Ah, Ether.fi-now making waves with the grace of a drunken sailor on a 7-day bender! Its price has surged 6.23% in just 24 hours, reaching a princely $1.29. Why? Oh, the usual suspects: whale buying (because who doesn’t love a good feeding frenzy?), Ethereum’s ecosystem blooming like a spring garden, and trading volumes climbing faster than a monkey up a banana tree. With a market cap now tipping $544.91 million and trading volume soaring by 23.54%, it seems everyone wants a slice of this crypto pie. But where to next, you ask? Ah, dear reader, patience! Let us dissect this farce further.

Why This Sudden Burst of Enthusiasm? 🤔

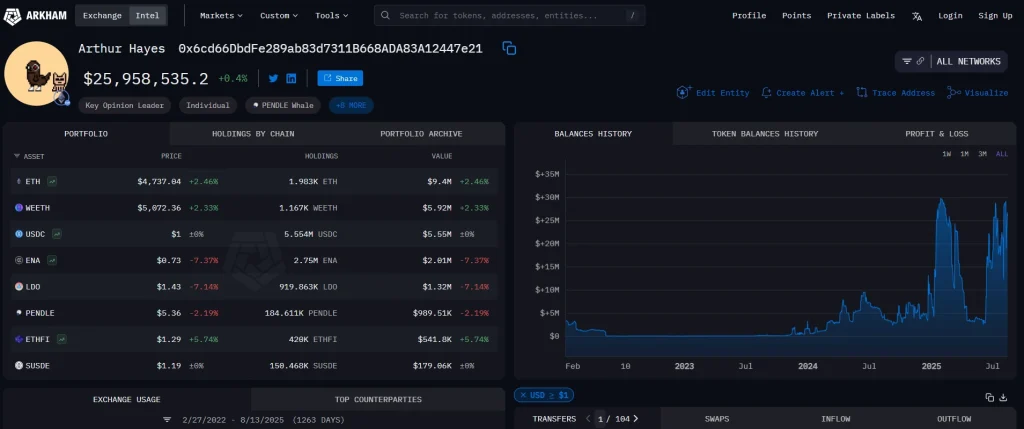

Enter Arthur Hayes, the BitMEX co-founder with a flair for dramatic purchases. On August 11, he scooped up 420,000 ETHFI tokens-worth roughly $517,000-as part of an $8.4 million DeFi shopping spree that included LDO and PENDLE. Truly, a man who shops like he’s stocking up for doomsday! Such high-profile antics often spark copycat behavior among traders, leading whales to now control 42% of ETHFI’s supply. While this centralization might raise eyebrows (and risks), it’s currently fueling bullish dreams. But beware, dear spectators-whales are notorious for taking profits at the most inconvenient moments!

Meanwhile, Ethereum itself is flexing its muscles, rallying to $4,300 and driving capital into liquid restaking protocols like ether.fi. The platform’s Total Value Locked (TVL) has rebounded to $6.7 billion, with revenues jumping 58% month-over-month. Add a shiny new partnership with Superstate (using weETH as collateral for yield funds), and ETHFI appears ready to conquer the world-or at least the Real World Asset (RWA) space. However, should Ethereum falter below $4,200, ETHFI may find itself abandoned like last season’s fashion trends.

An Analysis Worthy of Molière Himself 📊

Behold, the charts reveal their secrets! ETHFI has broken above its 7-day Simple Moving Average (SMA) at $1.21 and conquered the Fibonacci 23.6% retracement level at $1.29. Bravo! The Relative Strength Index (RSI-14) sits at 64-neutral yet hopeful-and the MACD histogram gleams positively, suggesting momentum stronger than a Frenchman defending his cheese. Traders now set their sights on $1.54, the 127.2% Fibonacci extension, though the pivot point at $1.31 looms ominously like a nosy neighbor. Should ETHFI falter below $1.25, prepare for profit-taking to drag prices down to $1.09. But if it breaks cleanly above $1.30, expect fireworks toward $1.50-$1.60.

Frequently Asked Questions (or FAQs for the Lazy) 😴

1. Why is ETHFI rising? Whale accumulation, courtesy of Arthur Hayes, and Ethereum’s rally have lit the fire under this cauldron of chaos.

2. What’s the short-term target? If momentum holds, aim for $1.50-$1.60, with $1.54 as the pièce de résistance.

3. What are the risks? Failure to hold $1.25 or whale profit-taking near $1.54 could send prices tumbling faster than a jester tripping over his own shoes.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- TV Shows With International Remakes

- 8 Board Games That We Can’t Wait to Play in 2026

- All the Movies Coming to Paramount+ in January 2026

2025-08-14 11:55