Plug Power (PLUG) emerges from the second quarter with a blend of progress and unyielding challenges, casting a long shadow over its future ambitions. This is no simple journey of profits but rather a tale of fervent striving, where each gain is tempered by an equal measure of toil. As an activist investor, I cannot help but feel the urgency of the winds that seem to push this company forward, yet the road ahead still remains uncertain and fraught with barriers.

Here, we peel back the curtain on Plug Power‘s financial results-an intricate dance between optimism and the cold reality of what remains to be done. What does this mean for the long-term investor, ever patient yet ever watchful?

Parsing the Glimmer of Progress

There was a slight stirring in the depths of Plug Power‘s financial well in the second quarter-$174 million in revenue, a 21% increase over the previous year. The surge is not without reason; it is the product of a well-placed bet on hydrogen. Demand for the company’s GenDrive fuel cells, GenFuel infrastructure, and GenEco electrolyzers flourished like the first blooms of spring after a long winter. The electrolyzer segment, in particular, saw an impressive threefold expansion to $45 million, revealing the company’s successful efforts to expand its global platform.

Yet even within the green shoots of progress, the underlying soil remains unsettled. The gross margin, though vastly improved, still languishes in negative territory, rising from a staggering -92% to a still unappealing -31%. This leap was not by chance but through cost reductions in services, a reduction in equipment costs, and a more favorable hydrogen pricing structure-yet the question remains, will this be enough to achieve a semblance of lasting stability?

Within the labyrinth of corporate restructuring, Plug Power has achieved a quieter victory. Through Project Quantum Leap-a name both poetic and prescient-the company has refined its internal machinery. Workforce optimization, facility consolidation, cost-cutting measures, and renegotiated supplier agreements all contribute to a future that seems more sustainable, if not yet entirely secure. Notable in its success was the extension of a key hydrogen supply agreement with a major U.S. industrial gas company, one that stretches all the way to 2030. Such agreements offer a glimpse of what could be-a promise of lower-cost, reliable hydrogen supply-a breath of fresh air in a sometimes stale and turbulent market.

Despite the tremors in its finances, Plug Power found a momentary reprieve. Its cash burn rate decreased by over 40% year-over-year, alleviating some of the pressures that once threatened to overwhelm its financial structure. Yet, even amidst these positive developments, there is a lingering question: can this momentum be sustained as the company stands on the precipice of greater fiscal demands?

The Uncharted Terrain Ahead

Despite the gains, the horizon remains dotted with clouds. Plug Power remains tethered to a negative gross margin-a perpetual struggle to make ends meet. The company continues to spend more than it earns, and while it aims for a break-even margin by the close of this year, this target, much like the winds of change, is elusive and fraught with uncertainty.

The company’s cash burn is another haunting specter. Despite trimming excess costs, Plug Power consumed a staggering $385 million in the first half of the year. The question is no longer “if” but “how” the company will continue to finance itself. The company has sought refuge in external funding-$280 million raised through stock issuance in March and a secured $525 million credit facility in May. Even now, it remains perched precariously, with $140 million in cash and an additional $300 million available from its credit facility.

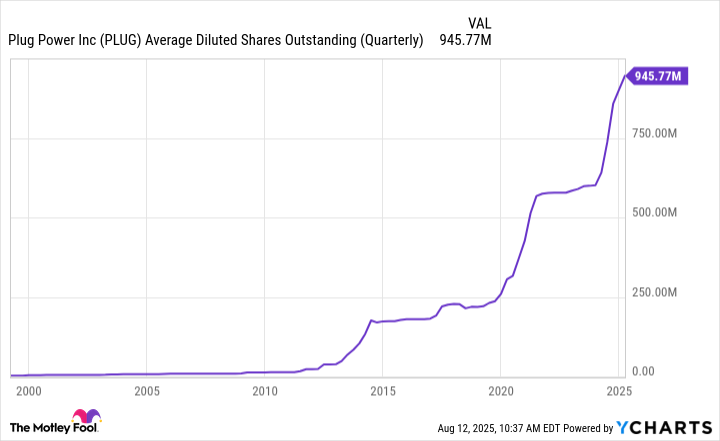

At its present burn rate, the company can only survive for a couple more quarters before further capital injections will be necessary. And thus, the dance continues, the cycle of dilution and expansion, ever onward until it reaches a critical mass. The company anticipates that it will not reach profitability until 2028. Between now and then, further capital raises will only increase the share count-already climbing-and further dilute the value of each share.

And yet, the stock, having once soared, now languishes in the gloom. A catastrophic 99% loss since its IPO is a stark reminder of the volatility inherent in such ventures. The growth of the share count, born from necessity, adds yet another layer of complication to an already fragile value proposition.

As Plug Power navigates the storms of its own financial creation, the road ahead grows longer still. A few more years will pass before positive operating income materializes. And in the interim, the company’s stock will continue its slow descent-a casualty of its own expanding ambitions. For long-term investors, the horizon is uncertain, even if the potential for hydrogen as a sector remains vast. Patience may not be enough. The question becomes one of endurance, not just in the market but in the very essence of the company’s survival.

Reflecting on the Journey

In the quiet sweep of time, Plug Power has achieved something remarkable-a tentative stride forward. Yet, the future remains a series of elusive mirages. Even in the glow of opportunity, the company’s path is lined with shadows. For the long-term investor, this is not a place for blind optimism but a space for vigilance, a watchful eye trained on the company’s every move. The road is long, and the trials are many, but perhaps, somewhere within the rustle of the future’s winds, there lies the quiet hope of a breakthrough.🌿

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-13 10:32