If the universe had a stock market, it might look something like Datadog‘s recent 4% dip-a brief hiccup in the grand cosmic teapot of financial chaos. The company reported Q2 results that would make a black hole envious, yet shares dipped. Perhaps the market is simply overthinking it, like a tea spill in a library of infinite knowledge. Let’s untangle this.

Datadog (DDOG), provider of cloud-based observability tools and security services, is the IT equivalent of a Swiss Army knife with a PhD in existential dread. Its customers monitor cloud infrastructures, scan for vulnerabilities, and now, increasingly, chase AI-driven insights. The irony, of course, is that the tools designed to make sense of chaos are themselves part of the chaos. But here’s the kicker: demand for these tools is exploding, thanks to AI-the universe’s latest attempt to reinvent itself as a spreadsheet.

Let’s dissect why this dip might be a buying opportunity, assuming you enjoy riding comets through fiscal supernovas.

AI Tools: The Universe’s Most Persuasive Sales Pitch

Datadog’s Q2 revenue surged 28% year-over-year to $827 million, a number so large it could power a small galaxy. Earnings per share? A delightful $0.46, which is about what you’d pay for a cup of tea in a universe where money has no meaning. CEO Olivier Pomel noted on the call that “AI-native customers are growing meaningfully,” a phrase that sounds like it was generated by an AI trying to sound meaningful. And yet, it is.

The company has launched over 125 new AI-powered tools, including autonomous agents that monitor alerts and a coding assistant that fixes cloud applications. These tools are like sentient teacups-fragile, temperamental, and occasionally prone to existential crises. But customers are buying them, deploying them at cloud providers like CoreWeave. In a world where AI applications are sprouting like mold in a damp server room, Datadog’s offerings are the antifungal cream of the digital age.

Over 4,500 customers now use Datadog’s AI tools, and they’re spending more. Pomel revealed that AI-native customers now contribute 11% of revenue, up from 4% a year ago. That’s a fivefold increase in a single quarter, which is like watching a fern grow into a redwood in the time it takes to brew tea. The dollar-based net retention rate? A stellar 120%, meaning customers are clinging to Datadog like clingfilm to a leftover lasagna.

With 31,400 customers and counting, Datadog’s remaining performance obligations (RPO) jumped 35% to $2.4 billion. This is the financial equivalent of a supernova-explosive, luminous, and slightly terrifying. Yet here we are, debating a 4% dip.

A Stock So Expensive, It Has Its Own Gravitational Pull

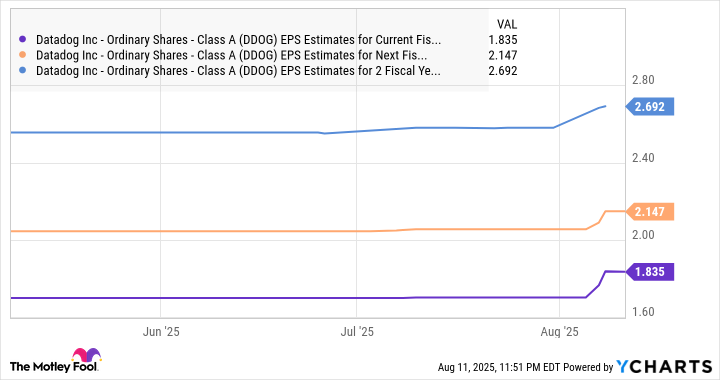

Datadog trades at 76 times forward earnings, a valuation that makes a luxury yacht look like a bicycle. But let’s not forget: the company is spending aggressively on R&D and marketing, with operating expenses up 37% year-over-year. This is the price of admission to the AI arms race, where competitors are firing lasers at each other with code. And yet, Datadog expects flat earnings in 2025. It’s the financial equivalent of ordering a soufflé and being told it will arrive cold.

But here’s the catch: these investments are building a revenue pipeline that could outpace even the most optimistic analyst forecasts. The company’s customer base is growing, existing customers are spending more, and the AI tools are just beginning to take off. It’s like investing in a bicycle that’s about to discover it can fly.

In the grand cosmic lottery of stock picking, Datadog’s dip is a rare alignment of planets-a moment where absurdity and opportunity collide. The stock is expensive, but then again, so is everything in this universe. And if AI can help Datadog regain its “mojo,” as the CEO so quaintly put it, then perhaps this is the kind of madness worth betting on. After all, what is a stock portfolio if not a collection of stories we tell ourselves while waiting for the universe to stop making sense? 🚀

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- South Korea’s Wild Bitcoin ETF Gamble: Can This Ever Work?

- TV Pilots Rejected by Networks

- Gold Rate Forecast

2025-08-15 17:02