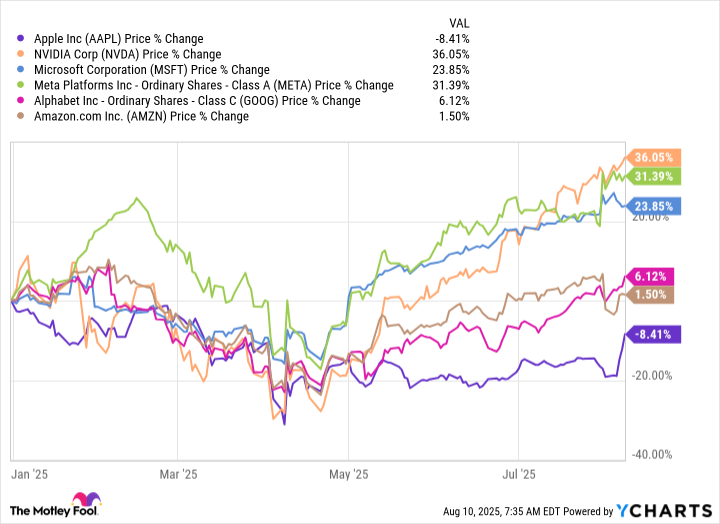

In the grand theater of commerce, where fortunes rise and fall with the caprices of investors, two new protagonists have taken the stage: Nvidia, that sprightly upstart of silicon and code, and Microsoft, the seasoned actor donning a cloak of cloud and algorithms. Together, they have leapt into the $4 trillion valuation club, leaving Apple, that once-mighty nobleman of consumer electronics, trailing in their wake like a courtier who has misplaced his fanfare. One might ask: Will the apple of Cupertino’s eye regain its luster, or shall it become a cautionary tale of hubris and missed cues?

Act I: The Alchemist of AI

Nvidia, that cunning scene-stealer, has transformed from a mere purveyor of gaming chips into the alchemist of artificial intelligence. Its graphics processing units, once dismissed as tools for pixelated diversions, now fuel the generative AI revolution-a modern-day Philosopher’s Stone. With a revenue surge of 69% in its latest quarter, it struts across the stage, its P/E ratio of 31 a modest costume for such a star. The audience, ever enamored by spectacle, whispers of a $5 trillion valuation before the curtain falls on this fiscal year.

Microsoft, ever the pragmatic statesman, follows suit. Its Azure cloud, swelling with a 34% revenue increase, becomes the stage’s supporting chorus, while its investments in large language models echo the overtures of a grand opera. At a P/E of 29, it plays the wise investor, content to let the spotlight share the stage.

Act II: The Bourgeois Gentleman’s Dilemma

And where does Apple, that paragon of minimalist elegance, now stand? Still the third-most-esteemed name in the ledger, yet its gait has grown heavy. This year, it alone among the six great stocks has faltered, its iPhone-centric revenues a relic of a bygone era. The court is abuzz with murmurs: Is this the folly of a bourgeois gentleman who clings to his powdered wig while the world demands a revolution?

The iPhone, that golden goose, now lays eggs of diminishing weight. Alphabet’s Sundar Pichai, with a Gallic shrug, remarks that phones shall reign for “two to three years”-a polite dismissal veiled as prophecy. And Apple’s foray into AI? A half-hearted waltz, met with yawns. Yet CEO Tim Cook, with the resolve of a man who has weathered storms before, vows to pour more gold into the cauldron. One might pity the investors who must now bet on a comeback as uncertain as a jester’s balance.

Act III: The Imaginary Invalid

Yet let us not dismiss Apple too hastily. For in this farce, redemption is a recurring motif. The company, after all, has a history of transforming its imaginary invalid into a phoenix of innovation. Its user base, a loyal court, remains vast. Its balance sheet, a fortress. And though the scribes scoff at its current P/E of 29, history teaches that even the most stubborn oak may yet sprout new branches.

Thus, the curtain does not fall on Apple. It merely pauses-for a moment of reflection, a sip of champagne, and perhaps a new act. Whether it shall reclaim its place in the $4 trillion club remains to be seen. But in the theater of finance, as in Molière’s own, the greatest folly is to declare the final scene before the last bow. 😏

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

2025-08-13 16:22