On the last day of July 2025, XRP was spotted lounging around at $3.12, boasting a market cap that would make a dragon hoard blush at $185.20 billion, and a 24-hour trading volume that could drown a small island nation at $5.3 billion. Throughout the day, XRP did what it does best—fluctuate, swinging like a pendulum between $3.04 and $3.17, keeping traders on their toes and their coffee cups full.

XRP

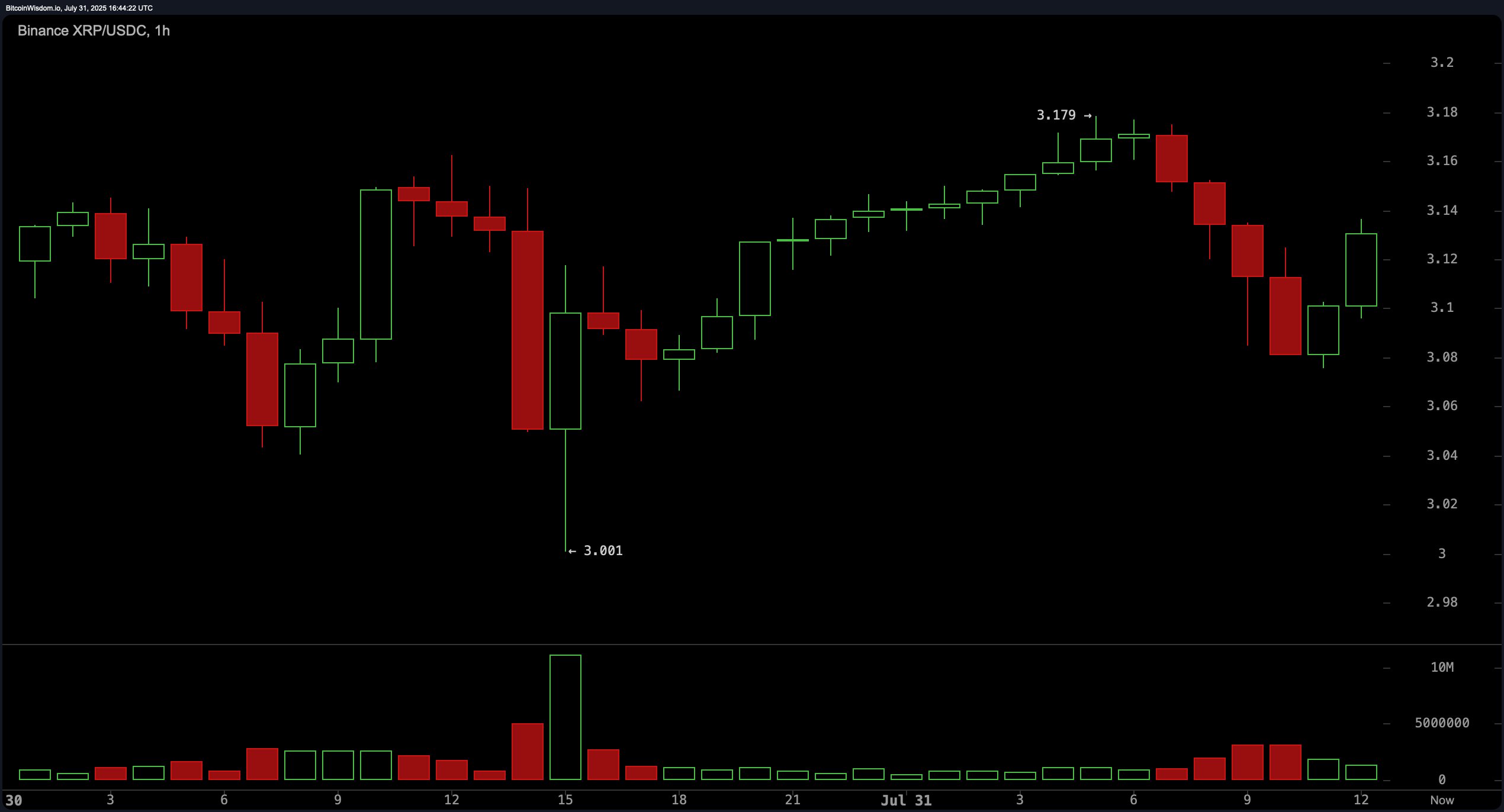

On the 1-hour chart, XRP decided to play a game of hide-and-seek after being rejected at $3.179. It managed to paint five consecutive red candles, which is like a painter who can only see the world in shades of doom. But fear not, dear reader, for there were minor recovery signs, hinting at a possible short-term squeeze. As volatility narrowed, the air grew thick with anticipation, much like the tension in a room full of cats eyeing a mouse. Technical patterns suggested a potential bull flag, but only if $3.12 support holds and XRP can muster the courage to break above $3.18. 🦁

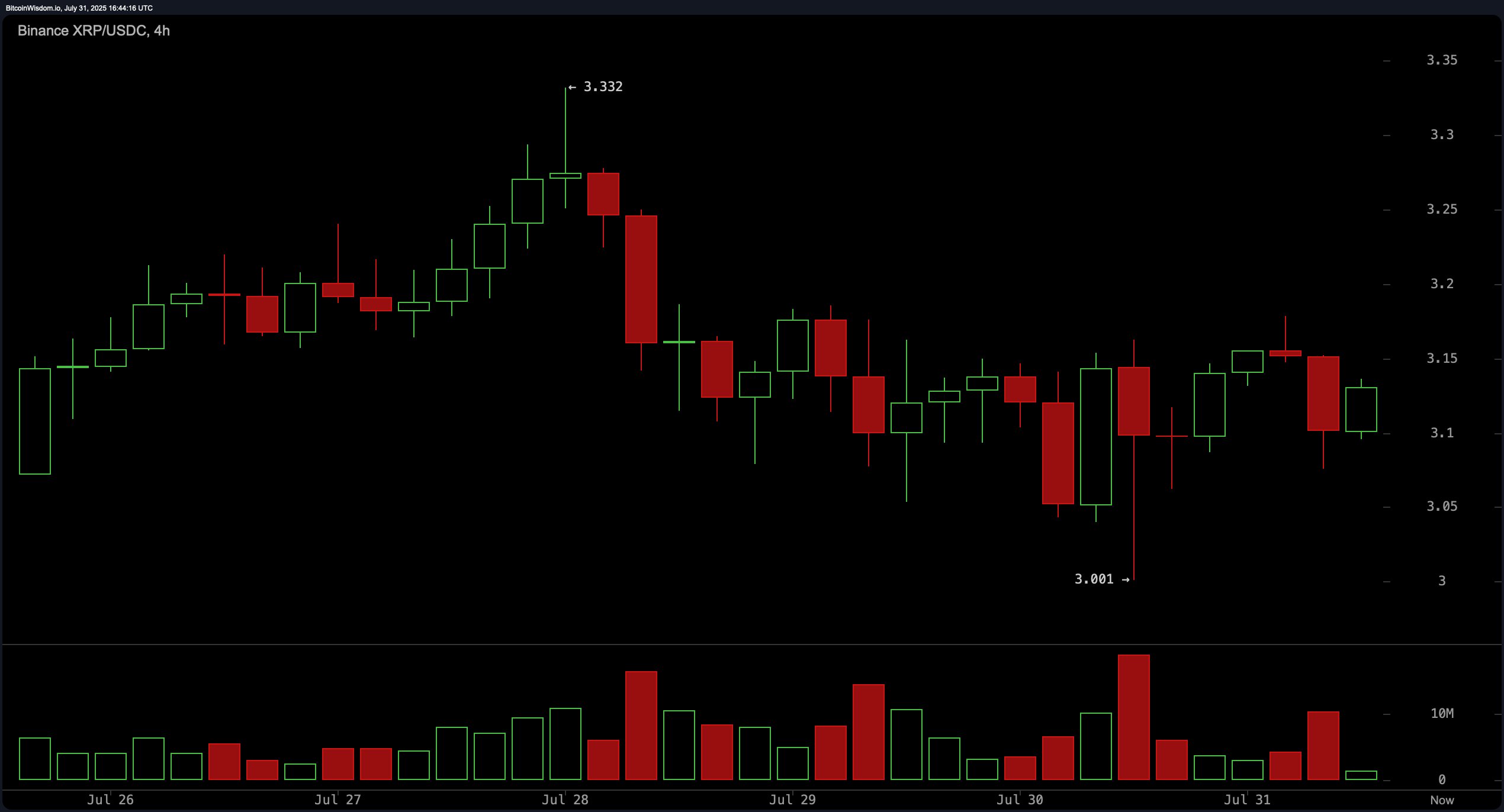

The 4-hour chart, always one to add a twist, reinforced a bearish-to-neutral bias. Lower highs and lower lows have been parading like a circus act since the recent peak at $3.332. A descending triangle has formed, with horizontal support stubbornly holding at $3.00 while resistance gracefully bows downward. Selling volume has been outpacing buying, a clear sign that bears are having a field day. While $3.00 has held twice, the lack of a strong upward push casts a shadow over any bullish hopes. A failure to break $3.20 could mean another trip to the $3.00 support level, where XRP might just decide to set up a tent and call it home. 🏕️

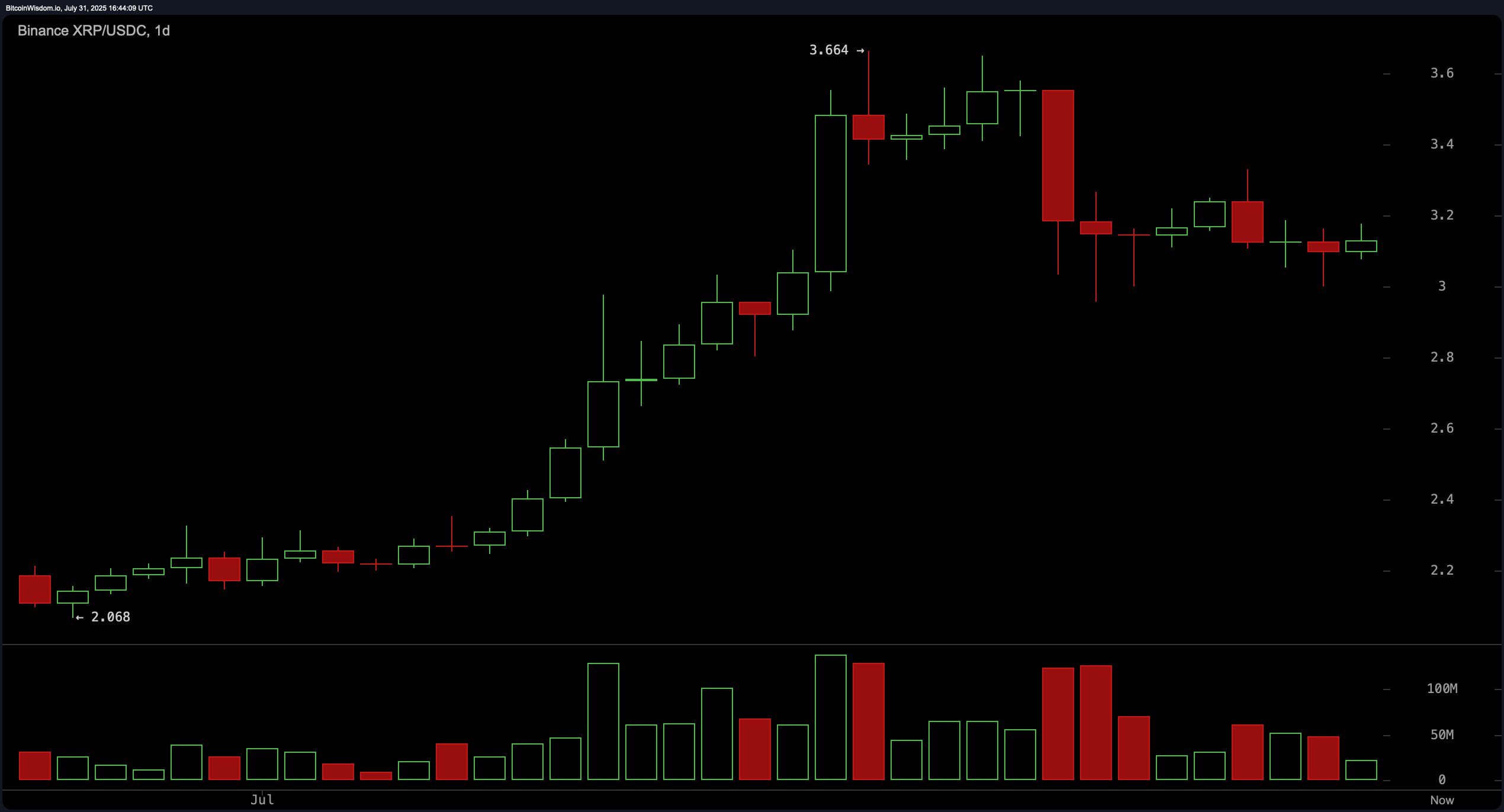

On the daily chart, XRP had a bit of a rollercoaster ride, rallying from about $2.07 to $3.66 before hitting a wall of resistance and taking a nosedive. The current consolidation within the $3.10–$3.20 range suggests either a distribution phase or the early stages of a trend reversal. The volume spike at the peak followed by a decline in momentum tells a story of a market that’s lost its way. Technically, the formation of lower highs poses a risk of more downside unless XRP can summon the strength to break above the $3.40–$3.66 resistance corridor with a roar. For now, the short-term daily bias is leaning neutral to bearish, like a weather forecast predicting rain on your picnic. ☔

Oscillator readings painted a picture as clear as mud. The RSI was a bland 57.65, the Stochastic oscillator hinted at a modest oversold recovery at 25.30, and the CCI was a tepid −17.82. The ADX came in at 43.93, suggesting a lack of direction, while the Awesome oscillator maintained a neutral stance at 0.336. The momentum indicator, however, threw a spanner in the works with a bearish −0.416, and the MACD level of 0.1527 supported the bearish bias with a negative designation. 🤷♂️

Moving averages (MAs) added to the confusion. The 10-period EMA at $3.1617 and the 10-period SMA at $3.1912 both pointed to bearish signals. Yet, the medium- and long-term indicators leaned bullish, with the 50-period EMA at $2.7745 and the 200-period EMA at $2.3190 suggesting a strong, longer-term uptrend. This divergence is like a choir where half the singers are off-key, but the overall harmony still sounds good. 🎵

Bull Verdict

XRP’s long-term bullish structure remains intact, with a suite of medium to long-term moving averages confirming upward momentum. Despite short-term weakness and consolidation, the preservation of key support levels near $3.00 and the potential for a breakout above $3.18 suggest that upside opportunities are still on the table. A reclaim of $3.40 with volume could rekindle the bullish rally, like a phoenix rising from the ashes. 🌟

Bear Verdict

The technical landscape reveals mounting short-term pressure, with descending triangle formations, a stalled recovery, and multiple oscillators flashing bearish signals. Without a decisive break above $3.20, XRP risks further downside toward or below the $3.00 support zone. Momentum’s and MACD’s bearish signals reinforce a cautious stance in the near term, much like a cat eyeing a bowl of water. 🐾

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Thinking Before Acting: A Self-Reflective AI for Safer Autonomous Driving

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

- Ethereum Flips Netflix: Crypto Drama Beats Binge-Watching! 🎬💰

2025-07-31 21:28