The universe, in its infinite wisdom, has chosen this precise moment to hurl trillions of dollars at artificial intelligence. It’s as if the cosmos whispered, “Here, let these corporations build things-quickly, before we all forget what ‘efficiency’ means.” Market research firm Gartner estimates that by 2025, spending on generative AI will balloon to $644 billion (a number so large it makes the national debt of small countries blush). This is not a crisis. This is not a drill. This is an invitation to consider two companies that have mastered the art of profiting from humanity’s collective panic about the future.

Taiwan Semiconductor Manufacturing: The Cosmic Chip Whisperer

Taiwan Semiconductor Manufacturing (TSM) is not merely a company. It is a celestial forge, where silicon wafers are transformed into the lifeblood of modern civilization. From smartphones to data centers, TSMC’s chips are the unsung heroes of an age where even toasters have opinions. Gartner, that paragon of earthly wisdom, notes that 80% of generative AI spending this year will be on hardware. In other words, if AI is the cake, TSMC is the oven-and the flour, and the recipe, and the person who forgot to turn off the oven timer.

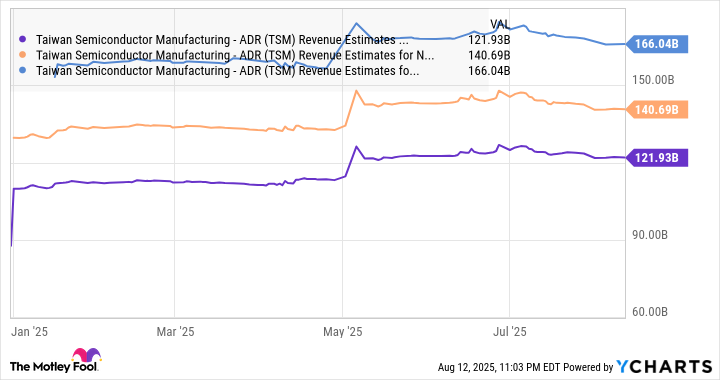

In the first seven months of 2025, TSMC’s revenue leapt 38% year-over-year. This is not a typo. It is a cosmic sigh of relief from clients like Nvidia, Apple, and Qualcomm, who have collectively decided that TSMC’s chips are less likely to combust than their own business strategies. The company even upped its revenue guidance to 30% growth, a number so modest it could be mistaken for a polite lie.

Counterpoint Research predicts a 68% surge in AI-capable smartphones in 2025. Apple, TSMC’s largest customer, recently reported a 13.5% jump in iPhone sales. Meanwhile, Qualcomm’s partnership with TSMC suggests that even the most stubbornly analog of us will soon be typing on screens made by people who live on an island. And yet, TSMC trades at a mere 24 times forward earnings, a price that defies logic unless one considers that logic is now a deprecated feature in the age of AI.

By 2029, the Foundry 2.0 market is expected to grow at 10% annually. TSMC, with its advanced chip packaging and market-share-expanding antics, is not just riding this wave-it’s the wave. Or perhaps it’s the surfer, the ocean, and the existential dread that follows the surfer home. Either way, it’s a compelling investment in a universe that seems determined to complicate everything.

Twilio: The AI-Powered Whisperer of Customer Service

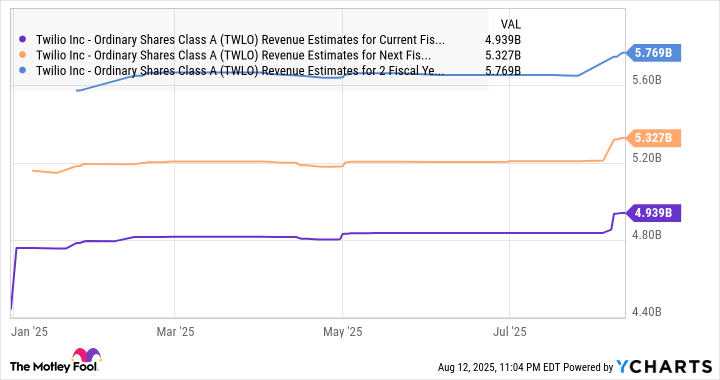

While TSMC builds the engines of progress, Twilio (TWLO) ensures that progress is communicated with the urgency of a telemarketer at 3 a.m. As generative AI services and software spending soars 119% to $65 billion in 2025, Twilio has become the reluctant bard of corporate communication. Its APIs let businesses send texts, emails, and AI-powered voice messages that sound like they were written by someone who cares. (Spoiler: They weren’t.)

Twilio’s AI tools have led to a 57% increase in $500,000+ deals and a 10% rise in active customers. Its dollar-based net expansion rate now sits at 108%, a number that suggests clients are not only staying but also buying more. This is not the work of a struggling startup. This is the work of a company that has figured out how to monetize the very fabric of human interaction, which is arguably the universe’s most overrated invention.

Twilio trades at just 3 times sales, a price so low it could be mistaken for a mistake. Yet here it is, thriving in a world where customer service is increasingly conducted by algorithms that sound like they’re reading from a script written in the 1990s. If you’re looking for a stock that combines the thrill of AI with the timeless appeal of corporate jargon, Twilio might just be the answer. Or, as the universe might say: “Here’s another thing to worry about. Enjoy!”

Invest in these companies, and you’ll be part of a story that’s as old as time itself: humanity trying to outsmart itself, with mixed results. 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-15 21:04