of 50 times forward earnings-a figure comparable to Nvidia-it would boast a market capitalization of $392 billion. Alas, this falls short of its present stature, suggesting that the stock already anticipates more than half a decade of growth. To purchase it at such a premium strikes one as imprudent, particularly when other opportunities beckon with less extravagant demands.

In conclusion, while Palantir’s achievements are undeniable, its stock appears ill-suited for those seeking prudent investments. The wise wealth builder knows better than to chase after fleeting allure when steadier paths lie ahead. Let us leave speculation to the gamblers and seek instead those ventures which promise lasting prosperity 🌟.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

2025-08-16 14:07