Behold, Arista Networks (ANET)-a tempest in the stagnant sea of cloud computing, its switches and software the very sinews of data centers. Yet what is progress, if not a fever dream of silicon and ambition? The market, in its infinite madness, now hails this company as a savior of artificial intelligence infrastructure. But tell me, dear reader: does salvation lie in the hands of those who chase it like a mirage in the desert?

On Aug. 5, Arista’s quarterly results arrived like a thunderclap, shattering Wall Street’s brittle expectations. Its stock soared 17%, a delirious dance of numbers and hope. Yet beneath this euphoria, one must ask-what specter haunts this ascent? The company, in its hubris, raised full-year guidance as if to say: “Behold, the future is ours to command.” But the future is a fickle mistress, and Arista’s 360% surge over three years may yet curdle into folly.

The Illusion of Unstoppable Growth

Q2 revenue leapt 30% to $2.2 billion, non-GAAP earnings rising nearly 38% to $0.73 per share. The company’s scribes attribute this to the “strong demand” from AI hyperscalers and cloud providers. But what is “strong demand” if not the echo of a crowd rushing toward a cliff? Arista’s switches and routers, they claim, reduce AI data center costs by optimizing network utilization. Yet I wonder-does this not merely delay the inevitable collapse of a system built on sand?

The company now forecasts 25% revenue growth for 2025, a revision from 17%. One might call this progress, but progress toward what? The market’s total addressable value, they say, will swell to $70 billion by 2028. But what of the human soul, the existential dread of a world where GPUs and switches reign supreme? Arista’s 30% market share in high-speed switching is a triumph-yet it was wrested from Cisco Systems, a titan that once towered over this field. Is this not a parable of the fall of empires?

The company boasts that 30% to 50% of AI cluster processing time is wasted on data transfers. Its solutions, they argue, will eliminate this “waste.” But what is efficiency if not the enemy of serendipity, the very lifeblood of innovation? Arista’s AI-related revenue is projected to exceed $1.5 billion in 2025, yet the market’s $155 billion forecast for data center networking by 2033 feels like a gilded cage. To chase TAM is to chase a phantom; the true question is whether Arista’s soul can endure the weight of its own ambition.

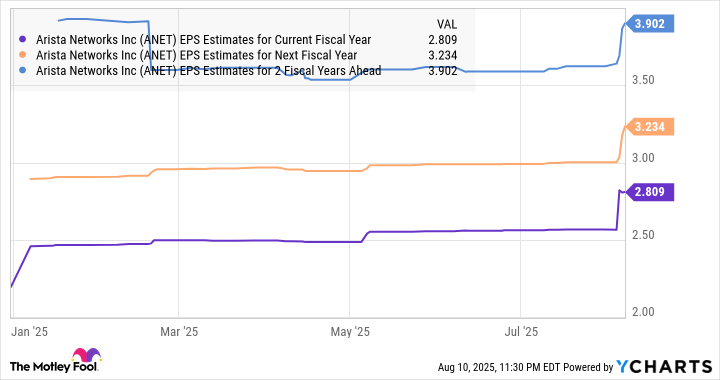

And what of its valuation? A P/E ratio of 54-such a number whispers of madness, a man who sells his shadow for a crown. The stock has run ahead of itself, a Sisyphean folly where every gain is a step closer to the void. Yet Arista’s revised growth estimates for the next three years offer a perverse comfort: perhaps the market will forgive its sins, if only for a little longer.

The company’s $10 billion revenue target in 2026, two years ahead of schedule, is a testament to its relentless drive. But let us not mistake velocity for direction. Arista’s growth may outpace estimates, yet the question remains: can it transcend its valuation, or will it collapse under the weight of its own delusions? The market, in its infinite irony, may yet crown this stock a king-only to see it fall like Icarus, its wings of wax melting in the sun.

Thus, the paradox: Arista is both savior and destroyer, a company that dances on the edge of a blade. To invest in it is to bet on the madness of the crowd, to embrace the chaos of progress. But in the end, what is the stock’s fate if not a reflection of our own? A mirror held up to the abyss, where hope and despair are but two faces of the same coin. 🔥

Read More

- 21 Movies Filmed in Real Abandoned Locations

- Gold Rate Forecast

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 39th Developer Notes: 2.5th Anniversary Update

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- The Timeless Allure of Dividend Stocks for Millennial Investors

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

2025-08-14 15:12