Let’s talk about sports betting, shall we? If you’ve been paying attention to anything involving balls, bats, or even virtual dragons lately, you’ve probably noticed that the U.S. has gone full *casino mode*. It’s like every state decided to turn their local stadium into Vegas North. And why not? The tax revenue is juicier than a Sunday mimosa brunch.

Ah yes, the Supreme Court’s 2018 ruling-legalizing sports betting in states across America-was basically the starting pistol for what can only be described as “Capitalism Olympics.” Now, everything from football to Fortnite has odds attached, and DraftKings (DKNG) is here leading the charge like a caffeinated cheerleader at halftime.

If you’ve got $1,000 burning a hole in your pocket-and I do mean AFTER you’ve paid off high-interest debt and stashed six months’ rent under your mattress-DraftKings might just be the stock equivalent of putting all your chips on black… but smarter.

Financials That’ll Make You Say ‘Cha-Ching!’

Let’s dive into the numbers because, let’s face it, no one wants to hear me riff about fantasy football leagues without some proof this thing actually works. DraftKings recently dropped its Q2 earnings report, and it reads like an overachiever’s LinkedIn post: Revenue up 37% year-over-year to $1.5 billion. Adjusted EBITDA? Up a whopping 135% to $301 million. These aren’t just records; they’re *Olympic gold medal* records.

Now, if you’re wondering why adjusted EBITDA matters more than your Aunt Karen’s hot takes on inflation, here’s the deal: It strips away all the fluff (like stock-based compensation) to show how the core business is doing. For years, DraftKings played the startup game-grow fast, worry about profits later-but now? They’re flipping the script faster than Taylor Swift changes boyfriends. Profitability is officially Plan A, B, and C. Oh, and did I mention they bought back 6.5 million shares while still funding growth initiatives? Someone give these guys a trophy.

Beyond Sports Betting: Because Life Isn’t Just Tailgates and Touchdowns

Here’s where things get interesting. The sports betting space is starting to feel like peak Starbucks saturation-there’s one on every corner. FanDuel, ESPN Bet, Caesars, MGM… it’s getting crowded enough to make anyone claustrophobic. But DraftKings isn’t sitting around waiting for someone else to eat their lunch. Nope, they’re diversifying faster than a Tinder profile during dating season.

Take their iGaming division, which grew 23% YoY. Or better yet, their jackpot gaming revenue, which doubled since last year. Remember when they bought Jackpocket, the digital lottery app? Yeah, turns out that wasn’t just a random shopping spree-it was strategy. Pure, calculated genius. By offering lotteries and casino games alongside sports betting, DraftKings is basically saying, “Why stop at Monday Night Football when you could also win big on Mega Millions?”

This cross-selling approach is working wonders too. Monthly unique payers ticked up slightly from 3.1 million to 3.3 million, but the real kicker is the average revenue per user jumping from $117 to $151. Translation: People are sticking around longer and spending more money. It’s like DraftKings figured out how to monetize FOMO itself.

Is the Stock a Bargain or Just Another Mirage?

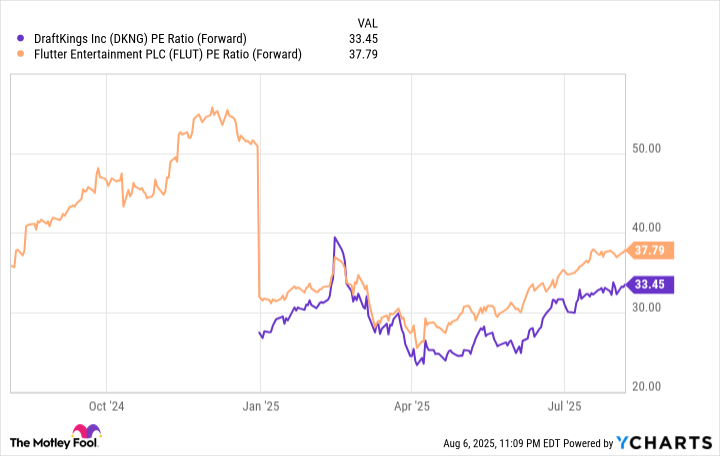

Okay, so the stock is up nearly 25% year-to-date and 45% in the past 12 months. Sounds great, right? But before you start daydreaming about yacht parties, let’s talk valuation. At 33 times projected earnings for the next 12 months, DraftKings isn’t exactly cheap. Still, compared to Flutter Entertainment (FanDuel’s parent company), it looks downright reasonable.

In the U.S., DraftKings and FanDuel are essentially the Coke and Pepsi of online sports betting. But if I had to pick one, I’d go with DraftKings. Why? Because it feels less like a conglomerate trying to sell you soda AND theme parks, and more like a laser-focused bet on the future of legalized gambling. Plus, their aggressive expansion into non-sports areas gives them an edge that screams “long-term winner.”

So there you have it. DraftKings may not solve world hunger, but it sure knows how to play the odds. And honestly, who doesn’t love a good underdog story? 🎲

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-08-12 05:01