Buffett’s been playing it safe – shunning the tech circus like a wary old gambler avoiding a rigged game. He fancies the kind of companies that don’t dance on the edge of a knife; predictable, profitable outfits with simple business models. In the high-stakes world of artificial intelligence, that means most AI stocks never see the light of day in Berkshire’s portfolio.

But not every tech stock is a flash in the pan. A few AI players are built on solid ground, with enough moat and margins to catch the eye of even the most cautious investor. I’ve been tracking them – and if you’re looking to add some AI exposure without the wild swings, these are the names you want on your radar.

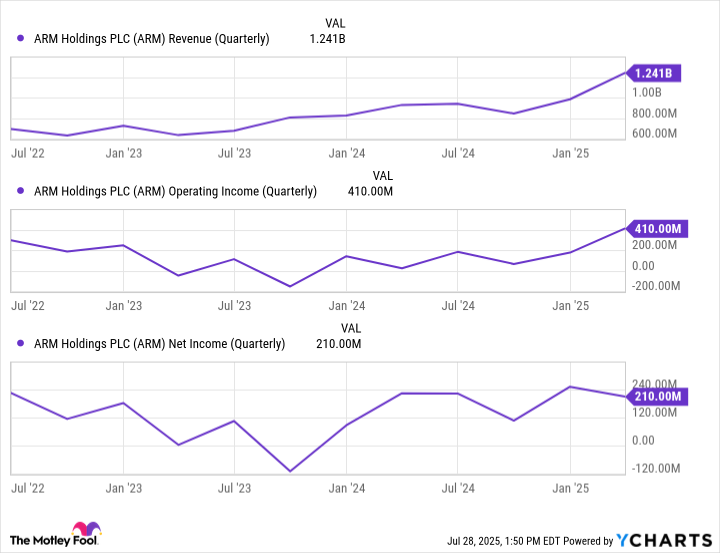

Arm Holdings

Arm Holdings – it’s a curious beast. Its quarterly numbers might not come in like clockwork, but the bottom line is as steady as a well-worn revolver. The outfit designs microchip architecture – not the hardware, but the blueprint – and then licenses that secret recipe to chipmakers.

It isn’t manufacturing like Intel or Qualcomm; it’s more like a mastermind selling the plan while others do the dirty work. Take Apple’s latest iPhone processor: it’s built on Arm’s design, yet the chips are actually made by a third-party foundry. That means Arm pockets a tidy fee for every sale – and because it avoids production costs, its margins are as fat as a gambler’s winnings.

Last year, the company turned $4 billion in sales into nearly $800 million in net income. And in the data center arena – where power efficiency is as crucial as a sharp wit – Arm’s processors demand up to 60% less juice than the competition’s. With plans to control half the market by year’s end (up from about 15% in 2024), Arm is carving out a moat as wide as the Pacific.

Taiwan Semiconductor

Taiwan Semiconductor Manufacturing isn’t some fly-by-night outfit. They’re the undisputed kings of chip production – the ones who build processors for giants like Nvidia, Qualcomm, AMD, and Broadcom. In an industry where making chips is as complicated as a mob conspiracy, TSMC has emerged as the premier contract manufacturer.

Analysts peg their global market share of high-performance processors anywhere from 80% to a staggering 90%. That’s the kind of moat Buffett always admired – proven, high-quality, and nearly impenetrable. Even Intel, which sunk billions into its own foundries in Europe and the U.S., has found that catching up to TSMC is as hard as a one-way ticket to a dead end.

And then there’s Apple. Rather than trying to build a fortress from scratch, they’ve joined forces with TSMC to establish a U.S. manufacturing presence – a nod to the reality that the chip game is a tough racket. In a world that’s never going to stop craving better, faster chips, TSMC’s stronghold remains as solid as a vault.

DigitalOcean

DigitalOcean is the dark horse in this race. With a market cap under $3 billion, it might not turn heads at a cocktail party – but that’s exactly what makes it so Buffett-like. Its business model is as predictable as a metronome: clients pay a steady, recurring fee for cloud-based services. And in a world where the cloud is as inevitable as sunrise, that’s a recipe for steady growth.

They offer everything from blockchain solutions and web hosting to AI training and automated coding. Their numbers speak volumes: a Q1 run rate of $843 million in annualized recurring revenue (up 14% from the year-earlier period) and a total top line of $781 million last year, with $84 million turned into net income. In an economy that’s shifting inexorably toward cloud-based AI, DigitalOcean is as reliable as a trusted partner in a back alley deal.

In the grand chess game of global tech, these three stocks aren’t just isolated plays – they’re cornerstones of an evolving landscape. They offer the kind of stability, recurring revenue, and moats that even Buffett would nod to. As the world leans further into AI and cloud solutions, these companies are well-positioned to weather economic storms. In a game where fortunes rise and fall on a dime, they’re the kind of players you want on your side. 🔍

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-08-02 11:45