![]()

If the S&P 500 is a demented casino and the Nasdaq is a crooked slot machine gulping quarters, then July 25 was a jackpot night. All-time highs, baby—one big manic surge while the meat of America guzzles index funds and believes the lie. But beneath the bright lights, Texas Instruments (TI) and ASML were being strangled in the alley by Market Sentiment, that greasy-fingered assassin that doesn’t discriminate between gods and insects.

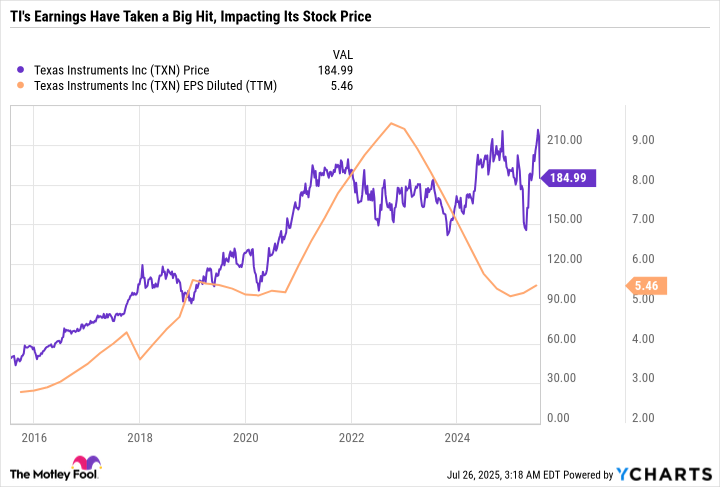

TI and ASML—the once-proud workhorses of the sprawling semiconductor jungle—just got blindsided by their own “earnings.” No warning, no note: the lights flickered, trigger pulled, and the numbers fell. TI lost 13.9% in just three sweaty days after reporting, while ASML’s shares did an equally shameful swan dive of 13.6%. You could almost smell the burning circuit boards and panic sweat in the air. We are living through the Age of Artificial Intelligence, but there’s nothing artificial about the terror in the eyes of bag-holding investors.

Sirens Wailing: The Great Slowdown That Everybody Saw Coming (But Denied)

TI shuffled out some decent numbers, shrugged, and then whispered, “Brace yourselves, the next quarter’s going to suck.” Boom—down goes the stock. Whispered horrors of a slow third quarter infecting the veins of the whole tech sector like some Wall Street flu. ASML, high on its own supply, posted good results too, but with the wariness of a shell-shocked gambler, said they can’t guarantee growth in 2026. Maybe the macro monsters will get hungry. Maybe the geopolitical clowns will light another trade war. Or, hell, maybe it’ll rain frogs. Anyway, ASML still insists their 2030 targets will turn out fine—double the revenue, fattened margins, holy visions of a golden future for those who can sleep till 2030.

The faint of heart are already bolting for the exits, spooked by the prospect of stagnation. But here’s the thing—everybody is so gleefully hooked on the AI feeding frenzy that they forget the real monsters are just under the floorboards, waiting.

Inside the Mad Machine Shop: Not All Chips Are Created Equal

If the world’s tech economy is a deranged Choose Your Own Adventure story, then Texas Instruments isn’t the hero, villain, or wise old wizard—they’re the duct tape. The analog and embedded chips, quietly holding your miserable little gadgets together while you chase the next EV dream. Analog chips are the translators between sound and signal, pulse and code, the foot soldiers hiding in your car, your hospital scanner, maybe even your overpriced smart toaster.

Then there’s the embedded side: hardware and software working in unholy concert to keep industrial robots twitching and the Ai-at-the-Edge dream alive—factories humming, cameras watching, everything gathering data to either save or doom you, depending on the algorithm’s mood.

So no, TI isn’t the thunder god manufacturing GPUs and CPUs for the data center armageddon—Nvidia and AMD are still hoarding that glory. Instead, TI sells the pickaxes, the shovels, the fuse wires. Power management, controllers, converters—without this plumbing, your dazzling data centers would collapse in a heap of sizzling circuits and disappointed VCs. But with more irons in the fire, they are chained to the whole global circus—if a butterfly flaps its wings in the Chinese supply chain, expect chaos in TI’s earnings spreadsheet. That’s how you ride the tiger and wake up with claw marks.

Look at the chart. Four years of going nowhere fast. Earnings plunging, the bulls cracking their skulls on the ceiling of inflated “demand” from 2022 that evaporated just as suddenly. CEO Haviv Ilan sits at the analyst table, fielding questions with the haunted look of a man who’s read the last page of the book and didn’t like the ending.

“Tariffs, geopolitics, disrupted supply chains… not over yet. Short reprieve, but you’d be a fool to let your guard down.”

The dream of a quick “cyclical recovery” was smashed against the windshield. Even the hints of industrial recovery weren’t enough—the automotive sector still flatlined, no hint of adrenaline. Investors hoping for an upbeat script got a monologue from Hamlet instead, and the market dumped the stock like a three-day-old tuna sandwich.

ASML: The Untouchable Dealer in a Game Rigged by Ghosts

Now to ASML—the Dutch masters of ultraviolet lithography. If semiconductors are the world’s lifeblood, these guys sell the transfusion machines. Their extreme ultraviolet (EUV) units are arcane, $150-million behemoths, each one smuggled out to giants like TSMC, Samsung, and Intel. It’s not business—it’s licit arms dealing for the digital age, and there’s only a handful of buyers on Earth who can afford a six-ton box of Dutch black magic.

ASML feasts only when their biggest clients feel flush: think Apple, Nvidia, Broadcom—names with a taste for blood and a bottomless appetite for capex. Even for the whales, buying one of these monsters means betting billions on the murky future of AI silicon and praying the machines don’t break down before the next paradigm shift.

But the game isn’t played just in spreadsheets. Trade wars, saber-rattling, and the kind of bureaucratic paranoia that only Brussels and Washington can conjure have forced ASML to block off the best toys from the Chinese, all while the supply chains get re-wired to avoid whatever fresh hell the next round of tariffs brings. Sure, they’re Dutch. But in this world, every passport has a US stamp somewhere, and ASML’s fortunes are chained to fragile international politics.

Bargains or Just More Roadkill? What the Investor Sees in the Ashes

Here’s your reality check on a silver platter: TI and ASML are not chip designers—they’re the backbone, the connective tissue, the guys selling bullets to a world that’s perpetually on the edge of shooting itself in the foot. Cyclical swings stain every number, and control is just an illusion kept alive by C-suite optimism and PowerPoint slides. The lessons? Simple. The semi industry doesn’t care about your 18-month investment thesis. It chews up your projections and spits them out mixed with tar, whiskey, and the stray fingernail of a dead analyst.

If TI starts to wobble, you might see the tremors run down the spines of stocks like Analog Devices or NXPI Semiconductors. If ASML hiccups, the neighbors—Lam Research, Applied Materials—feel a chill. But Nvidia, Broadcom, the black-swan chip designers? They’re still swan-diving into pools of hyperscaler cash, completely divorced from the reality haunting these old-world infrastructure names. Microsoft and its AI clique don’t even blink. Spending keeps climbing, love letters to the future keep going out on schedule.

In the cold light of the trading screen, TI and ASML are still fine beasts for the slightly masochistic long-term investor—decent dividends, dividend growth, the steady heartbeat of infrastructure dollars. Just don’t fool yourself: if you want excitement, buy a Harley and ride through a hurricane. If you want exposure to the real sausage-making of global AI, these are the blue chips to chew on. If you want certainty, you’re in the wrong line of work, partner. 😵💫

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Gold Rate Forecast

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Thinking Before Acting: A Self-Reflective AI for Safer Autonomous Driving

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

2025-07-31 14:38