In the grand bazaar of finance, where the absurd often masquerades as clever, we now witness the spectacle of The Smarter Web Company, a name that, in the annals of history, may well echo alongside titans of industry! They recently pranced into the spotlight with an £8.1 million capital raise—an act so bold, you might suspect they were inspired by the antics of a jester. All this, mind you, after their Bitcoin (BTC) stockpile tiptoed across the monumental threshold of 2,050. Can BTC’s bounty propel stock prices skyward? The answer is as slippery as a fish in a barrel! 🎣

- You won’t believe it! This U.K. luminary’s stock has skyrocketed by 208% in a mere month—who knew hoarding cryptocurrency could be so chic?

- In a bold gamble, they scooped up 225 BTC, raising their hefty hoard to 2,050 BTC, joining a rather peculiar club of companies looking to inflate stock prices through digital gold.

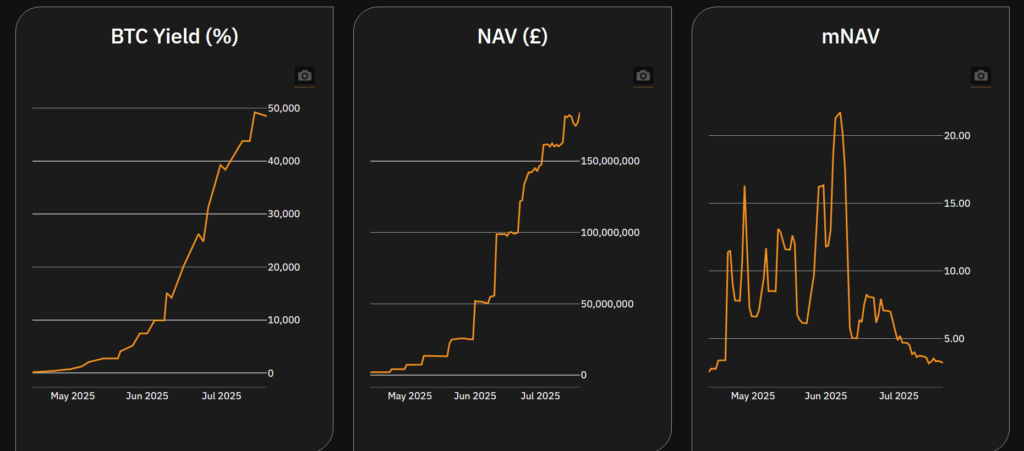

- As of August 4, this esteemed company has its formidable share price bobbing at £230.75, with a Net Asset Value residing at an amusing 3.22, a significant drop from its former glory of nearly 20 in June.

According to the latest unsolicited oracle—from somewhere deep within the mysterious depths of omniscient press releases—the total capital raised would be worth £8.1 million ($10.75 million). Investors could snag shares at £2.05 a pop, although these shiny new offerings won’t be glittering on the trading floor until August 7, 2025. Set your calendars! ⏰

In a strange twist worthy of a Dostoevskyan banquet, data from the great mystic known as Google Finance reveals the stock has performed acrobatics most breathtaking—peaking at 208.094% just as the company fattened its crypto reserves through a series of well-timed BTChas.

The Grand Revelation of Bitcoin Stockpiling

On an unsuspecting day—April 28, 2025—The Smarter Web Company unveiled a “10-Year Plan” along with a Bitcoin Treasury strategy. Imagine the onlookers, jaws dropping like pigs in an August downpour! This revelation came after an era of timid BTC holdings, marking a departure toward the bold and audacious.

Alas, for our bravely investing protagonist, the transition to BTC wasn’t a charm for establishing faith in the weary market. That fateful April day found shares languishing at £3.125, while the company’s cap rested languidly at £5.1 million. Within this pitiful realm, their statement of holding just 2.3 BTC felt like announcing a buffet and bringing along only a crust of bread.

But wait! Like a well-delivered punchline, by early June, the market cap had multiplied—a transformation worthy of a fable! From a grousy £5 million to a dazzling £150 million within a two-month span; a stock price leaped—£500 from a low tiptoeing just above £0.05—a dizzy 1,000% rise following the BTC strategy’s announcement.

Currently, the company basks in the glory of possessing 2,050 BTC, while its shares float at £230.75. Sizeable? Quite! According to their own literature, The Smarter Web Company presents a market Net Asset Value of 3.22—an interesting measure of inflation as the stock value absorbs amounts akin to toothpaste in a child’s grasp! Who knew investors were paying £3.22 for every £1 resting comfortably in Bitcoin and cash?

And let us not forget Michael Saylor’s grand strategy—a veritable Moby Dick of BTC-focused firms, showcasing a mNAV of 1.65. Apparently, some folks are less constrained by prudence.

Comparing Foolishness Across the Board

Alas! The Smarter Web Company is but one of many weaving a Bitcoin tapestry. Recently, other institutions began trumpeting the formation of their own BTC treasury strategies, followed closely by announcements that could rival tales from the chorus of Morning Radio. 📻

On June 30, the beleaguered coffee chain, Vanadi Coffee, saw its stocks rocket 242% with the announcement of its strategy to ensconce more BTC within its balance sheet. Their recent venture, the acquisition of a mere 7 BTC, pushed their total to an astonishing 85 BTC—good for a 0.73% bump in value.

Yet, while Vanadi revels in minuscule gains, Valereum—another company flaunting its bourgeois Bitcoin treasury—has not enjoyed such fortune. Its stock took a modest dip of 4.35% despite boasting of its own noble ambitions. Currently, their shares are floating around a comical 0.03 euro.

Meanwhile, the wider world observes—287 entities in total now grasping Bitcoin, including institutions and state governments, reflecting a relentless pursuit of digital gold. In the past 30 days, a record 22 new diasporas have joined the fray. Truly, the scene performs like the grand opera of our day!

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

- Ethereum Flips Netflix: Crypto Drama Beats Binge-Watching! 🎬💰

2025-08-04 16:43