Meta Platforms (META) has lately enjoyed a period of apparent prosperity, its stock price propelled upwards by reported earnings. The figures are, superficially, impressive. The company now trades at levels previously unseen, and has for the past two years presented a facade of unstoppable growth. However, appearances, as any seasoned investor knows, can be deceptive.

To declare Meta a continuing ‘hot buy’ would be premature. Too many uncertainties remain. This assessment will examine the recent performance – the causes of its upward trajectory – and, more importantly, the substantial risks that linger beneath the surface, risks which the market appears, with characteristic short-sightedness, to have largely ignored.

Expansion Beyond North American Shores

The latest quarterly report indicates a revenue increase of 22%, reaching $47.5 billion, exceeding the predicted $44.8 billion. Earnings per share, at $7.14, also surpassed expectations of $5.92. These numbers, on their own, offer a pleasing enough picture.

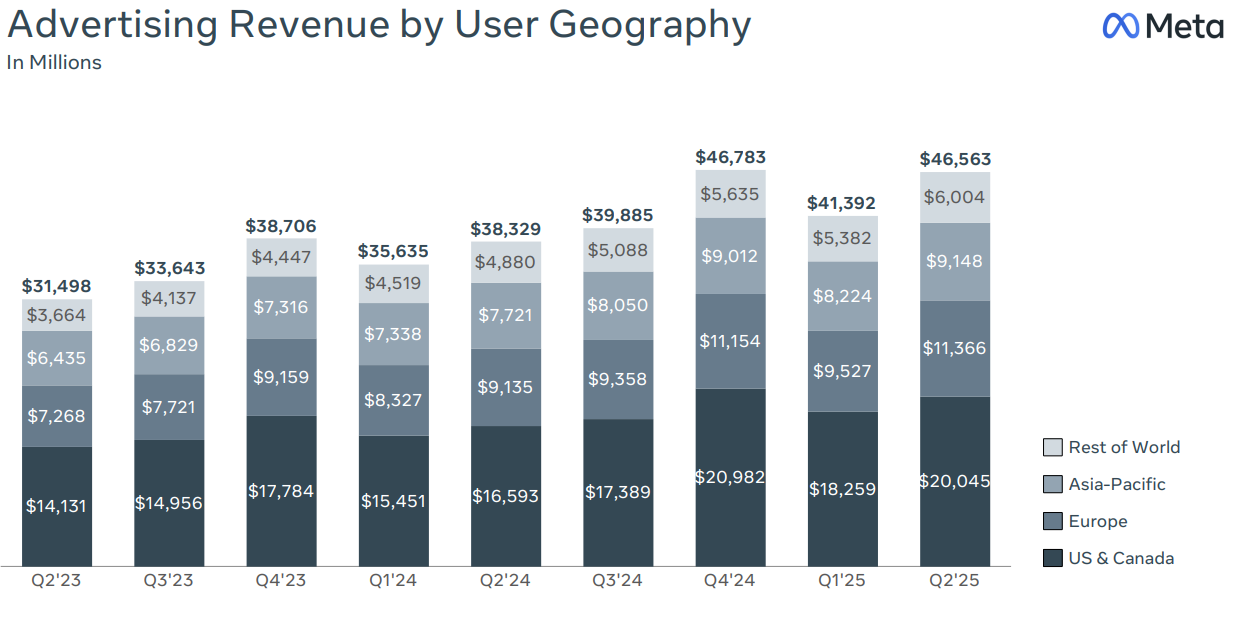

More revealing, however, is the source of this growth. While advertising revenue in the United States and Canada has risen modestly – by a fraction under 42% over the last two years – expansion in other markets has been considerably more pronounced. Europe has witnessed a 56% increase over the same period, and Meta’s ‘Rest of World’ segment a still more substantial rise of 64%. Asia-Pacific growth, exceeding 42%, outstripped that of its North American base.

This indicates that Meta’s future prospects are increasingly tied to international markets. Whether these markets will continue to yield such profitable returns remains to be seen. Growth dependent on unpredictable external factors is inherently unstable.

The Illusion of Efficiency

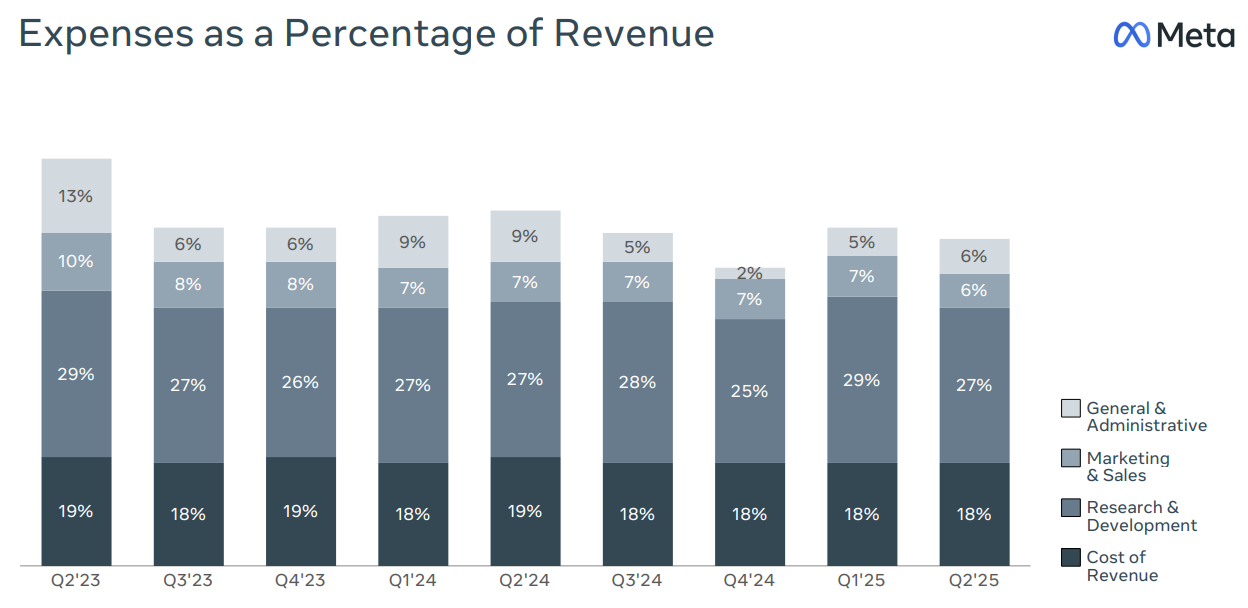

Meta’s declared ‘efficiency’ is another point for consideration. Expenses, as a percentage of revenue, have indeed declined. The operating margin for the last quarter was 43%, a slight improvement over the previous year’s 38%. This is presented as evidence of prudent management.

The company attributes this to the increasing utilization of artificial intelligence. While automation may offer some advantages, the notion that technological solutions inherently equate to genuine efficiency should be treated with caution. A wider margin simply means more profit from a given revenue. It does not necessarily indicate a leaner, more robust organization.

The Expanding User Base – A Question of Quality

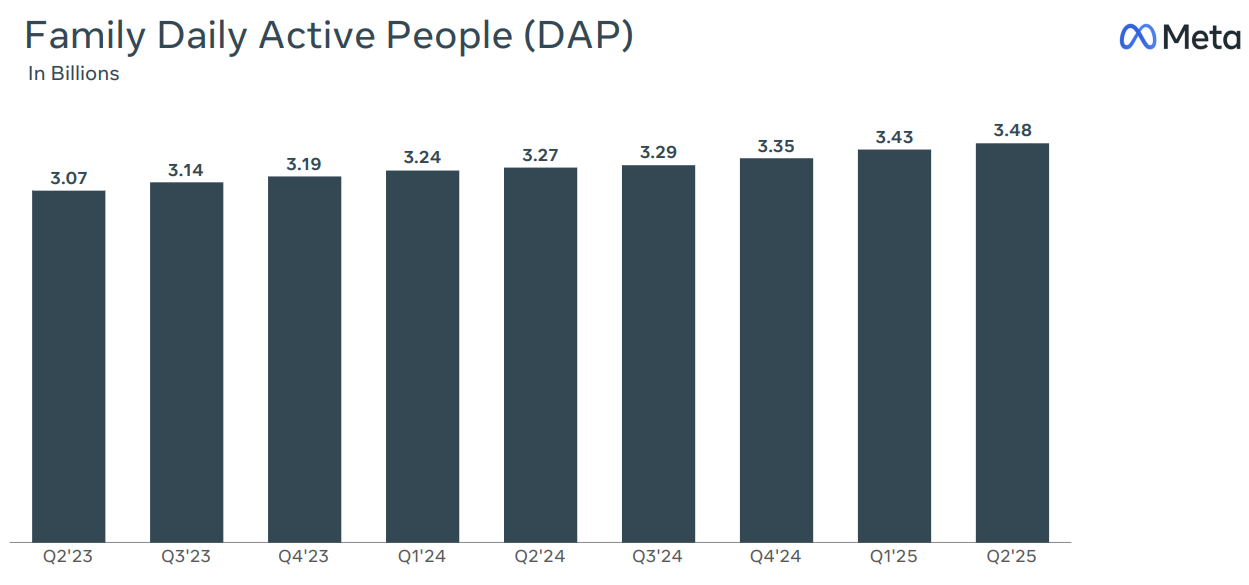

Concerns regarding user growth in 2022, when Facebook experienced a decline in daily active users, appear to have subsided. The company now reports a steady increase in its user base.

With approximately 3.5 billion daily active users across its platforms (Facebook, Instagram, Messenger, and WhatsApp), Meta maintains a position of dominance. However, sheer numbers are not a reliable indicator of value. The question is not merely how many users are engaging with these platforms, but *who* those users are and the nature of their engagement.

Uncomfortable Truths and Looming Threats

To characterise Meta’s business as ‘unstoppable’ is, frankly, irresponsible. The company faces significant challenges, primarily the threat of antitrust action. A forced divestiture of Instagram and WhatsApp – assets of considerable value, particularly among younger demographics – would represent a substantial blow.

Furthermore, and perhaps more troubling, is the disturbing evidence – reported by The Wall Street Journal – regarding Meta’s lax approach to fraud. The platforms have become a breeding ground for scams and illicit activity. A 2022 analysis estimated that as much as 70% of new advertisers were either promoting fraudulent schemes or offering substandard goods. This suggests that a significant portion of reported growth is not attributable to legitimate commerce, but to the activities of those who exploit the system. A growth built on sand is, inevitably, precarious.

A Prudent Course of Action

As of today, Meta’s stock has increased by 32% since the start of the year, trading at a forward price-to-earnings multiple of 28. Its profit growth is comparatively strong, justifying, to some extent, its current valuation.

However, a rush to invest would be unwise. Clarity regarding the potential breakup of Instagram and WhatsApp is essential. Equally crucial is an honest assessment of the impact of fraudulent activity on reported user growth and revenue. The evident successes should not be celebrated blind to the underlying rot. This business, while currently thriving, is certainly not the monolithic, ‘unstoppable’ entity it is often portrayed to be. Prudence dictates caution. 🧐

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

2025-08-04 03:36