Well, ain’t this just a sight? The Floki price, like a stubborn mule, keeps prancing around its support zone, kicking up dust but not making much progress. But hey, there’s a glimmer of hope, folks! 🌟 The chart wizards say the bulls might be gearing up for another charge toward greener pastures.

As of today, our little Floki friend is trading at $0.00010620, which is a bit like finding a shiny penny in your pocket after a long, hard day. It’s not much, but it’s something, right?

Support Zone Holds as Floki Tests 200-Day Moving Average

Now, let me tell you about this macro chart that analyst Hasan (@TradebyHasan) shared. It’s like a treasure map, but instead of X marking the spot, it’s a bunch of squiggly lines and numbers. The important part is that Floki’s support zone is right around $0.00009050 to $0.00010779. This area is as crucial as a lifeline to a drowning man.

See, the price recently bounced off a resistance near $0.00014700, which is like hitting a brick wall. This 200-day moving average line is now acting as a pivot point, deciding if Floki will stay put or take a nosedive back to the lower levels. It’s a real nail-biter, folks!

Hasan reckons that if Floki can hold above this support, it could break through the $0.00014700 to $0.00015000 region and aim for the stars—well, at least for $0.00022009 and $0.00028231. These levels are like old friends, familiar and comforting in their predictability.

But if Floki can’t hold its ground, it might find itself back at the $0.00006522 support level, where it spent some quality time in Q2 2025. 🙄

Intraday Weakness Signals Near-Term Hesitation

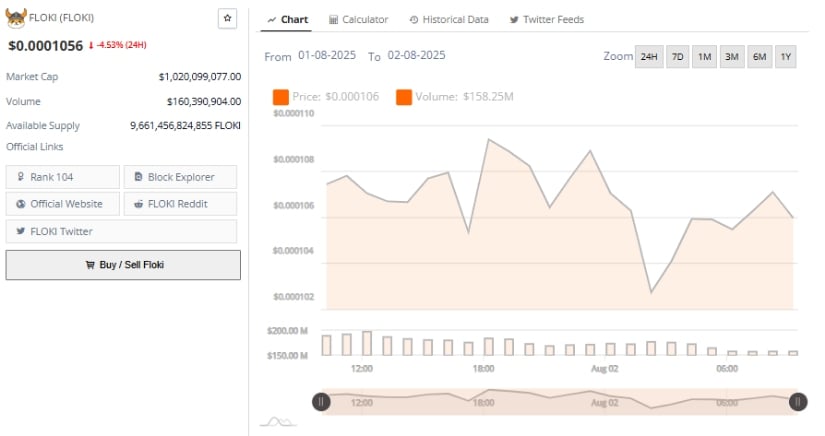

Over the past 24 hours, Floki’s been a bit of a rollercoaster ride. Down by 4.53%, it’s currently priced at $0.0001056. The price action looks like a kid trying to climb a tree—getting a few inches up, then sliding back down.

Each attempt to reach those earlier highs was met with resistance, leading to a series of lower highs. It’s like trying to push a boulder uphill; the effort is there, but the results are lacking. Traders seem to be taking profits, which is understandable when the market’s feeling a bit skittish.

Despite the ups and downs, the trading volume has stayed steady at about $160.39 million. There was a spike around 18:00 UTC on August 1, but it didn’t have the legs to keep running. This pattern suggests that the buyers are getting a bit tired, or maybe they’re just waiting for the right moment to jump back in.

Floki’s market cap is sitting at $1.02 billion with a whopping 9.66 trillion tokens in circulation. That’s a lot of tokens, and it means that without a surge in demand, it’s going to be tough for the price to rocket up anytime soon.

Momentum Indicators Show Bearish Pressure Fading

At the moment, Floki has gained 2.25% over the past day, trading at about $0.00010620. It’s pulled back from its recent high of $0.00015777, but it’s found a comfy spot at $0.00010386. This little price floor has held up, giving the bulls a chance to catch their breath and maybe gather some more strength.

Even though the recent charts have been a bit red, the price is still well above its multi-month low of $0.00004545 from earlier this year. That’s something to be grateful for, I suppose.

The momentum indicators are telling us a story of their own. The Chaikin Money Flow (CMF) is in negative territory at -0.13, which means more money is flowing out than in. The Bull and Bear Power (BBP) indicator is at -0.00002125, showing that the bears are still in control. But if the BBP can get back above zero and the price starts to rise, we might see a trend reversal. For now, it’s a wait-and-see game, with a cautiously optimistic outlook.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

2025-08-02 21:53