The markets, as ever, are a torment. A fever dream of speculation, rising and falling with the unsteady breath of collective hope and, more often, despair. Thus far in 2025, the volatility has been… pronounced. One might say, a rather unsettling glimpse into the fragility of our constructed realities.

April arrived like a harbinger of ill omen, President Trump’s pronouncements on tariffs and trade igniting a tremor that shook the foundations of Wall Street. The S&P 500 (^GSPC) suffered a decline almost biblical in its severity—the fifth steepest in nearly a century. The venerable Dow Jones Industrial Average (^DJI) and the ambitious Nasdaq Composite (^IXIC) succumbed to correction and, for the latter, the chilling embrace of a bear market. A fall, one could argue, mirroring the internal fallibility of man himself.

And yet, a strange resurrection followed. A rebound of almost indecent haste, fueled by a halting of the “reciprocal tariffs.” The S&P 500, defying gravity, achieved a gain unseen in decades – a feat repeated only five times prior. One wonders, of course, if such exuberance is not merely the prelude to a more devastating reckoning. A brief reprieve before the inevitable.

But let us not be deceived by apparent victories. The confrontation between President Trump and Federal Reserve Chair Jerome Powell continues, a shadowy struggle played out on the public stage. And, I suspect, it has already been decided, though not in the manner most assume. The legalistic quibbles over Powell’s potential dismissal are, ultimately, a distraction—a contrivance to obscure a far more insidious truth.

The Illusion of Control: Can Powell Be Dismissed?

//media.ycharts.com/charts/077b2e041b9ebccc5ae47db28f124168.png”/>

Chairman Powell, to his credit (or perhaps to his detriment), has resisted the President’s insistent demands for lower rates. Rumors abound of a potential “dismissal,” but the legality of such an act remains shrouded in uncertainty. The Federal Reserve Act of 1913 allows for the removal of Governors “for cause,” but ’cause’ itself is an abyss of interpretation. What constitutes sufficient justification? Neglect of duty? Irreparable harm? The very notion seems… subjective, doesn’t it?

Recent rulings from the Supreme Court further muddy the waters, hinting at a unique protection afforded to the Board of Governors. The Reserve, the court noted, exists in a peculiar space—a quasi-private entity steeped in historical precedent. Thus, without demonstrable ’cause,’ Trump’s attempts to unseat Powell stand on shaky ground. A rather academic debate, however, when one considers the deeper currents at play.

For the true resolution of this conflict lies not in legal maneuvering, but in the relentless, unforgiving logic of economics. And that logic dictates that Powell’s fate is sealed, not by Trump’s power, but by Trump’s own policies.

The Wages of Protectionism: Trump’s Policy Undermines His Aims

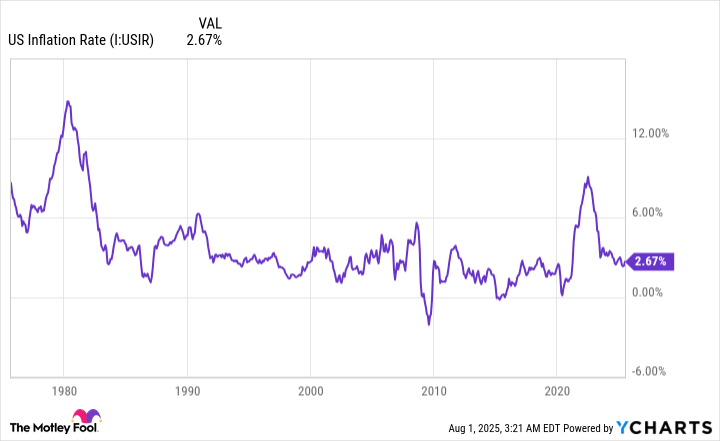

While the world fixates on interest rates, the true engine of this struggle is inflation—as measured by the Consumer Price Index for All Urban Consumers (CPI-U). A meticulously constructed barometer of our collective spending habits, weighting each category to reflect its relative importance. And right now, that barometer is flashing warning signals.

The Fed, of course, aims for an arbitrary 2% inflation rate, a target as illusory as any other attempt to impose order upon chaos. But the current reality is far more troubling. Although inflation has retreated from its peak of 9.1%, it remains stubbornly above the 2% threshold. And, more alarming, it appears to be *reaccelerating*, thanks to the resurgence of Trump’s tariff and trade policies.

The April announcement of a 10% global tariff, coupled with reciprocal levies on numerous nations, has injected a potent dose of inflationary pressure into the system. The President’s subsequent adjustments—pauses and modifications—have complicated the assessment of their impact. But the signs are unmistakable.

The June inflation report confirms the dreadful truth. Between May and June 2025, the trailing-12-month CPI-U rose by 32 basis points to 2.67%. Core inflation—excluding the volatile elements of food and energy—climbed to 2.9%, the fastest pace since February of this year. A chilling indicator, suggesting that the brief respite was merely a phantom.

Trump’s tariffs, in essence, are rendering the entire debate over monetary policy moot. The June data clearly demonstrates that there is no immediate justification for lowering the fed funds rate. This uncertainty—this constant shifting of the goalposts—implies that pricing pressures will persist. It is a self-inflicted wound, born of a misguided belief in protectionism.

The narrative investors should be following is not whether the Fed is stifling growth, but whether Trump’s tariffs will decimate corporate earnings, as they did during the trade war with China from 2018 to 2019. The market, currently enjoying an almost obscene valuation—the third-highest in its 154-year history—has little margin for error. The whispers of tariff-related anxieties are growing louder, and it is time to heed them.

The attention must be directed towards the inflationary consequences of Trump’s policies, and their impact on the companies that drive this fragile economy. The abyss gazes back, and it demands vigilance.

😟

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

2025-08-03 10:18