All good stories have their finales, and after more than sixty years of shaping fortunes and legends alike, Warren Buffett-sometimes called the Oracle of Omaha-has signaled that he’s ready to step back from the day-to-day long enough to let someone else handle the genius. The man who transformed a sleepy textile mill into the sprawling, trillion-dollar behemoth known as Berkshire Hathaway (BRK.A, BRK.B) is, quite fittingly, passing the torch while still clutching the steering wheel as chairman. It’s a bit like a grandmaster chess player conceding the title but still looming in the background, plotting moves.

The good news-if one can call it that for such a legendary figure-is that Buffett’s fingerprints remain all over Berkshire’s portfolio, which currently holds investments worth roughly $280 billion. These are his “best ideas,” the ones he’s still whispering sweet nothings to, and it’s worth listening in if you want to profit alongside him amid the modern economic chaos.

1. Kroger

When wallets tighten, it’s a natural human behavior to cut back on dining out and cook more at home-nothing like a bowl of cereal or a three-ingredient casserole to keep costs down. Enter Kroger (KR), the largest grocery chain in the US that’s been happily rolling with this trend. With over 2,700 stores, Kroger is the grocery equivalent of a well-oiled, discount-loving behemoth.

Kroger’s size isn’t just for show; it confers considerable clout. Its buying power rivals that of some small countries, allowing it to negotiate prices and pass savings along to cash-strapped Americans. What’s more, Kroger’s aggressive investment in technology has paid dividends-literally-fueling a 15% jump in digital sales in just the first quarter. Think of it as a supermarket on the digital highway, and it’s not just about convenience but keeping up with changing habits.

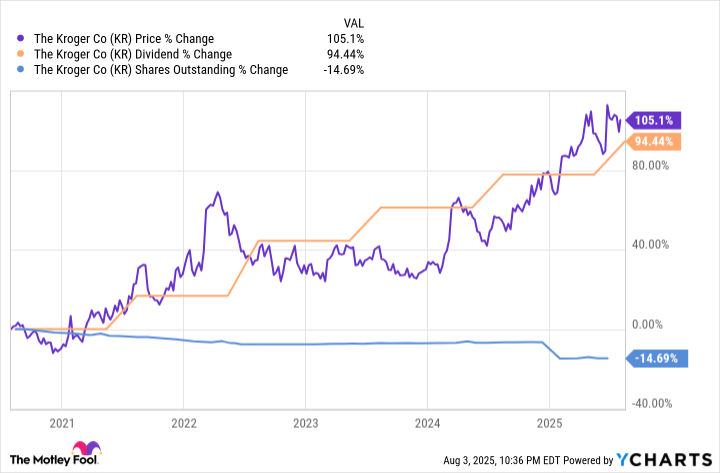

Owning Kroger feels a bit like cozying into a well-worn armchair-safe, reliable, and unlikely to cause sleepless nights. Food is one of those basic needs that never quite goes out of fashion, and Kroger’s business model shows resilience across economic climates. They’re sitting on a mountain of free cash flow-projected to reach as high as $3 billion in 2025-that they use to grow dividends and buy back shares. It’s the sort of steadiness that could help any investor sleep peacefully, even if the world outside seems to be teetering.

2. Coca-Cola

Few names in stocks come with as much cozy familiarity as Coca-Cola (KO), the fizzy beverage titan that Warren Buffett himself has championed for decades. The company’s record of increasing dividends for 63 consecutive years is frankly more reliable than your grandmother’s Sunday roast. It’s a bottle of consistency in a sometimes turbulent world.

Of course, step one might be worrying about sugary sodas contributing to the obesity epidemic. But Coca-Cola, to its credit, has been diversifying like a culinary adventurer-adding milk, tea, bottled water, and high-protein drinks under its Fairlife umbrella. Its Zero Sugar and other sugar-free options continue to fly off shelves, appealing to anyone who wants the taste without guilt-or at least less guilt.

This diversification, coupled with a generous cash flow, makes Coca-Cola a prime candidate for those seeking stability and dividends-currently offering a juicy 3%. Plus, the brand’s ubiquity and global reach make it less vulnerable to local market hiccups. In other words, if you’re looking for a stock that’s been around the block and still enjoys making regular payments, Coca-Cola could well be your fizzy friend.

3. Berkshire Hathaway

And then there’s Berkshire Hathaway itself-a kind of financial fortress, sitting on what might look like a small ocean of cash ($340 billion, to be precise). Think of it as a giant squirrel, hoarding acorns in preparation for the storm, waiting quietly for the right moment to pounce on undervalued assets like a financial hawk.

The beauty of Berkshire Hathaway isn’t just its cash mountain but also its sprawling universe of businesses-railroads, insurance, ice cream, underwear-the sort of eclectic mix that keeps the company lively and resilient. Its subsidiaries-BNSF Railway, GEICO, Dairy Queen, and Fruit of the Loom, to name a few-generate more than $10 billion in operating cash flow in just the first quarter. Berkshire’s diversified portfolio is like a plethora of legal safety nets, each one reducing the risk of a single misstep bringing the whole enterprise tumbling down.

While Warren Buffett is planning to bow out as CEO at the end of 2025, he’s chosen a successor who is already a trusted lieutenant, Greg Abel. This transition looks more like a baton pass than a thunderclap, suggesting Berkshire will continue to operate as its own peculiar, prosperous universe. Some analysts speculate that this change might even accelerate the sale of some underperforming assets-like a strategic yard sale-further enriching Berkshire’s coffers. And with even more cash on hand, the company is poised to seize opportunities when markets are roaring or tumbling alike.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

2025-08-06 04:00