In the grand theater of Wall Street, where fortunes are made and unmade with the flip of a stock ticker, investors have long chased the next “revolutionary” trend. From the internet’s gilded dawn to the metaverse’s pixelated promises, each wave has brought a new chorus of optimists, venture capitalists, and the occasional charlatan with a PowerPoint thicker than a Kremlin dossier. But nothing has captivated the masses quite like artificial intelligence-a digital alchemy that turns data into gold, if only for a moment.

PwC’s analysts, with the enthusiasm of a con artist pitching a bridge to Brooklyn, have declared the AI pie to be worth $15.7 trillion by 2030. Such numbers, of course, are the lifeblood of Wall Street’s latest darling: Palantir Technologies (PLTR). A stock that has ascended not with the dignity of a rocket, but the chaotic energy of a drunken tightrope walker-balancing on a plank of hype and hope.

As of Aug. 10, Palantir has leaped from obscurity to the 19th largest public company in the U.S., its $443 billion market cap now eclipsing titans like Johnson & Johnson, Costco, and Home Depot. A 2,800% surge since 2023 is not merely impressive-it is the financial equivalent of a magician pulling a rabbit from a hat, only to reveal the hat itself is made of rabbits.

- Johnson & Johnson, that paragon of 35-year earnings growth, now lags behind a company whose existence is as concrete as a Soviet five-year plan.

- Costco, with its “members only” stability, is outshone by a firm that markets software to governments like it’s selling bottled water to the Sahara.

- Home Depot, that humble purveyor of nails and optimism, now watches from the sidelines as a data broker climbs the ranks.

Two more percent, and Palantir will surpass ExxonMobil, the oil giant that once made “peak oil” sound like a bad joke. The irony is thick enough to choke a gas station.

Palantir’s rise is not a fluke but a carefully orchestrated farce of competitive advantages. Its Gotham platform, a government-facing SaaS with the allure of a black box, secures multiyear contracts like a bureaucrat hoarding office supplies. Meanwhile, Foundry, its business-oriented sibling, promises to streamline operations with the same vigor as a Soviet factory manager promising a 100% increase in tractor production.

Neither segment has a competitor worth mentioning. In the world of Wall Street, this is the financial equivalent of owning a monopoly on air-until, of course, someone invents a respirator.

Palantir’s profitability, meanwhile, has been a masterclass in outpacing expectations. Alex Karp, the company’s enigmatic leader, has the Midas touch of a man who once sold bottled oxygen to miners. Yet, as any seasoned investor knows, the higher you climb, the harder the fall-and the more likely you’ll land on a landmine.

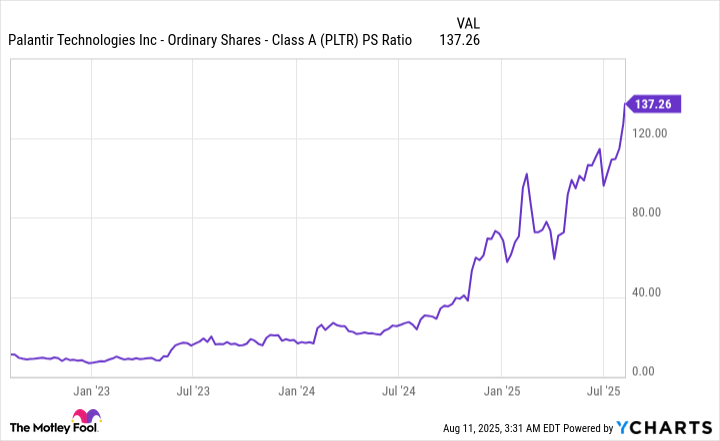

Here lies the rub: Palantir’s valuation is a Jenga tower built on sand. Its P/S ratio of 137 is not a number but a dare-a challenge to gravity, logic, and the very laws of economics. For context, even Nvidia, the AI titan, peaked at a P/S of 42. Palantir’s figure is like a magician’s trick-impressive until you realize there’s no rabbit in the hat, just a lot of smoke and mirrors.

History has a way of reminding us that every great scheme, from tulip mania to the dot-com crash, eventually meets its Waterloo. The S&P 500’s Shiller P/E ratio, now flirting with its third-highest level in 154 years, is a ticking clock. When it strikes midnight, Palantir-like so many before it-will find itself the star of a very unglamorous encore.

And let’s not forget the political tightrope. President Trump may have painted defense spending in bold strokes, but the next administration could render Gotham’s contracts as obsolete as a typewriter in a digital age. Palantir’s future is as stable as a house built on a tectonic plate.

So, dear investor, consider this: Palantir is not a stock-it’s a gamble. A high-stakes poker game where the pot is a $443 billion dream and the dealer is a man with a calculator and a smile that doesn’t reach his eyes. The question is not whether the house of cards will fall, but when. And when it does, may your portfolio be as sturdy as a fortress, not a sandcastle.

🏗️

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

2025-08-14 10:59