Beneath the tensile veil of late summer, the market simmers—the fever dream of artificial intelligence persists, refusing to surrender its place in the heart’s ledger. The investor, like a poet on the brink of revelation, searches for symbols in the scatter of electronic stars. My desk is strewn with reports, yet the true stories are those of strangers—corporations, yes, but as enigmatic in their ambitions as wind on glass. These four, then, are my companions in the pell-mell of August: Nvidia, Taiwan Semiconductor, Alphabet, and ASML. Each, an entity in the long procession of progress, shaped by market tides and the loneliness of invention.

1. Nvidia

Nvidia—how its name rings, like the click of hooves on winter streets. Once mere artisans of graphics, the company now strides as a colossus across the AI frontier, its chips the seed from which verdant forests of code spring. The world bends around its GPUs: silicon petals conjuring intelligence where before there was only dust.

Yet a shadow passed this April—the United States, wielding the cold logic of geopolitics, withdrew the right to send the H20 chip eastward, denying Nvidia both passage and promise. Eight billion in awe-struck, unearned revenue vanished, dissipating like mist at sunrise.

Now Nvidia gathers itself, hopeful for renewal—a reapplication for the export license, the muttered assurances of approval ringing like birds at dawn. August will not yet record the harvest (earnings come later), but if Chinese shores open again, the cornucopia may resume its overflow. The market, forever peering at horizons, waits to see if fortune will breathe warmth into Nvidia’s sails once more.

2. Taiwan Semiconductor

To stand before Taiwan Semiconductor (TSMC) is to contemplate the roots of civilization—its plants, thrumming on the island’s spine, sustain the digital flora of the world. Not a mere foundry but an alchemist, transforming designs into reality, TSMC is what the oracle was to ancient men: the hidden instrument of fate for Nvidia and so many others.

Their most recent quarter swelled with vigor—44% growth, a monsoon after the slow trickle of years.

Yet their vision is not bounded by the present. Management, with the calm of old gardeners, promises a near-20% compound annual growth rate, not as hyperbole, but as a tree growing slow, strong rings in the core of every quarter. Despite the world’s inflation of price, TSMC’s shares remain, for now, surprisingly fertile ground—trading at 25 times forward earnings, the mathematics of hope not yet exhausted.

3. Alphabet

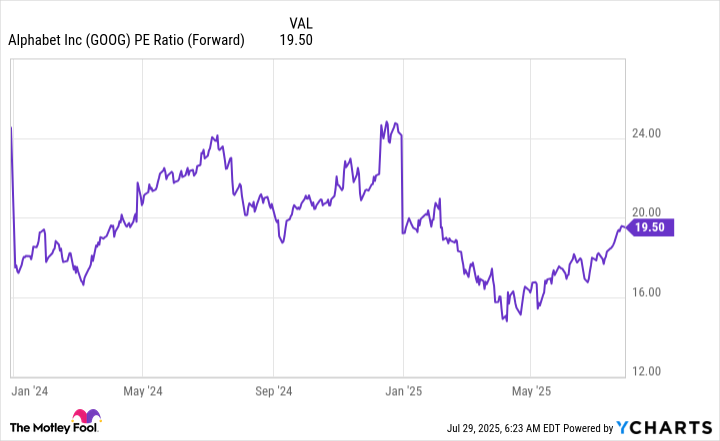

Alphabet, inscrutable as a wintry sky, reported results that glimmered with financial poetry: revenue up 14%, earnings up 22%, the syllables of prosperity pronounced with effortless grace. Yet, in some ironic stroke of fate, it moves neglected on the stage—traded as though it were a cipher, scarcely worth deciphering. Less than 20 times forward earnings, cheaper than the S&P 500: here is a treasure hidden in open sight.

Rumor winds its way through the streets: Search will falter, dethroned by the upstart power of generative AI. But the reality, stubborn as birch in frost, shows endurance. Two billion souls have encountered Google’s AI search overviews, a subtle fusion of old and new, and the gold of monetization gleams untouched. Each quarter, twelve percent growth speaks—quietly, persistently—that Alphabet kneels before no invisible adversary. The market’s disregard is, to my mind, a kind of oversight only poets and contrarians can appreciate: in this August, Alphabet is the mispriced lullaby.

4. ASML

ASML enters the scene almost shyly, an engineer among kings, but such modesty belies the lightning in its grasp. Extreme ultraviolet (EUV) lithography—this rare element, invented not from necessity but destiny—places ASML as the lone smith at the edge of modernity. Without its devices, the dreams of AI are mere sketches.

As chips ascend in demand, so too does the quiet pulse of ASML’s order book. Management, haunted by shifting tariffs, tempers enthusiasm for 2026, but the current of the future is not so easily diverted. The market grants it a price—26 times earnings—and yet, given such dominion, the valuation is less a gate than an archway opening onto promise.

To invest here, in any of these entities, is to bet on the long memory of time itself—the arc of invention, the search for meaning, the hope that through the clamor of markets and machines, a warmer dawn waits. 📈

Read More

- DOGE PREDICTION. DOGE cryptocurrency

- Calvin Harris Announces India Debut With 2 Shows Across Mumbai and Bangalore in November: How to Attend

- EQT Earnings: Strong Production

- The Relentless Ascent of Broadcom Stock: Why It’s Not Too Late to Jump In

- Docusign’s Theatrical Ascent Amidst Market Farce

- TON PREDICTION. TON cryptocurrency

- HBO Boss Discusses the Possibility of THE PENGUIN Season 2

- Why Rocket Lab Stock Skyrocketed Last Week

- Ultraman Live Stage Show: Kaiju Battles and LED Effects Coming to America This Fall

- The Dividend Maze: VYM and HDV in a Labyrinth of Yield and Diversification

2025-08-04 01:41