Investors have turned their attention to the semiconductor sector, a cornerstone of the artificial intelligence (AI) revolution. These companies, often buried in the shadows of data centers and cloud infrastructure, are where the money from AI is being made. Hyperscalers and cloud providers are building their capacity to train and deploy AI models, and the chipmakers are reaping the rewards.

Though many chip stocks have soared in recent years, their trajectories remain compelling. Three stand out as logical choices for investors willing to navigate the semiconductor landscape with a clear head.

Nvidia

Nvidia (NVDA) designs chips but leaves the manufacturing to others. Its graphics processing units (GPUs) have become the go-to tool for AI computations, owing to their parallel processing capabilities. These chips, when clustered, amplify their utility in handling the complex tasks demanded by AI systems.

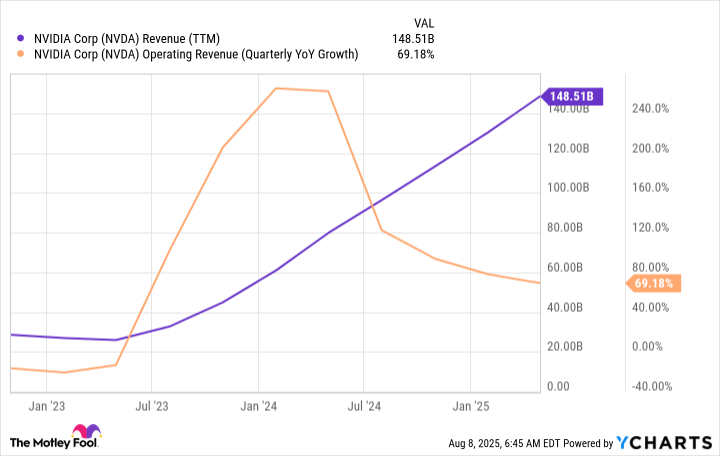

Nvidia’s revenue growth has been steady, though the percentage rate has slowed slightly. Yet 69% growth is no small feat, and the 50% projected for Q2 suggests the company’s momentum is far from exhausted.

Concerns about slowing demand persist, but the AI hyperscalers-Nvidia’s largest clients-hint at another record year of capital expenditures by 2026. Meanwhile, a recent Trump-era deal allows Nvidia to export its H20 chips to China, albeit with a 15% revenue cut for the U.S. government. The H20, a deliberately scaled-down version of its top-tier chips, sidesteps trade restrictions while opening new markets.

Nvidia’s long-term performance is undeniable, but its ability to maintain growth amid regulatory and geopolitical headwinds remains a test of its resilience. For now, it warrants a place in the portfolio of the discerning investor.

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor (TSM) is Nvidia’s fabricator, but it also serves AMD, Broadcom, and Apple. Its manufacturing prowess is unmatched, cementing its role as the world’s leading semiconductor foundry.

Its proximity to mainland China-on an island claimed by Beijing-raises geopolitical concerns. Yet TSM is diversifying its footprint, investing $165 billion in Arizona to reduce reliance on its home base. This move, while prudent, invites questions about the feasibility of replicating its success in new locations.

Management forecasts 45% annual growth in AI revenue and 20% overall over five years. Such projections, while ambitious, reflect the scale of demand for its services. Whether TSM can meet these targets without compromising margins remains to be seen.

ASML

ASML (ASML) holds a monopoly on extreme ultraviolet (EUV) lithography machines, essential for producing cutting-edge chips. These tools etch microscopic circuits onto silicon, enabling the miniaturization that drives computing power forward.

ASML’s dominance is unchallenged, but its Dutch origins subject its machines to U.S. tariffs. This complicates forecasts for 2026, though management remains confident in its 2030 guidance of €44 billion to €60 billion in revenue. The company’s technological lead is formidable, but the world is not static. Competitors may emerge, and trade policies can shift overnight.

For now, ASML remains indispensable to the chip industry’s future. Its stock, like its machines, is a precision instrument-one that rewards patience and a long-term view. 🧩

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Is T-Mobile’s Dividend Dream Too Good to Be True?

2025-08-13 23:44