Behold, the specter of decline! Last week, the colossus known as Amazon (AMZN) unveiled its second-quarter accounts, and lo, the market recoiled. A 10% plunge, a descent into the shadows, as if the very soul of commerce had been pierced. Investors, those weary pilgrims of fortune, now gaze upon the horizon with a mixture of dread and curiosity. For what is a market cap, if not a mirror reflecting the collective psyche? The titans of technology-Nvidia, Microsoft-now loom twice the size of Amazon, their shadows stretching like serpents over the landscape. Yet, within this abyss of uncertainty, a question lingers: can a beast of such magnitude yet rise again?

Let us not be deceived by the surface. Beneath the tremors of the stock, a deeper truth stirs. Amazon, that labyrinth of commerce, harbors within it the seeds of its own redemption. Its e-commerce empire, a fortress of advertising revenues, has grown from $7.4 billion to $15.7 billion, a crescendo of profit that echoes through the corridors of its balance sheets. Here, in the realm of third-party sellers and subscription services, a silent revolution brews-a dance of margins and leverage, a testament to the human spirit’s relentless hunger for expansion. Even as the world whispers of stagnation, the numbers whisper of triumph.

Consider the international markets, those distant provinces where Amazon’s shadow stretches but still holds sway. With a 3.4% operating margin on $150 billion in revenue, it is a tale of delayed but inevitable ascension. The same principles that have lifted North America’s profits-7% margins on $400 billion in sales-now beckon from afar, a promise of growth etched in the very fabric of its operations. Even a slight elevation in margins, a mere fraction of a percentage, could summon billions from the void.

And what of the cloud, that once-glorious bastion of Amazon’s might? The AWS division, though trailing its peers, remains a colossus in its own right. Its 17.5% growth, though modest, is a whisper of the AI revolution that looms on the horizon. The alliance with Anthropic, that fledgling star, promises a renaissance-a feverish dance of data and dollars. With $130 billion in annualized sales, AWS stands at the precipice of a $150 billion future, its profit margin of 37% a beacon in the darkness.

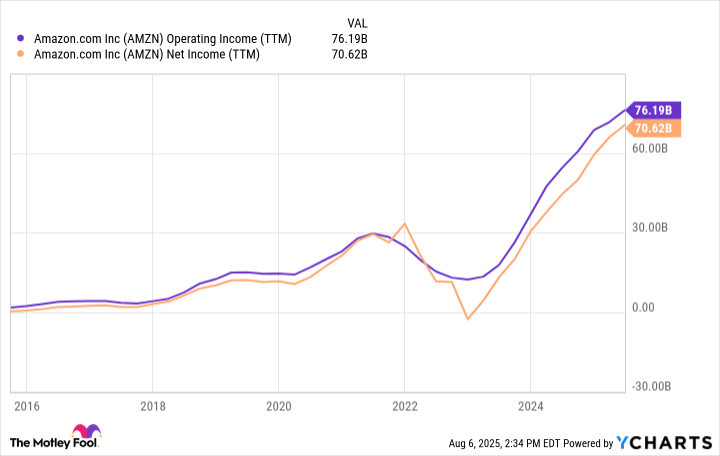

Let us not forget the arithmetic of salvation. Amazon’s $76 billion in operating income and $70 billion in net income are not mere numbers but the pulse of a giant. With continued margin expansion and AWS’s growth, these figures could swell to $100 billion by 2026. A forward P/E of 30, a mere fraction of the S&P 500’s 30, would elevate Amazon’s market cap to $3 trillion-a mathematical prophecy, if you will, etched in the stars.

Yet, what is this valuation but a mirror to the soul of the market? A reflection of greed, of hope, of the eternal struggle between reason and irrationality. The investor, that solitary figure, must navigate this labyrinth with both courage and caution. For in the end, the numbers are but shadows, and the true reckoning lies in the choices we make. Will we cling to the present, or dare to believe in the promise of the future? The answer, like the stock price, remains an enigma-waiting, ever waiting, for the next chapter to unfold.

📈

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- 39th Developer Notes: 2.5th Anniversary Update

2025-08-11 05:30