In the vast American economic landscape, where the dust of uncertainty settles on the fields of commerce, two titans stand—Costco and Target. One, a fortress of membership loyalty; the other, a cathedral of bargain-hungry shoppers. Both have weathered storms, yet today, the winds shift, offering a sliver of opportunity for those willing to dig in the dirt of discounted valuations.

When the earth cracks and the market’s drought tightens its grip, even the sturdiest trees bend. But in that bending lies a chance for the small investor, tilling the soil of the stock market, to plant a seed that might yet bear fruit in uncertain seasons.

Let us walk these fields together, measuring the soil’s richness, the roots of shareholder returns, and the whispers of financial winds that shape the future.

Does Costco or Target have a better valuation?

Valuation is the farmer’s ledger, a measure of how much land the market demands for a harvest of earnings. Costco, with a market capitalization of $413 billion, stands like a redwood—towering, unyielding. Target, at $47 billion, is a sturdy oak, though its branches have weathered a harsher winter, its stock withering 23% in 2025.

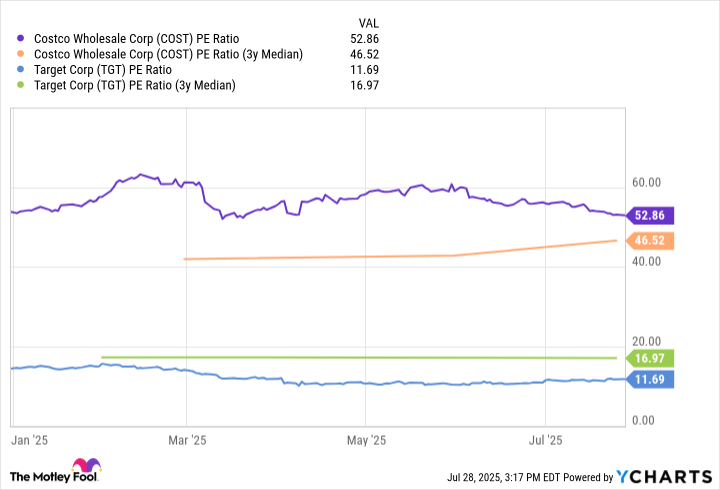

Costco’s trailing P/E ratio of 52.8 is a field plowed too deep, its price-to-earnings ratio bloated beyond its three-year median of 46.5. Target, by contrast, trades at 14.6 times earnings—a field already tilled, its soil ready for planting. It is not merely numbers but a story of confidence: Costco’s recurring membership revenue, a river of steady cash; Target’s declining sales, a dry creek bed in need of rain.

Valuation alone is no panacea, but in the desert of high prices, Target’s oasis glimmers with promise.

Returning capital to shareholders

Costco’s dividends are the steady rhythm of a harvest moon. Its 21st consecutive raise, a testament to patience—a yield of 0.56%, modest as a farmer’s smile, yet bolstered by occasional golden windfalls. In 2024 alone, it showered shareholders with $15 per share. Its payout ratio, a frugal 20%, leaves room for growth, like a seedling reaching for the sun.

Target, a Dividend King, has raised its payout for 54 years, a tradition as American as the fields it serves. Its 4.4% yield is a bountiful harvest, though its 49% payout ratio leaves less room to stretch. Share repurchases, meanwhile, are a dance of strategy: Target spent $251 million last quarter, pruning its branches to grow taller. Costco, more cautious, spent $215 million to offset the weeds of dilution.

For the investor who craves the rhythm of income, Target’s yield is a hymn. But Costco’s discipline, its history of generosity, offers a different kind of faith. Both nourish their shareholders, but in different seasons.

Recent financial performance and outlook

In the final reckoning, the land speaks through its harvest. Costco’s most recent quarter was a bounty: $62 billion in revenue, 8% growth, and e-commerce surging like a spring-fed stream. Its 92.7% membership renewal rate in the U.S. is a covenant—a promise between merchant and member that outlasts the fickle whims of the market.

CEO Ron Vachris, a man of quiet confidence, declared, “We are confident in the ability of our operators to rise to the challenges.” It is the voice of a farmer who has seen drought and flood, yet still plants his seed.

Target’s harvest, however, was leaner. Revenue fell 2.8%, and adjusted EPS plummeted from $2.03 to $1.30. Its digital sales, a glimmer of hope, rose 4.7%, but the rest of the field was fallow.

CEO Brian Cornell, his voice tinged with the weariness of a man who has watched his crops wither, admitted, “We’re not satisfied with this performance.” The land, it seems, is not yet ready to yield.

Costco’s growth is the surety of a well-tended field. Target’s struggles are the ache of a season gone awry.

Which stock is the better buy?

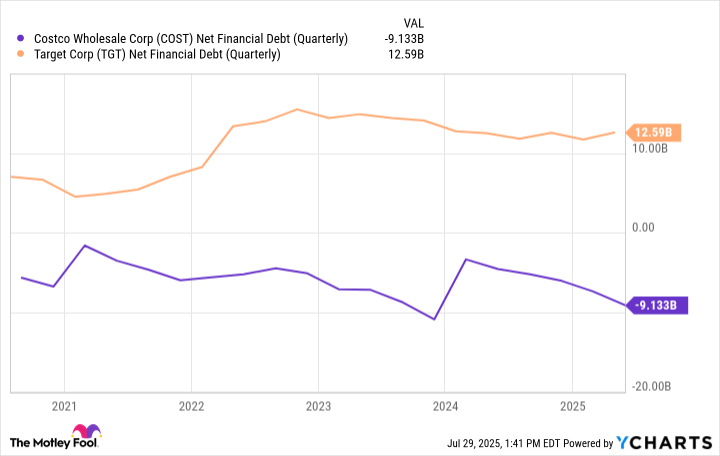

Target offers the promise of a cheaper field, a higher yield, and the hope that its crops will revive. Costco, however, is the old oak—its roots deep, its branches broad. In a world where tariffs loom like thunderclouds and economic uncertainty casts long shadows, Costco’s balance sheet—$9.1 billion in net cash versus Target’s $12.6 billion in debt—is the difference between a full cistern and a cracked one.

For the long-suffering investor, the choice is not merely numbers but trust. Trust in the model that has fed 80 million households. Trust in the consistency that outlasts the storm.

And so, the land whispers its verdict. 🌾

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

2025-08-02 11:18