Micron Technology (MU) finds itself in the dazzling spotlight of artificial intelligence, a stage upon which others scramble and tumble. Its memory chips have become the prized possessions of chip virtuosos like Nvidia and Advanced Micro Devices, who employ these gems in their grand data center graphics cards. Ah, the glamour of silicon and data!

In a world enamored with speed, Micron’s high-bandwidth memory (HBM) caters to the fastidious needs of AI accelerator graphics processing units (GPUs). These chips, capable of zipping vast troves of data around with exquisite low lag, practically whisper sweet nothings to the energy calculator. With whimsical surplus demand for AI chips, Micron’s HBM has enjoyed a robust ascendance-one must wonder if this growth is indeed a product of foresight or merely the flotsam of a speculative tide.

Significantly, the unbridled prosperity of Micron seems far from transient, as a prosperous opportunity in the HBM realm unfurls before it, evidenced by a rather rosy guidance update that breathes life into the corporate halls.

The Dawn of Micron Technology’s AI-Enhanced Fortune

As the sun rises on Monday, Micron delightfully uplifted its already sunny fiscal 2025 forecasts. The fourth quarter, set to end on August 28, now promises revenues between $11.1 billion and $11.3 billion, a charming uplift from the previously lackluster $10.4 billion to $11 billion. By the deft hand of accounting gymnastics, that midpoint translates to a cheeky $500 million boost. Not to forget, the management buoyed its non-GAAP earnings guidance from $2.50 per share to a cheeky $2.85 per share-an exquisite promise of 44% year-over-year revenue growth and a fantastical 141% spike in adjusted earnings per share.

But hold the applause! The fine print reveals that “improved pricing, particularly in DRAM, and strong execution” are the culprits behind this uplifting guidance. As demand for HBM surges, memory makers find themselves basking in the glowing warmth of increased prices. It’s been estimated that the HBM market’s revenue may perpetrate an audacious double, leaping to $34 billion in 2024, driven by the twin forces of ample shipment and inflated pricing.

Picture this: production limitations poised to push HBM prices upward by a chic 15% to 20% come the third quarter. A sharper climb compared to the modest 5% to 10% we baulked at last quarter. And as if to gild the lily, next-gen AI graphics cards from the likes of Nvidia and AMD shall embellish themselves with heftier HBM chips-after all, one must add some flair to the elegant dance of data!

Nvidia, in a mercurial display, is cramming a staggering 288 gigabytes (GB) of HBM into its Blackwell Ultra B300 GPU, a cornucopia of numbers up from the modest 192GB of the B200. In similar folly, AMD is enlarging the HBM capacity of its MI355X and MI350X accelerators to match Nvidia’s extravagance at 288GB, leaving behind its erstwhile 256GB models. Not to be outdone, AMD plans to elevate the HBM capacity of its next-generation MI400X GPUs to an audacious 432GB.

As one observes from the sidelines, the appetite for HBM shows no signs of waning anytime soon. Micron’s illustrious rival, SK Hynix, anticipates a sprightly 30% annual growth in the HBM market until the very turn of 2030. Thus, AI shall remain a vibrant wellspring of long-term growth for Micron, particularly given the company’s steadily improving share of this burgeoning market.

The memory wizard of Micron claims it is dispatching HBM chips “in high volume” to an illustrious quartet of major customers-hinting at the likes of Broadcom and Marvell Technology joining this esteemed league. Unsurprisingly, Micron’s HBM market share is set to leap to 24% by the close of 2025, a range considerably improved from the humble 20% at the dawn of this year.

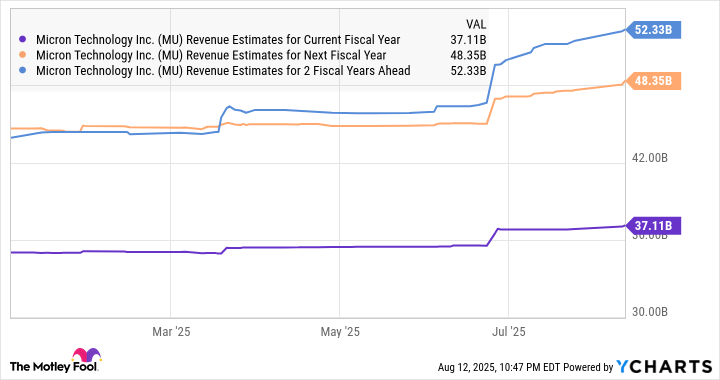

This dreamy prospect of growing market share, paired with the blooming HBM market, explains the alignment of analysts who have upgraded their revenue growth forecasts for the chipmaker-a triumph indeed, one might say!

As fate would have it, Micron’s vibrant growth at the top line is destined to propel a significant leap in its bottom line, as the enthusiasm for HBM outpaces supply. This golden supply-demand dalliance should bolster memory prices, which, combined with the fervor of Micron’s earnings, makes investing in this stock feel like a laborious no-brainer.

Micron’s Pocket Change: An Investment Opportunity You Can’t Shirk

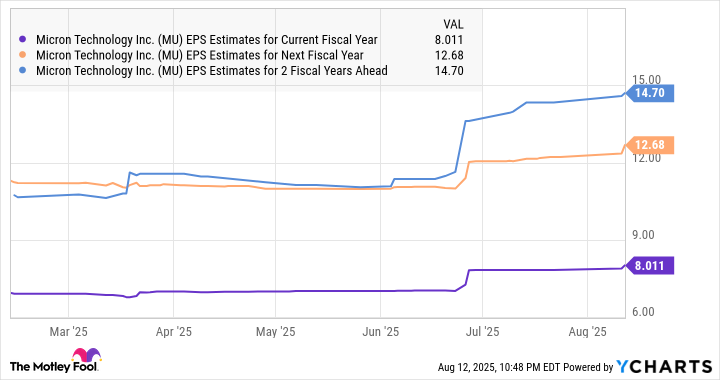

In fiscal 2024, Micron reported earnings to the tune of $1.30 per share. This visual manifestation of excellence stands as testimony that its earnings are well on pace for monumental growth in the present fiscal year and possibly beyond. What a time to be alive!

For those with an adventurous spirit, here’s the piquant cherry on top: Micron’s stock is currently trading at a scrappy 10 times forward earnings-a pittance considering the anticipated value it’s set to unleash. This figure comfortably undercuts the tech-clad Nasdaq-100 index’s hefty multiple of 30.

In a perfect world (or perhaps just a fanciful dream), the market will inevitably reward the AI-imbued growth Micron is poised to deliver, with a higher earnings multiple. Picture this-a multiple of 20 could elevate its stock price towards $244 based on a forecasted fiscal 2026 earnings estimate of $12.22 per share. Nearly double its current price, can you fathom?

In light of all this, investors ought to consider procuring this AI stock with the enthusiasm of a child in a candy store-it has the potential to soar high, even after a brisk 52% gain witnessed so far in 2025. Truly, when cloaked in the guise of fortuitous investment opportunities, who can resist?

🚀

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 39th Developer Notes: 2.5th Anniversary Update

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

2025-08-15 19:23