On August seventh, the energy beverage producer Celsius Holdings, once a beacon of promise, stirred from its slumber, its stock rising like a weary soul seeking redemption. Shares, now ascended more than 29% since its report, scale heights unseen in half a year, surpassing the $55 mark-a price that once seemed a distant dream. A year prior, it languished at $21, a shadow of its former self.

Once, Celsius danced in the limelight, its growth a siren song to investors. Yet in 2024, the melody faltered. Setbacks crept in, and the chorus of optimism turned to doubt. The stock, once a paragon of potential, now bore the weight of disillusionment.

Yet the latest quarter whispers of resilience. The enterprise, though battered, still clings to the promise of long-term triumph. Let us dissect why.

The Rise of a Beverage Giant

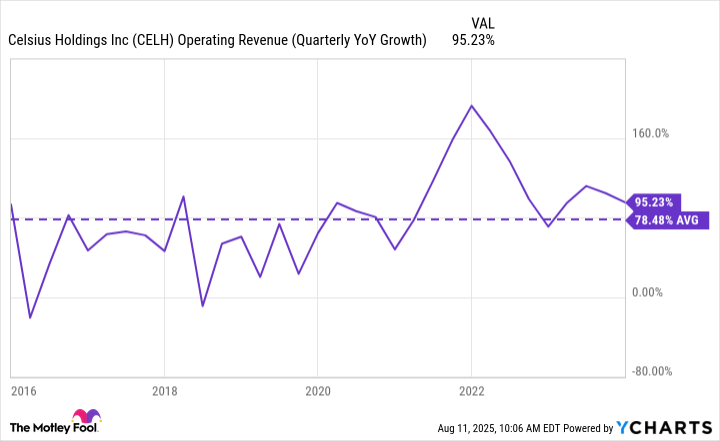

The company’s portfolio of energy drinks, once a whisper in the market, now roars. From 2016 to 2023, it averaged quarterly revenue growth of nearly 80%, a testament to its allure. But 2024 brought a cruel twist: a 31% plunge in revenue, followed by two more quarters of decline. Management blamed supply chains, not dwindling demand, yet investors, skeptical, watched the stock plummet 78% from its peak.

Yet the second quarter of 2025 tells a different tale. The flagship brand, Celsius, grew revenue by 9%, reaching $438 million-a sign that consumer hunger endures. This growth, however, is but one thread in a tapestry. The acquisition of rival Alani Nu, now a 40% cornerstone of the business, surged with 129% retail sales growth. A new engine, forged in the fires of competition, now drives the enterprise.

The gross margin, though slightly lower, remains steadfast. A 51.5% margin in Q2 2025, a mere hair below the 52% of the prior year, suggests the company’s resilience. Vertical integration, born from the purchase of Big Beverages, has fortified its position. Yet, the path ahead is fraught with challenges.

Management credits operational improvements for the margin’s stability. Still, the specter of Alani Nu’s $900 million debt looms. The fusion of two brands, though strategic, risks internal strife. Will their combined might outshine the sum of their parts, or will they devour each other in the shadows of the market?

For now, the stock ascends. A glimmer of hope for those who once despaired. Yet, the road is long. Distribution of Alani Nu remains untapped, and international markets, vast and uncharted, await. With a market cap of less than $14 billion, Celsius stands at the threshold of a new era-a testament to the tenacity of enterprise.

The Uncertain Horizon

Can this ascent endure? The acquisition of Alani Nu, while a bold move, carries risks. The debt, a chain around the neck, may yet hinder progress. And the question lingers: will the brands coexist, or will they clash, their shared consumer base a battleground?

Yet, the potential is undeniable. With room to expand Alani Nu’s reach and the untapped promise of global markets, Celsius may yet write a new chapter. The second quarter, a beacon of progress, hints that the company is no longer adrift.

The stock’s rise is not merely a tale of numbers. It is a mirror reflecting the struggles and triumphs of a system that favors the bold. For the workers, the consumers, and the dreamers, it is a reminder that even in the darkest hours, the light of resilience persists.

🚀

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- USD RUB PREDICTION

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- 8 Board Games That We Can’t Wait to Play in 2026

- South Korea’s Wild Bitcoin ETF Gamble: Can This Ever Work?

- TV Pilots Rejected by Networks

2025-08-15 11:43