To observe UnitedHealth Group (UNH) these days is rather like witnessing a parade of fortune-tellers who forgot their crystal balls at home. Investors, once upright and bold, now shift uncomfortably on their seats, poker-faced, desperately seeking guidance. The year 2025, which promised so much-if one believes in annual resolutions-has greeted UnitedHealth shareholders with all the warmth of a Siberian winter. The company has shuffled through more misfortunes than a protagonist in a second-rate Russian novel: uninspiring financial reports, a CEO change executed with less ceremony than a village mayoral swap, and the tiresome specter of a Department of Justice investigation. But why rest at grim? UnitedHealth, ever the overachiever in adversity, promptly unveiled another basket of bad news in its most recent earnings. Wall Street, struck as always by surprise, responded with the swiftness of a dissatisfied aunt: it punished the shares without mercy.

By July 31, any shareholder possessing an optimistic temperament or a taste for risk had discovered that the stock lost half its value in 2025-hardly a feat for the company brochure. The sinking ship, however, may not have reached the ocean floor; further turbulence is as likely as an accountant’s love for paperwork. Should the prudent citizen cross to the opposite side of the street at the sight of UNH stock, or is there a cunning angle for the connoisseur of neglected assets?

UnitedHealth’s Augury: Cloudy With a Chance of Disappointment

On July 29, under a sky untroubled by omens, UnitedHealth published its quarterly numbers. Revenue, for the quarter closing June 30, squeaked modestly upward to $111.6 billion-precisely 2% higher than last year, or, as bureaucrats would put it, “statistically significant in an entirely meaningless way.” But all the clever arithmetic failed to distract from the greater tragedy: net profit slid down a steep embankment, coming to rest 43% below the previous year, at $5.2 billion. If this trend continues, perhaps next quarter they’ll send shareholders invoices.

The chief villain in this melodrama is medical costs, ever ascending and apparently trained in the art of levitation. The medical care ratio-the figure beloved by actuaries and dreaded by romantics-jumped from 85.1% last year to 89.4% now. In translation: for every dollar received, nearly ninety cents are dispatched with a bow to cover expenses, leaving the company with little but the satisfaction of honest labor. Blame may be assigned to patients, those eternal optimists, who have resumed their operations and therapies once postponed during the pandemic’s heyday, reminding insurers everywhere that healthcare, like the plot in a detective novel, never truly ends.

Earlier in the year, UnitedHealth dispensed with “guidance,” which is finance speak for squinting at the horizon, due to opaque forecasts. Then, under the stewardship of Stephen Hemsley-who ascended the CEO throne after Andrew Witty’s exit and a polite round of applause-the company at last presented new predictions. Alas, these proved to be inspired less by vision and more by self-preservation: earnings per share “$16 or better,” far beneath the $20.91 that Wall Street, that sturdy old gambler, had penciled in. The market reacted as one might if served borscht made with beets of dubious provenance.

Cheap as Chips-Or Fool’s Gold?

When was UnitedHealth stock last seen at these levels? One must reach back to the COVID crash of 2020, a time when toilet paper and flour inspired more confidence than blue-chip shares. Today, UNH’s five-year haul is firmly in the red at -16%, before dividends. The advanced inquirer, armed with analyst estimates, may calculate that UNH trades at a forward price-to-earnings ratio of 13-the kind of number that Jane Austen’s Mr. Darcy might view with cold interest. But a word of caution: if these analysts, famed for sudden changes of mood, trim their forecasts further, even that modest multiple will balloon like a bureaucrat’s expense account.

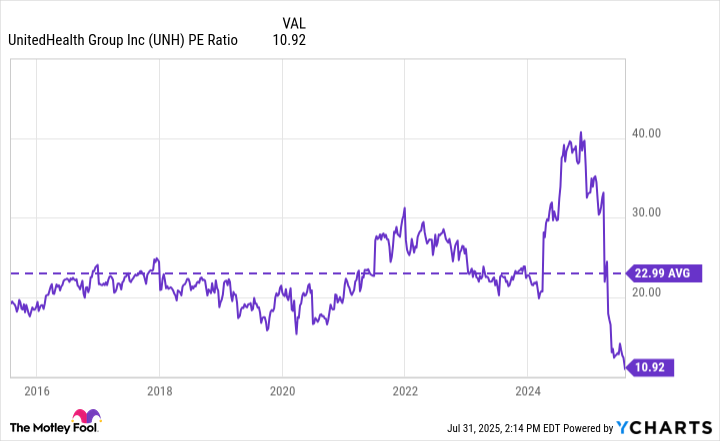

Using trailing earnings as the sacred metric, investors are paying a multiple of around 11-a level so historically low the chart below practically weeps for joy.

The market, it appears, is selling UnitedHealth at a discount you’d expect from a street vendor hawking “designer” watches at midnight. Can one resist?

Investment or Case Study: What To Do with UnitedHealth Stock?

Were this an epic of commerce, UnitedHealth would be the weary knight, his armor battered by the daily onslaught of adverse bulletins. But veteran punters-and the odd schemer with a taste for chaos-know that beneath the apparent wreckage sometimes lies an opportunity. For those who can suppress the urge to panic and instead don the thick coat of patience, the company may yet reward loyalty. Compared to the S&P 500, which gorges itself at a price-to-earnings multiple of 25, UNH lounges in the bargain bin, ignored only by those afraid of dusty stories.

the company is trimming unprofitable segments, neatly stepping away from cumbersome Medicare Advantage markets. The dividend, meanwhile, is as respectable as an official’s handshake-north of 3%, enough to console those whose patience borders on the heroic. Yes, risk lurks, as ever, beneath the surface. But one suspects the latest sell-off is rather like most fashionable panics: overdone, and worthy of a second look by the shrewd. No guarantees, naturally, except perhaps the certainty that mediocrity, bureaucracy, and sudden reversals are the only constants in business. Shall we toast to that? 🥂

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-08-06 03:58