The journey of wealth accumulation often begins with incremental investments—modest sums methodically deployed. Should you find yourself with $1,000 in discretionary capital, the question arises: where should those funds be allocated? While personal risk tolerance and financial objectives dictate the ultimate decision, certain investments warrant consideration as foundational portfolio components.

Individual equities, while potentially lucrative, introduce single-company volatility and valuation risks that may prove suboptimal for systematic capital deployment. Exchange-traded funds (ETFs), by contrast, offer diversified equity exposure with structural advantages for dollar-cost averaging. Among Vanguard’s offerings, the Vanguard S&P 500 ETF (VOO) emerges as a particularly compelling candidate for such disciplined investment.

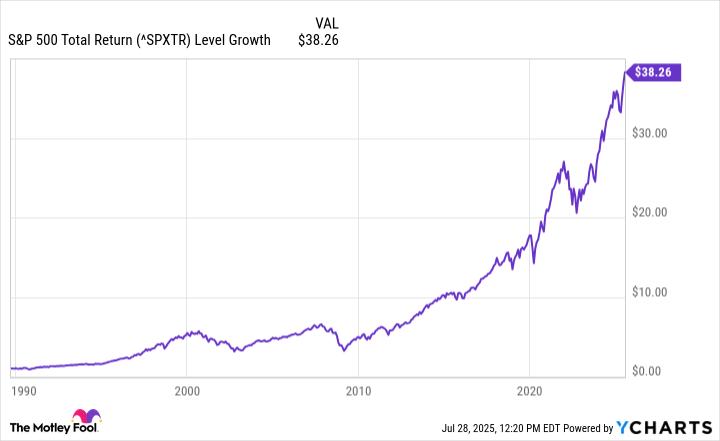

The Historical Resilience of the S&P 500 Index

The Vanguard S&P 500 ETF provides direct exposure to the S&P 500—an index representing approximately 80% of U.S. equity market capitalization by value. Its constituents, selected through stringent profitability and liquidity criteria, represent the apex of American corporate achievement. The index employs market-cap weighting, resulting in disproportionate influence from sector-leading enterprises—precisely the entities most likely to compound capital over extended periods.

The empirical evidence supporting long-term index investment remains unequivocal:

- Average annual returns approaching 10% across multiple market cycles

- Approximately 38x growth since 1989 on a total return basis

- Persistent outperformance relative to actively managed portfolios

While periodic drawdowns have occurred—sometimes exceeding 20-30%—the index has demonstrated remarkable recuperative capacity, invariably achieving new highs following contractions. This resilience stems from continuous constituent turnover, with underperformers replaced by emerging industry leaders—an inherent mechanism for long-term quality maintenance.

Structural Advantages of the Vanguard S&P 500 ETF

Multiple vehicles offer S&P 500 exposure, yet the Vanguard implementation presents distinct benefits:

- Cost Efficiency: The fund’s 0.03% expense ratio ranks among the industry’s lowest, preserving approximately 99.97% of investment capital for productive deployment

- Scalability: There exists no practical minimum investment threshold, allowing incremental position building

- Liquidity: Daily trading volume exceeding 5 million shares ensures tight bid-ask spreads

- Provider Stability: Vanguard’s nearly five-decade operational history and $7 trillion in assets under management suggest institutional permanence

The Futility of Market Timing

Market prognostications regarding valuation levels or optimal entry points persist despite extensive evidence demonstrating their counterproductivity. Consider:

- Missing the S&P 500’s ten best days between 2002-2022 would have reduced annualized returns from 8.1% to 4.5%

- The index achieved positive returns in approximately 70% of rolling five-year periods since 1950

- Cash holdings consistently underperformed equity investments over 20-year time horizons

This data strongly suggests that immediate deployment of available capital—regardless of current market conditions—remains the mathematically optimal strategy for long-term investors. The Vanguard S&P 500 ETF, with its low-cost access to quality enterprises, provides an effective mechanism for executing this approach—whether deploying $1,000 or incremental contributions over time. The patient investor rewards themselves far more effectively than attempting to outguess market fluctuations.📈

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

2025-08-03 11:31