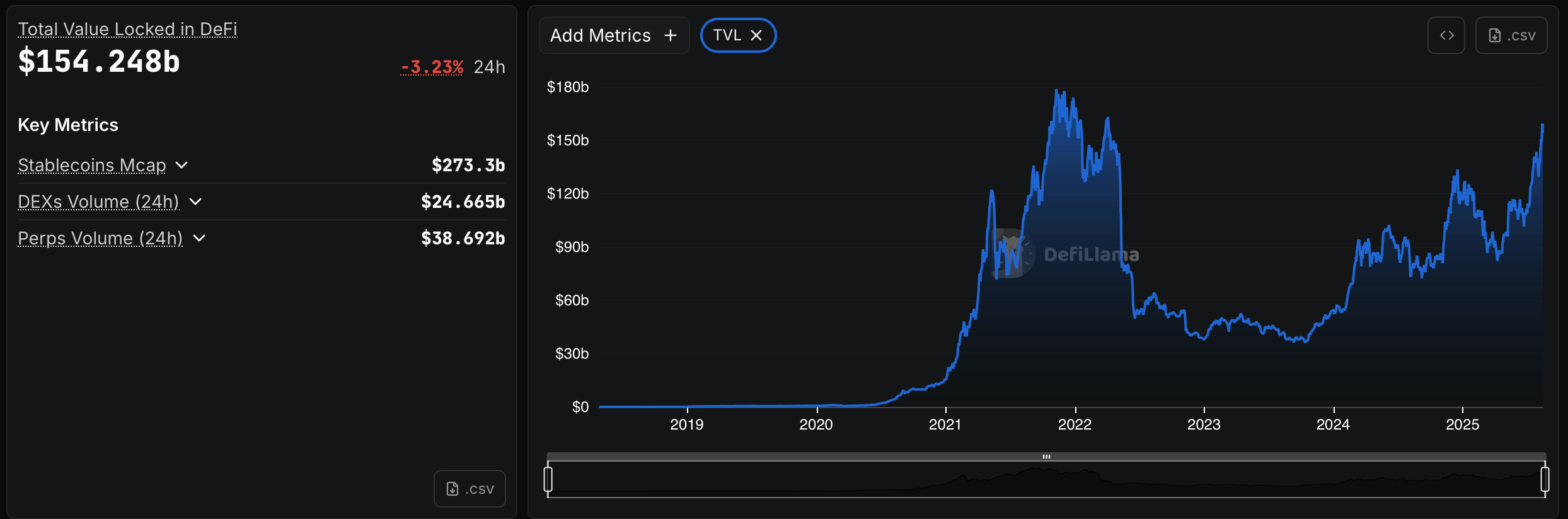

Ah, the delectable drama of decentralized finance! The total value locked (TVL) in DeFi has pirouetted to a staggering $154.248 billion, despite a modest 3% dip that, dare I say, only adds to its allure. Lido and Aave, those darling dukes of the crypto ball, continue to lead the dance with unparalleled grace.

According to the ever-watchful defillama.com, the TVL may have taken a 3.23% tumble in the past 24 hours, but it remains firmly above the $150 billion mark-a testament to the sector’s indomitable spirit. Stablecoins, those steadfast wallflowers, boast a combined market capitalization of $273.3 billion, while DEX platforms waltz through $24.665 billion in daily trading volume. Perpetuals markets, ever the show-offs, processed $38.692 billion, and network participants generously parted with $121.27 million in transaction fees. 🕺💸

Lido, that liquid staking maestro, leads the orchestra with $40.065 billion locked across five chains, primarily through its ethereal services for Ethereum and other proof-of-stake assets. Aave, the lending laureate, follows closely with $38.018 billion spread across 17 chains, cementing its role as the éminence grise of DeFi lending and borrowing. Eigenlayer, the restaking prodigy, ranks third with $21.116 billion, proving that restaking is the new black in the DeFi ecosystem. 🌟✨

Other luminaries include Binance’s staked ETH offering ($14.551 billion), Ether.fi ($12.109 billion), and Ethena ($11.147 billion). Yield protocol Pendle holds $8.681 billion across ten chains, while Spark, Sky, and Morpho each control sums that would make a Victorian aristocrat blush-between $6.3 billion and $8.3 billion. Uniswap, the DEX darling, reigns supreme with $6.234 billion locked across 38 chains. 🏆💰

The current TVL flirts with historical highs, a phoenix rising from the ashes of the 2022 and early 2023 drawdowns. DeFi has entered a renaissance, with steady inflows pushing TVL levels toward their late 2021 zenith. Daily DEX trading volumes have been nothing short of theatrical, trending toward the higher end of the monthly range. Fee distribution data reveals a gilded concentration of revenue among the largest DeFi protocols, with Lido, Uniswap, and several stablecoin issuers leading the fee generation charts. 🎭📈

The alchemy of high TVL, abundant stablecoin liquidity, and consistent transaction fees underscores DeFi’s seamless integration into the broader digital asset market and traditional finance (TradFi). With protocols like Lido and Aave as the pillars of this new financial Parthenon, the competition for liquidity and user activity remains as fierce as a Wildean wit. 🏛️🔥

As DeFi teeters on the brink of new TVL records, protocol innovation and cross-chain expansion emerge as the twin engines of growth, even amidst the daily market fandango. Will the sector waltz to greater heights, or will it stumble in a dramatic flourish? Only time-and the whims of the crypto gods-will tell. 🕊️🎩

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Gold Rate Forecast

- Elden Ring Nightreign stats reveal FromSoftware survivorship bias, suggesting its “most deadly” world bosses had their numbers padded by bruised loot goblins

2025-08-15 23:48